Winnileaks - a new crime by Julie Meyer MBE, lies and fraud from 2018

By Tom Winnifrith | Tuesday 19 June 2018

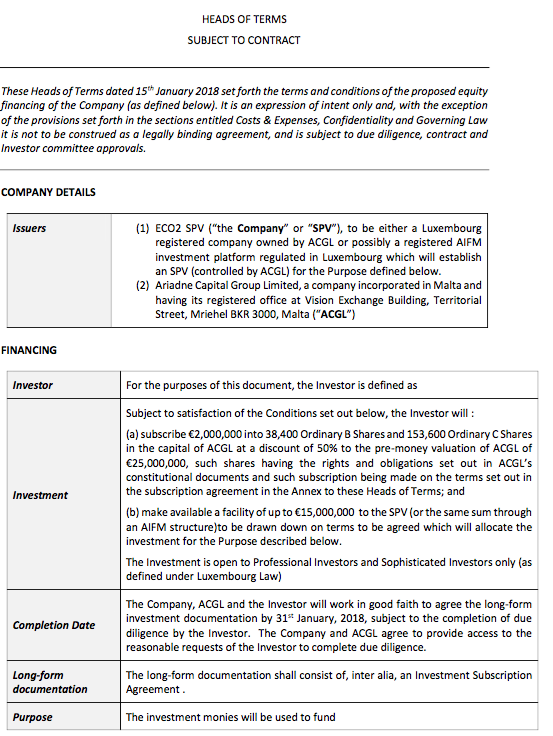

Another day, another drop to Winnileaks, this time from someone who Julie "Lingerie on expenses" Meyer groomed but who refused to hand over cash. However in this lie packed attempted fraud from January 2018 some were fleeced.

On January 16th the email below was sent by Ms Lingerie on expenses.

From: julie@ariadnecapital.com

Sent: 16 January 2018 Subject: Private & Confidential - ECO2 Termsheet * Confirmation of Anchor LP in ECO2 for €5 m & ACGL Board Seat - closing 31 Jan

Dear Ariadne Shareholder,

We have confirmation of €5 m from a major technology entrepreneur & UHNWI from yesterday’s mtg which is being followed up tomorrow, and will close the 31st of January 2018. The terms are attached, and I would like to invite you to participate in this round in allocations of as little as €100 K to €5 m.

The anchor investor above will be joining Ariadne Capital Group Limited’s Board of Directors, and is a major name brand investor. You would all know who he is.

Please call me on +44 xxxx xxx xxx if you would like to talk, or indicate your interest, and I will tailor the termsheet for you.

Ends.

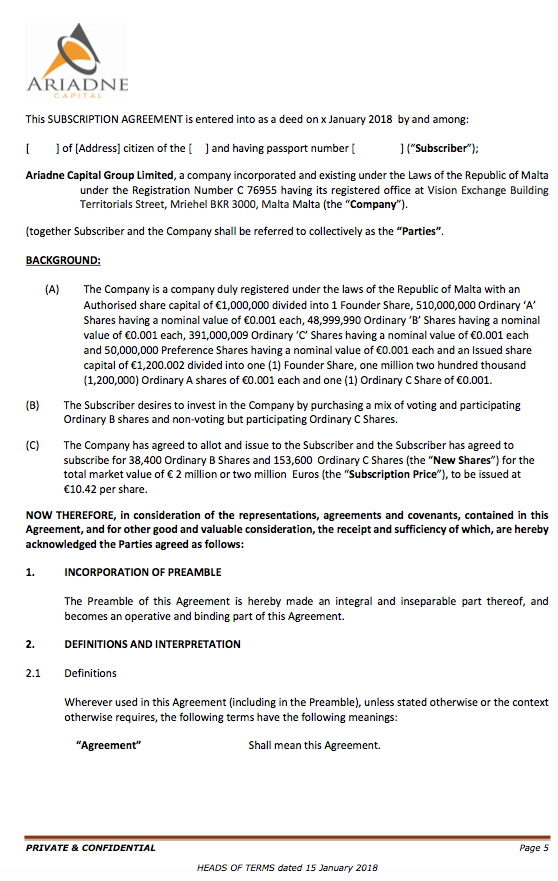

The terms are indeed attached at the bottom of this article. The only problem is that the whole thing is a lie from top to bottom.

Let’s start with the introduction. The devout Christian Julie addresses those she is grooming as “Ariadne Shareholder.” This refers to Ariadne Capital Group Ltd (Malta). The reality is that subscription papers were signed by many, money was transferred but the Shareholders Registry was never changed, forms never submitted to MFSA.... up until today the sole shareholder in ACGL is...... well take a guess. Hint. Lingerie on expenses - here is the MFSA confirming that point.

Then lets go to the idea that someone was putting cash into a Julie fund managed out of Malta. Hang on folks, we all now know thanks to Winnileaks – see HERE – that Meyer was barred by the MFSA from taking on any new cash for her funds as of November 2017 because of numerous compliance failings. Natch she had not told anyone about this so she could not have taken this investor on board.

