By Tom Winnifrith | Sunday 28 October 2018

Can Julie "Lingerie on Expenses" Meyer MBE sink any lower? Pursued by the Maltese Police on criminal charges, under FCA and SFO investigation, owing vast sums to the IRS, HMRC and numerous other creditors can she sink lower ? er yes as we show below.

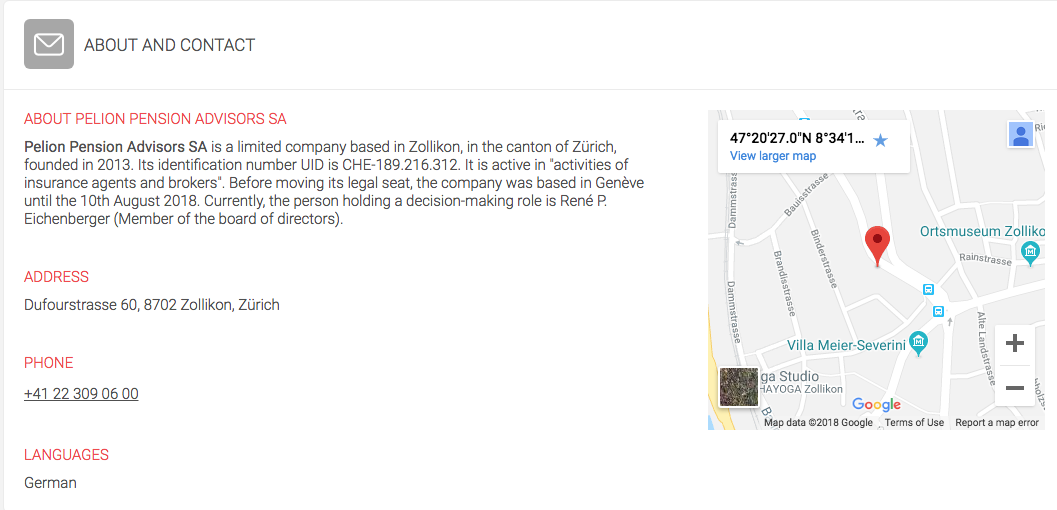

About two or three months ago a Swiss Gentleman named Rene Eichenberger claimed to have bought the assets from the Meyer empire that were worth buying. But Maltese Regulators have confirmed that they are allowing no assets or companies there to be sold given the regulatory and criminal matters outstanding. And the administrator of Ariadne Capital Limited (ACL), Julie's London flagship, says none of its "assets" have been sold. So what has Eichenberger bought?

