By Tom Winnifrith | Wednesday 30 May 2018

Another day and another bombshell document lands with Winnileaks concerning Julie "lingerie on expenses" Meyer MBE. This is such dynamite that I shall have to examine it in parts but let's start with our old friend Entrepreneur Country Global, ECG, a company established in 2013 and at that point wholly owned by Ariadne Capital Limited (now in administration).

Exhibit A is from Companies house and is the full list of shareholders in ECG as at 20 December 2015 ( filed 13 months later). It is 100% owned by Ariadne Capital Limited which paid £100 for its £100 shares - see HERE

Exhibit B is the report and accounts for ECG for calendar 2016 - see HERE. You can see that its only income is its dodgy R&D tax credits (see HERE ) that it loss almost a million quid, has retained losses of almost three million quid and net current liabilities of just over three million quid - in other words it is insolvent. But look further and you will see that there are also still only 100 £1 shares in issue.

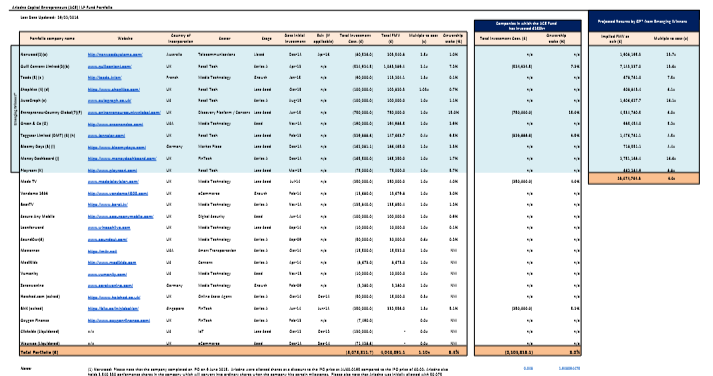

Now to the latest Winnileaks discovery, Julie's spreadsheet (below) of the ACE fund she manages as at 29 February 2016 and you will see that in it is a 15% stake in ECG which was bought with cash for £750,000. So a fund - other people's money - managed by Julie Meyer spent £750,000 - which works out at c20% of its portfolio - on a 15% stake in a company which was almost certainly insolvent and it was bought direct from Ariadne Capital Limited a company whose largest shareholder and sole director was Julie Meyer and which we know, from the administrators report, was struggling to pay its bills and being chased by creditors all over the shop.

Hilariously Julie promises her investors that there is massive upside in ECG claiming that it will be a six bagger when sold ( far column) . In the notes to the spreadsheet Meyer asserts "The fund aims to exit in January 2018."

Of course it has all worked out rather differently. In late 2016 the fund bought the other 85% of ECG for £3.75 million ( netting Ariadne a "profit" of £3,749,915) but as it had no cash it did not actually pay. That has not stopped Julie claiming 100% ownership - SEE HERE- as she endeavours to entice suckers to put more money into her fund.

At least with that second deal the fund ( Other People's cash) did not actually spend any cash. In the first deal it did. That was money that cash strapped Ariadne needed to pay for staff, Julie's lingerie, her flat, her massages and other vital running costs, just to keep the lights on.

How on earth is this acceptable? And how on earth are the FCA still showing that Ariadne Malta is able to run a fund and how is it allowing Julie Meyer to solicit fresh investments? Doesn't the FCA realise that it is meant to be protecting investors from scams like this?

Click to view larger PDF version

Become a member starting at £6.99 per month for all articles, the Bearcast, and our seven year archive.

Filed under:

Friday »

Tuesday »

Monday »

Sunday »

Saturday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Sunday »

Saturday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Sunday »

Saturday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Sunday »

Saturday »

Thursday »

Wednesday »

Tuesday »

Monday »

Sunday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Sunday »

Saturday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Saturday »

Friday »

Time left: 21:55:35