Let us be clear that raising and managing money, holding out to do investment business when you are not regulated to do so is a criminal offence. Wakey wakey FCA are you not meant to tackle that sort of thing?

And thus it will come as no shock to you all that despite Meyer claiming there was “confirmation” the blank term sheet she serves up below was never turned into an actaul deal. The deal did not go ahead.

I am afraid that this sounded so good that some folks on the grooming list did send cheques to Julie Meyer… they should not plan on retiring on the proceeds.

This story is available to all readers

ShareProphets is reader-supported journalism

Become a member starting at £6.99 per month for all articles, the Bearcast, and our seven year archive.

Filed under:

Market News

Complete Coverage

Recent Comments

That Was the Week that Was

Saturday »

Professor Malcolm Stacey’s Celebrated, Universally Acclaimed, Legendary and Illustrious Christmas Lecture, Exclusive to this Magical Website.

- By Tom Winnifrith

- 21 December 2024, 09:39

Friday »

Video: Ron Paul says DOGE and Elon the hope for American Liberty

- By Tom Winnifrith

- 20 December 2024, 17:50

Tom Winnifrith Bearcast: Tiger completes a dream team of scallywags

- By Tom Winnifrith

- 20 December 2024, 17:44

Zotefoams – “to pause its investment in ReZorce” but a core business “strong financial performance” Buy

- By Steven Moore

- 20 December 2024, 16:31

Inspecs – “board has decided to start a process of enhancing its governance structures”. Er, you listed on AIM in 2020!

- By Steven Moore

- 20 December 2024, 16:07

Shearwater – “Contract wins” and “momentum is continuing to build through H2”, but it needs to be!…

- By Steven Moore

- 20 December 2024, 14:00

Tom Winnifrith 2nd bonus bearcast: A Christmas fuck you to Shareholders from Steve O'Hara, Neil Davidson and Liam Murray

- By Tom Winnifrith

- 20 December 2024, 12:58

Headlam – emphasises “highly attractive terms” property disposals, but a turnaround in trading will still be required…

- By Steven Moore

- 20 December 2024, 12:05

Tom Winnifrith bonus bearcast: Christmas comes early, Dave Lenigas to jail over Pennpetro fraud?

- By Tom Winnifrith

- 20 December 2024, 10:20

Pennpetro Energy (#PPP) – “taking advice to ensure it is staying within its solvency parameters” and to “address and investigate actions of previous directors”

- By Steven Moore

- 20 December 2024, 07:59

Tiger Royalties & Investments (#TIR) – arrival of chancer Jonathan Bixby with proposed strategy change and £3m fundraise at 0.1p per share

- By Steven Moore

- 20 December 2024, 07:59

Synairgen (#SNG) – conditionally raises £18m at 2p per share and seeking to raise up to £19m total

- By Steven Moore

- 20 December 2024, 07:57

Celadon Pharmaceuticals (#CEL) – reckons now sufficient funds to February, extending to March on an outstanding £0.25m of credit actually being received

- By Steven Moore

- 20 December 2024, 07:53

Georgina Energy (#GEX) – “Operational Update”, some attempted ramptastic even though arguing some “challenges from severe weather”

- By Steven Moore

- 20 December 2024, 07:53

Somero (#SOM) – CEO Jack Cooney to retire and Chairman Larry Horsch to “step down”, confident of FY results “in line with market expectations”

- By Steven Moore

- 20 December 2024, 07:45

Headlam (#HEAD) – sells properties for, ex-VAT, £53.9m, noting material premiums to book value and market valuation

- By Steven Moore

- 20 December 2024, 07:40

Ariana Resources (#AAU) – proposed Australia dual-listing delayed to H1 next year as “continues to work through the remaining requirements”

- By Steven Moore

- 20 December 2024, 07:34

Neometals (#NMT) – “sustainable process technology developer” proposed AIM cancellation as “concluded… is not delivering sufficient value for shareholders”

- By Steven Moore

- 20 December 2024, 07:30

Amcomri (#AMCO) – ‘buy, improve, build’ UK-focused engineering services and industrial manufacturing group raises £12m at 55p per share joining the AIM casino

- By Steven Moore

- 20 December 2024, 07:27

Thursday »

Tom Winnifrith Bearcast: my excuse is Jaya's scarf

- By Tom Winnifrith

- 19 December 2024, 18:11

Inspired plc – “announces… result of retail offer”, not ‘pleased to announce’ then?…

- By Steven Moore

- 19 December 2024, 17:30

Jaywing – interims argue “expected to deliver a stronger second half performance”, but how much so?…

- By Steven Moore

- 19 December 2024, 16:05

Jubilee Metals – states “uncertainty” whether guidance production volumes will be met, but that doesn’t look likely now. Sell

- By Tom Winnifrith

- 19 December 2024, 14:16

Video the BBC does not want you to see: Sir Starmer and the Granny Harmers

- By Tom Winnifrith

- 19 December 2024, 14:10

Tribe Technology: from AIM listing to funding-troubles proposed cancellation in less than 16 months – indeed AIM was “a natural fit”! You were warned…

- By Steven Moore

- 19 December 2024, 13:45

Tom Winnifrith bonus bearcast: Chill Brands caves to Yankee fraudsters, where next?