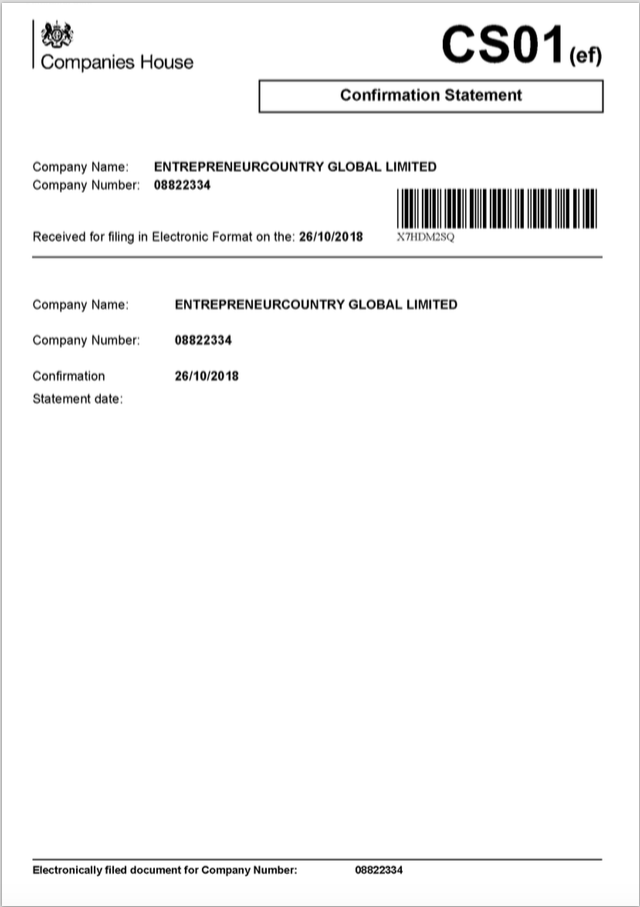

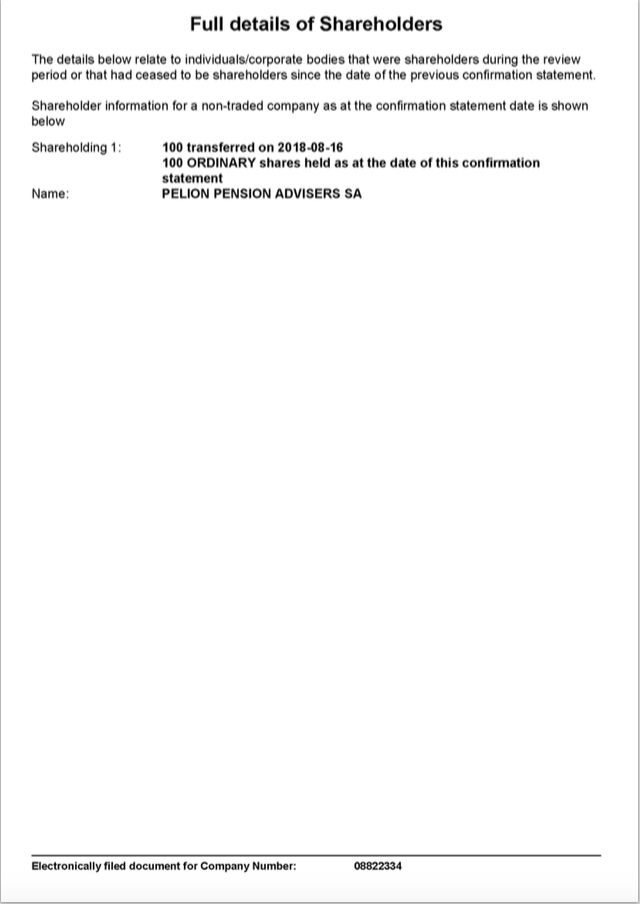

Over at Companies House as you can see below the entire share capital of EntrepreneurCountry Global - Julie's san revenue, cash guzzling events business, was - on August 16 - bought by Pelion Pension Advisers SA. You may think this is a reference to my second favourite part of Greece but it is in fact, as you can see below, Rene's Swiss company. So far so good.

The problem is that ECG was until late 2016 largely owned by ACL. In November of that year ACL (largely owned by Julie" sold its remaining interest in ECG for millions of pounds to Julie Meyer's ACE Fund (largely owned by other folks). ACL thus booked a £3 million profit for the year. The only problem is that the fund did not pay for its shares and its failure to pay despite Ariadne booking the sale as a profit are the key matters raised by the administrator in his report sent to the Insolvency Service in an attempt to get Meyer banned as a company director.

So to be clear, Julie's ACE Fund - currently not regulated by anyone - has sold ECG to Pelion without actually paying for it. So surely it does not own it? So surely that makes Meyer guilty of handling stolen goods or whatever the financial equivalent is?

Of course Meyer told ACGL (Malta) investors that it would retain a 30% revenue share from ECG. Will Pelion be honouring that? I gather Rene Eichenberger is an honourable man so must assume that when he bought the ECG shares from ACE he was unaware that ACE did not really own them. Imagine his horror when he finds out!

Become a member starting at £6.99 per month for all articles, the Bearcast, and our seven year archive.

Filed under:

Tuesday »

Monday »

Sunday »

Saturday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Sunday »

Saturday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Sunday »

Saturday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Sunday »

Saturday »

Thursday »

Wednesday »

Tuesday »

Monday »

Sunday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Sunday »

Saturday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Saturday »

Friday »

Thursday »

Time left: 21:55:22