- By Tom Winnifrith

- 19 December 2024, 13:41

Flip Flop Ben Turney claims to raise £6.6m in yet another placing but when will he get the cash, if ever?

- By Tom Winnifrith

- 19 December 2024, 11:25

MicroSalt, patently absurd, an expert writes on today’s ramping

- By Tom Winnifrith

- 19 December 2024, 11:02

Gelion – argues its fundraise “will help us drive forward our goal of integrating… into global supply chains”. Er, how much really so?…

- By Steven Moore

- 19 December 2024, 10:50

Intelligent Ultrasound (#IUG) – recommended takeover at 13p per share

- By Steven Moore

- 19 December 2024, 07:57

Chill Brands (#CHLL) – out-of-court settlement with former directors, continues to work with auditors re. accounts for year ended 31st March 2024!

- By Steven Moore

- 19 December 2024, 07:54

FD Technologies (#FDP) – tender offer for 21.8% of shares at 1950p per share

- By Steven Moore

- 19 December 2024, 07:50

Kavango Resources (#KAV) – “strategic financing” to raise £6.6m at 0.7p per share

- By Steven Moore

- 19 December 2024, 07:46

Inspired (#INSE) – “up to £2 million” ‘retail offer’ at 40p per share raises just £410,214

- By Steven Moore

- 19 December 2024, 07:40

Clean Power Hydrogen (#CPH2) – £6.1m placing and subscription at 7.5p per share

- By Steven Moore

- 19 December 2024, 07:37

Gelion (#GELN) – raises £1.57m at 15p per share and an “up to” £0.15m Bookbuild platform ‘retail offer’

- By Steven Moore

- 19 December 2024, 07:33

Serco (#SRP) – 2024 cash flow and net debt guidance improved, though 2025 immigration contracts and UK national insurance headwinds

- By Steven Moore

- 19 December 2024, 07:28

Wednesday »

Victrex – after recent results, an income and recovery value Buy...

- By Steven Moore

- 18 December 2024, 17:00

Biome Technologies – secured funding facility from related parties, states “interest is not payable” BUT…

- By Steven Moore

- 18 December 2024, 16:27

Tom Winnifrith Bearcast: words from a genius (Mark Slater) and from a congenital idiot (Simon Botfield)

- By Tom Winnifrith

- 18 December 2024, 15:55

Feedback plc – trading update, how substantial really is its “runway for delivery”?

- By Steven Moore

- 18 December 2024, 14:19

Video: Disgraced Neil Woodford puts his side of the Woodford collapse, talking complete shit

- By Tom Winnifrith

- 18 December 2024, 13:48

Has Adam Reynolds got one more present from Belluscura for Evil Banksta before Christmas?

- By Tom Winnifrith

- 18 December 2024, 12:01

In Black and white: Rachel from customer services puts folks on the dole

- By Tom Winnifrith

- 18 December 2024, 11:36

Supply@Me Capital - the Eight Capital loan repayment mystery, the plot thickens and the FCA are just useless

- By Tom Winnifrith

- 18 December 2024, 11:29

Shoe Zone – hopefully my prior caution was heeded, as now states a very challenging trading conditions “significant impact”!

- By Steven Moore

- 18 December 2024, 11:27

Saba Capital Management requisitions board changes General Meetings at seven UK investment trusts

- By Steven Moore

- 18 December 2024, 07:59

#BHP – “sexual harassment and sex discrimination” representative class action filed against it in Federal Court of Australia

- By Steven Moore

- 18 December 2024, 07:59

Kingfisher (#KGF) – agreement for sale of Brico Dépôt Romania business for €70m Enterprise Value

- By Steven Moore

- 18 December 2024, 07:57

Westminster Group (#WSG) – attempted ramptastic “AGM Statement”, broker change to Strand Hanson

- By Steven Moore

- 18 December 2024, 07:55

Feedback (#FDBK) – argues “growing pipeline of opportunities” but H1 revenue only “expected to be broadly flat”

- By Steven Moore

- 18 December 2024, 07:52

Zotefoams (#ZTF) – “to pause its investment in ReZorce”, expects FY “comfortably in line with the guidance”

- By Steven Moore

- 18 December 2024, 07:49

Artisanal Spirits (#ART) – “on track to deliver the consensus EBITDA forecast of £1m for FY24”, argues “strategic investment in USA operations”

- By Steven Moore

- 18 December 2024, 07:47

#SHOE Zone – weakening of consumer confidence and unseasonal weather “significant impact” warning, not to pay a FY dividend

- By Steven Moore

- 18 December 2024, 07:43

Character Group (#CCT) – FY adj. EPS up to 29.76p, DPS maintained at 19p, expects trading for the current year “to remain at similar levels”

- By Steven Moore

- 18 December 2024, 07:38

IntegraFin (#IHP) – FY adj. EPS +7% to 16.2p, DPS +2% to 10.4p, argues “well positioned”

- By Steven Moore

- 18 December 2024, 07:33

Tuesday »

BREAKING: Pennpetro Energy – after Chairman Big Dave Lenigas last month, now also CEO “has resigned with immediate effect”!

- By Steven Moore

- 17 December 2024, 17:25

Tom Winnifrith Bearcast: Up 300% today the biggest sell I can remember for ages

- By Tom Winnifrith

- 17 December 2024, 14:54

Inspired plc – fundraise including outrageous ‘retail offer’ and is it really ‘to unlock growth opportunities’?…

- By Steven Moore

- 17 December 2024, 14:15

Conygar: Mr Market just does not believe you or in commercial property

- By Tom Winnifrith

- 17 December 2024, 14:00

Hollywood Bowl – argues “outlook remains positive”… but it’s full-year results earnings decline!

- By Steven Moore

- 17 December 2024, 11:35

Hemogenyx and that share consolidation to attract institutional investors: how’s it going?

- By Tom Winnifrith

- 17 December 2024, 11:25

Whilst the Kosmos bid for Tullow was interesting but is now off, neither company looks a great investment and Tullow is a BIG sell

- By Gary Newman

- 17 December 2024, 11:22

Financial Reporting Council – how good are the auditors of your investments?

- By ShareProphets

- 17 December 2024, 08:01

Supply@ME Capital (#SYME) – “Business Update”, attempted ramptastic

- By Steven Moore

- 17 December 2024, 07:59

Inspired (#INSE) – £21.25m placing at 40p per share with warrants and “up to” £2m Bookbuild platform “retail offer”

- By Steven Moore

- 17 December 2024, 07:57

Gulf Marine Services (#GMS) – now anticipates FY adj. EBITDA “at the upper end of previous guidance” and 2025 increased guidance range

- By Steven Moore

- 17 December 2024, 07:54

Hollywood #BOWL – FY adj. EPS -12% to 18.82p, DPS +2% to 12.06p, argues “well-placed to mitigate the increased costs”

- By Steven Moore

- 17 December 2024, 07:52

Netcall (#NET) – current year “has started well, with trading in line with management expectations”, looks forward with confidence

- By Steven Moore

- 17 December 2024, 07:49

#FRP Advisory – H1 adj. EPS up to 5.97p, DPS to 1.9p, “robust pipeline” means confident of achieving FY expectations

- By Steven Moore

- 17 December 2024, 07:45

Chemring (#CHG) – FY adj. EPS slightly lower to 19.3p, DPS up to 7.8p, current year expectation “remains in line with market expectations”

- By Steven Moore

- 17 December 2024, 07:42

Capita (#CPI) – adj. Op margin up “largely driven by cost reduction initiatives”, though still currently free cash outflow

- By Steven Moore

- 17 December 2024, 07:37

Goodwin (#GDWN) – H1 EPS up to 150.91p, H2 “similar level of activity for the group is expected”

- By Steven Moore

- 17 December 2024, 07:34

Bunzl (#BNZL) – FY “small decline in underlying revenue”, operating margin “moderately above the level reported for 2023”

- By Steven Moore

- 17 December 2024, 07:29

Monday »

Zenova – announces “restocking order… driven by strong interest from end customers”. Attempted ramptastic?

- By Steven Moore

- 16 December 2024, 16:55

Tom Winnifrith Bearcast: Its screwed by Africa weekend at Sheriff Towers

- By Tom Winnifrith

- 16 December 2024, 16:14

Tristel – “pleased to announce” AGM Statement on half-year performance, but how ‘pleasing’ really?…

- By Steven Moore

- 16 December 2024, 15:06

How can the FCA NOT investigate the share price movement of Supply@ME Capital?

- By Tom Winnifrith

- 16 December 2024, 13:27

One of twelve zeros for 2025, unless it goes bust before Christmas!

- By Steven Moore

- 16 December 2024, 13:03

Death by a thousand cuts: yet another bucket shop placing by Tern

- By Tom Winnifrith

- 16 December 2024, 11:39

Videndum – is “some signs of gradual improvement” a sufficient recovery?…

- By Steven Moore

- 16 December 2024, 11:35

Entain (#ENT) – acknowledges Australian civil penalty proceedings

- By Steven Moore

- 16 December 2024, 07:59

#TERN – £0.4m ‘keep the lights on’ placing at just 1.3p per share

- By Steven Moore

- 16 December 2024, 07:57

Cirata (#CRTA) – a “contract win” but overall trading means now “withdrawal of FY24 bookings guidance”!

- By Steven Moore

- 16 December 2024, 07:55

Videndum (#VID) – “some signs of gradual improvement” but “recovery in our markets continues to be slower than expected”

- By Steven Moore

- 16 December 2024, 07:52

Filtronic (#FTC) – “pull-forward of customer orders”, now expects FY stronger than current market expectations

- By Steven Moore

- 16 December 2024, 07:50

Tristel (#TSTL) – overall “continue to trade in line with expectations” but USA sales growth “below expectations”

- By Steven Moore

- 16 December 2024, 07:47

Ricardo (#RCDO) – agreement to acquire initial 85% of infrastructure projects adviser E3 Advisory for approx. Australian$101.4m

- By Steven Moore

- 16 December 2024, 07:43

Ricardo (#RCDO) – conditional disposal of defence business for $85m

- By Steven Moore

- 16 December 2024, 07:43

#SAGA – agreements for sale of insurance underwriting business for £67.5m and to operate its motor and home insurance business for initially £80m with Ageas

- By Steven Moore

- 16 December 2024, 07:36

Titon (#TON) – completes South Korea business sale, reports “slower moving inventory” value impairment

- By Steven Moore

- 16 December 2024, 07:27

Sunday »

Cohort – interims emphasise continuing positive outlook, BUT…

- By Tom Winnifrith

- 15 December 2024, 19:03

The View From The Montana Log-Cabin As Gold Recovers….And Then Falls Away Again

- By Nigel Somerville

- 15 December 2024, 18:38

Tom Winnifrith Bearcast: on a 20 year view are the housebuilders toast? It all depends on immigration

- By Tom Winnifrith

- 15 December 2024, 15:27

Sunday Long Reads: London’s Old Markets, Decivilisation, A Truly Awful Artist, Good Traitor, and Suspicious Deaths

- By ShareProphets

- 15 December 2024, 12:00

Notes from Underground – Most read articles for the week ending Dec 14

- By ShareProphets

- 15 December 2024, 11:51

Photo Article from the Welsh hovel: Christmas Carol party, Tom Winnifrith

- By Tom Winnifrith

- 15 December 2024, 08:00

Photo article from the Welsh Hovel: Cat in a box, Tom Winnifrith

- By Tom Winnifrith

- 15 December 2024, 08:00

Photo Article from the Welsh Hovel: Jaya and I inspect the pear tree chopping, Tom Winnifrith

- By Tom Winnifrith

- 15 December 2024, 08:00

Saturday »

Tom Winnifrith bearcast: Ariana screwed by the Croc, why does Africa always feck it up?

- By Tom Winnifrith

- 14 December 2024, 16:36

Friday »

Aurrigo International – “pleased to confirm” retail offer result, fooling itself or trying to fool everyone else?

- By Steven Moore

- 13 December 2024, 17:19

Chapel Down – “delighted to announce” appointment of new CEO, BUT…

- By Steven Moore

- 13 December 2024, 16:05

Tom Winnifrith Bearcast: no need to own retail or oil shares at all

- By Tom Winnifrith

- 13 December 2024, 14:44

Portmeirion – I having warned on second-half expectations, now updates performance is “below market expectations”…

- By Steven Moore

- 13 December 2024, 14:00

Video: Real Assets are Returning to the Playbook of the 1970s, a gold bull market

- By Tom Winnifrith

- 13 December 2024, 13:29

Amaroq Minerals – now also identifies high-grade gold at Eagle’s Nest target, BUY at 97p, target increased to 150p plus

- By Tom Winnifrith

- 13 December 2024, 12:30

Oracle Power: not a placing but worse, this stinks and when is the TR1 Peel Hunt?

- By Tom Winnifrith

- 13 December 2024, 11:41

Another Avacta shareholder trolling, defaming and showing just how dumb and nasty is ModernAngel

- By ShareProphets

- 13 December 2024, 09:42

Kosmos Energy (#KOS) – confirms “very preliminary discussions” re. possible all-share offer for Tullow Oil (#TLW)

- By Steven Moore

- 13 December 2024, 07:59

Serinus Energy (#SENX) – “up to” £0.75m placing at 2.5p per share and up to £0.25m Bookbuild platform “retail offer”

- By Steven Moore

- 13 December 2024, 07:57

Versarien (#VRS) – “€804,000 Grant Award”, though covering 70% of anticipated costs of energy storage devices project

- By Steven Moore

- 13 December 2024, 07:57

boohoo (#BOO) – response to letter from Frasers Group (#FRAS) re. proxy advisers voting recommendations

- By Steven Moore

- 13 December 2024, 07:56

Electric Guitar (#ELEG) – notes “minimal cash balances and known creditors of approximately £1 million”, 3radical business to be placed into liquidation

- By Steven Moore

- 13 December 2024, 07:53

Portmeirion (#PMP) – profit warning due to supply delays and continued destocking and challenging market conditions

- By Steven Moore

- 13 December 2024, 07:44

Resolute Mining (#RSG) – board changes as CEO Terry Holohan takes “leave of absence”, company “continues to engage with the Government of Mali” re. new Protocol

- By Steven Moore

- 13 December 2024, 07:42

Chapel Down (#CDGP) – appointment of James Pennefather as CEO and resignations of CFO Rob Smith and NED Stewart Gilliland, current trading “strong”

- By Steven Moore

- 13 December 2024, 07:37

Impax Asset Management (#IPX) – notice of termination of mandate on c.£5.2bn AUM at end-Nov Sustainable & Responsible Equity Fund

- By Steven Moore

- 13 December 2024, 07:36

W.H. Ireland (#WHI) – H1 another loss, emphasises cost reductions as now looks to return Wealth Management business to break-even

- By Steven Moore

- 13 December 2024, 07:31

Thursday »

Tom Winnifrith Bearcast: Tom Winnifrith you are a prick tweeted the impoverished peasant

- By Tom Winnifrith

- 12 December 2024, 16:28

Tan Delta Systems – trading warning, and not its first despite only listing on AIM in August last year!

- By Steven Moore

- 12 December 2024, 16:27

Photo Article: a reader sends a Christmas present to the Welsh Hovel, I am going to be a Skins double Millionaire. Whatever..

- By ShareProphets

- 12 December 2024, 14:35

Aurrigo International – discounted fundraise “to increase production capacity and create the potential to bring forward commercial sale timelines”. Er, really?…

- By Steven Moore

- 12 December 2024, 13:39

Avacta: more lack of meaningful progress news, slowly the warnings dawn on the gerbils

- By Tom Winnifrith

- 12 December 2024, 13:30

SThree – ‘Trading Update’, “have been able to withstand the external pressures until now”. Uh oh!…

- By Steven Moore

- 12 December 2024, 11:29

EXPOSE: Technology Minerals, which RNS was a GREAT BIG FAT STEAMING LIE?

- By Tom Winnifrith

- 12 December 2024, 11:06

Versarien - cash runway longer than I previously as annual report WRONG

- By Tom Winnifrith

- 12 December 2024, 10:24

Detailed Report on Energy Pathways – What is my take on the technical side? (hint – its not looking good)

- By Tom Winnifrith

- 12 December 2024, 08:39

Photo Article from the Welsh Hovel: I relent and the Christmas Tree goes up and is decorated in a multi-cultural way, Tom Winnifrith

- By Tom Winnifrith

- 12 December 2024, 08:00

Aurrigo International (#AURR) – £5.25m placing at 44p per share

- By Steven Moore

- 12 December 2024, 07:59

Parkmead Group (#PMG) – following agreement to sell Parkmead (E&P) to focus “on growing its Netherlands gas assets and its projects in renewable energies”

- By Steven Moore

- 12 December 2024, 07:59

Serica Energy (#SQZ) – agreement to acquire Parkmead (E&P) for initial £5m, a deferred £9m and development-contingent payments

- By Steven Moore

- 12 December 2024, 07:59

#RWS – FY adj. EPS -7% to 21.6p, DPS +2% to 12.45p, current year “growth in volumes expected to more than offset ongoing price pressure”

- By Steven Moore

- 12 December 2024, 07:51

Dewhurst (#DWHT) – FY EPS up to 66.58p, DPS to 16.50p, current year “sales have started the year slightly up on last year and in line with our expectations”

- By Steven Moore

- 12 December 2024, 07:49

Currys (#CURY) – H1 swing to adj. profit, FY guidance for growth in profits and free cash flow unchanged

- By Steven Moore

- 12 December 2024, 07:43

SThree (#STEM) – FY net fees -9% with “ongoing challenging market conditions”, “intention to launch a share buyback programme of up to £20m”

- By Steven Moore

- 12 December 2024, 07:39

Van Elle (#VANL) – H1 update, argues continues to expect FY in line with market consensus but “second half weighted”

- By Steven Moore

- 12 December 2024, 07:34

Carr's (#CARR) – FY adj. EPS 2.6p, DPS maintained, emphasises “refreshed Agriculture strategy”

- By Steven Moore

- 12 December 2024, 07:29

#NWF – H1 operating growth “in line with board expectations”, FY expectations unchanged

- By Steven Moore

- 12 December 2024, 07:28

Wednesday »

Yellow Cake – interims, a growth potential and value Buy

- By Steven Moore

- 11 December 2024, 16:36

RM plc – argues “ahead of market expectations”, but how much of an achievement here is that?

- By Steven Moore

- 11 December 2024, 16:04

Tom Winnifrith Bearcast: Is Euroloon Jonathan Price trying to kill me?? Evil Banksta even more conceited than usual today

- By Tom Winnifrith

- 11 December 2024, 14:52

Strip Tinning – argues “delighted to announce” contracted nominations increase, but how ‘delightful’ really?…

- By Steven Moore

- 11 December 2024, 13:45

Oracle Power: for all of the Lenigas ramping look where we are now!

- By Tom Winnifrith

- 11 December 2024, 12:28

Aferian – “Trading Update”, now why may it be “immediate effect” new broker appointment?

- By Steven Moore

- 11 December 2024, 11:32

BREAKING: Technology Minerals – the FRC investigation, for useless old TW yet another GOTCHA!

- By Tom Winnifrith

- 11 December 2024, 11:09

Video: Gold – The Monetary Hitching Post of the Universe, buy platinum and palladium too!

- By Tom Winnifrith

- 11 December 2024, 09:28

BREAKING: Amazing Morepen video, the truth about Skins share sales, FYB with Optibiotix

- By Tom Winnifrith

- 11 December 2024, 08:04

Gulf Keystone Petroleum (#GKP) – 'Operational & Corporate Update', “continues to engage with government stakeholders” re. a restart of crude exports

- By Steven Moore

- 11 December 2024, 07:59

Aferian (#AFRN) – argues “progress” including $2.4m net debt reduction but it still $12.5m, appointment of Zeus Capital as Nomad and broker

- By Steven Moore

- 11 December 2024, 07:57

ProCook (#PROC) – H1 increased loss, argues “outperforming a subdued market”

- By Steven Moore

- 11 December 2024, 07:54

Audioboom (#BOOM) – “ahead of current market expectations”, but again emphasising “adjusted EBITDA”

- By Steven Moore

- 11 December 2024, 07:52

RM (#RM.) – expects FY adj. Op profit of £8.4m-£8.8m, “5% to 10% ahead of market expectations”

- By Steven Moore

- 11 December 2024, 07:49

Optima Health (#OPT) – H1 adjusted earnings fall, argues “a strong pipeline”

- By Steven Moore

- 11 December 2024, 07:45

Billington (#BILN) – expects 2024 “ahead of current market expectations” after “continued strong delivery in the second half”

- By Steven Moore

- 11 December 2024, 07:38

Cohort (#CHRT) – H1 adj. EPS up to 20p, DPS to 5.25p, “continued strong order intake has driven a record closing order book”

- By Steven Moore

- 11 December 2024, 07:35

Volution (#FAN) – four months revenue slightly up, “adjusted operating margin has again improved”

- By Steven Moore

- 11 December 2024, 07:31

British American Tobacco (#BATS) – H2 acceleration in line with expectations, “on track” to deliver FY guidance

- By Steven Moore

- 11 December 2024, 07:27

Tuesday »

DG Innovate – “pleased to announce” placing, but how ‘pleasing’ is it really?…

- By Steven Moore

- 10 December 2024, 16:07

Tom Winnifrith Bearcast: is that a margin call I see Ms Binkowska?

- By Tom Winnifrith

- 10 December 2024, 16:04

Tortilla Mexican Grill – emphasises “gained further momentum in the UK”, BUT…

- By Steven Moore

- 10 December 2024, 14:50

Greatland Gold – acquisition and first gold pour completion, Buy

- By Steven Moore

- 10 December 2024, 12:34

Four Critical signs that Oracle Power is lining up a deeply discounted bucket shop placing

- By Tom Winnifrith

- 10 December 2024, 12:19

An economics lesson for a restaurant in Warwickshire: price setting and price taking

- By Tom Winnifrith

- 10 December 2024, 11:41

Dianomi – after in May arguing “well placed to drive scale and profitability”, what about its near year-end “Trading Statement”?…

- By Steven Moore

- 10 December 2024, 11:39

VINDICATION (sort of): The FRC slams Crowe and its CEO over the Akazoo fraud but it lets Deloitte off the hook: this is a fail for the watchdog

- By Tom Winnifrith

- 10 December 2024, 11:05

Evil Banksta on a very odd loan drawdown by EnergyPathways : just adds to the stink

- By Tom Winnifrith

- 10 December 2024, 10:19

Aptamer – share options and directors shares purchases announcements, attempted ramptastic?…

- By Steven Moore

- 10 December 2024, 08:00

Ashtead (#AHT) – H1 adj. EPS -5% to $2.136, DPS $0.36, “proposed move to a US primary listing”

- By Steven Moore

- 10 December 2024, 07:59

Tortilla Mexican Grill (#MEX) – emphasises gained momentum in UK, but overall FY trading “in line with management expectations”

- By Steven Moore

- 10 December 2024, 07:55

Naked Wines (#WINE) – H1 loss, argues “currently experiencing solid trading during the peak season period”

- By Steven Moore

- 10 December 2024, 07:55

Moonpig (#MOON) – H1 adj. EPS up to 6.1p, DPS 1p, trading “in line with our expectations”

- By Steven Moore

- 10 December 2024, 07:50

Solid State (#SOLI) – H1 adj. EPS down to 17.5p, DPS to 0.83p, emphasises “improvement in order books since the period end”

- By Steven Moore

- 10 December 2024, 07:46

Porvair (#PRV) – expects FY adj. EPS “marginally ahead of market expectations”

- By Steven Moore

- 10 December 2024, 07:42

Centrica (#CNA) – expects FY “broadly in line with analyst consensus”, extends share buyback programme by £300m

- By Steven Moore

- 10 December 2024, 07:39

Begbies Traynor (#BEG) – H1 adj. EPS up to 5.1p, DPS to 1.4p, states “supportive market conditions and good activity levels”

- By Steven Moore

- 10 December 2024, 07:35

FirstGroup (#FGP) – agreement to acquire London bus operator RATP London for £90m Enterprise Value

- By Steven Moore

- 10 December 2024, 07:32

Games Workshop (#GAW) – agreement with Amazon for films and tv series and associated merchandising, though films and tv “production processes… may take a number of years”

- By Steven Moore

- 10 December 2024, 07:27

Monday »

Tom Winnifrith Bearcast: I wish I knew what Luke Johnson was selling today, here are my two sell tips for Tim

- By Tom Winnifrith

- 9 December 2024, 14:53

Tribe Technology – “RC Drilling System Update” attempted ramptastic ahead of bailout fundraising attempt ahoy?

- By Steven Moore

- 9 December 2024, 14:30

Video: The Debt Doom Loop and the New Era of $4K Gold, $100 Silver, & 200K Bitcoin

- By Tom Winnifrith

- 9 December 2024, 13:49

Has nobody explained to Versarien owning gerbils what an RNS reach is? Nonsense deal announced

- By Tom Winnifrith

- 9 December 2024, 13:40

Wishbone Gold places again – what on earth is the point? Do the maths...

- By Tom Winnifrith

- 9 December 2024, 13:02

Chill Brands statement: does it have no idea at all about its cash position?

- By Tom Winnifrith

- 9 December 2024, 11:26

Inspecs – after as recently as September “confident in meeting market expectations”, now “improvement in Q4 sales not having been as strong as anticipated”. Uh oh!…

- By Steven Moore

- 9 December 2024, 10:57

Tom Winnifrith Bonus Bearcast: Hydrogen Utopia demolished and exposed via publicly available documents, where has the five hundred grand gone?

- By Tom Winnifrith

- 9 December 2024, 10:19

Chill Brands (#CHLL) – “Company Update”, with FCA “has lodged a request for the continuation of the suspension of its shares”

- By Steven Moore

- 9 December 2024, 08:00

Versarien (#VRS) – “Distribution Agreement for Graphene Biosensors”, RNS Reach attempted ramptastic

- By Steven Moore

- 9 December 2024, 07:57

Tribe Technology (#TRYB) – “has carried out several product demonstrations & presentations of the Sample System”, attempted ramptastic

- By Steven Moore

- 9 December 2024, 07:57

ValiRx (#VAL) – conditional £1.3m placing and a up to £0.25m “broker offer” at 0.65p per share with warrants

- By Steven Moore

- 9 December 2024, 07:56

Warpaint London (#W7L) – £1m ‘retail offer’ at 510p per share “very significantly oversubscribed”

- By Steven Moore

- 9 December 2024, 07:52

Angling Direct (#ANG) – “intends to increase capital investment” and to also commence “up to £4.0m” share buyback programme

- By Steven Moore

- 9 December 2024, 07:46

Tavistock Investments (#TAVI) – H1 swing to loss, notes restructured and increased DPS to 0.09p

- By Steven Moore

- 9 December 2024, 07:42

Synectics (#SNX) – “momentum in the second half of the year across all of its market verticals”, now expects FY “materially ahead of market expectations”

- By Steven Moore

- 9 December 2024, 07:38

Brave Bison (#BBSN) – trading “in-line with expectations”, agreement to acquire Engage Digital Partners

- By Steven Moore

- 9 December 2024, 07:37

Inspecs (#SPEC) – slower European markets recovery and some larger customers orders deferral trading warning

- By Steven Moore

- 9 December 2024, 07:31

Sunday »

Tom Winnifrith Bearcast: Be careful what you wish for

- By Tom Winnifrith

- 8 December 2024, 19:05

Golden Prospect – Subscription Rights Failure, Or A Golden Opportunity?

- By Nigel Somerville

- 8 December 2024, 14:16

AIM Sewer Market Statistics for November 2024 - Yet another disaster and there are even more departures in the pipeline

- By Tom Winnifrith

- 8 December 2024, 11:37

Eco Buildings Group proves modular housing business plan is working: STRONG BUY

- By Tom Winnifrith

- 8 December 2024, 11:13

Visual Aid: Share of Illegal Immigrants Across 9 Developed Countries

- By ShareProphets

- 8 December 2024, 10:46

The View From The Montana Log-Cabin As Gold Suffers Stock And Bitcoin Gains

- By Nigel Somerville

- 8 December 2024, 10:45

Sunday Long Reads: World’s Greatest Coffee, Great Abandonment, End of the World, Six Hours of Martial Law, Denying Insurance with AI

- By ShareProphets

- 8 December 2024, 10:44

Notes from Underground – Most read articles for the week ending Dec 7

- By ShareProphets

- 8 December 2024, 10:40

Photo Article: Storm Darragh claims a victim at the Welsh Hovel but every cloud has a silver lining, Tom Winnifrith

- By Tom Winnifrith

- 8 December 2024, 00:20

Photo Article from the Welsh Hovel: Gloriously happy fat cats, Tom Winnifrith

- By Tom Winnifrith

- 8 December 2024, 00:04

Amid storm Darragh, amazing levels of organisation for Christmas, Tom Winnifrith

- By Tom Winnifrith

- 7 December 2024, 00:10

National World – “minded to recommend” improved proposal price, but will an offer now be made on those terms?

- By Steven Moore

- 6 December 2024, 16:35

Quiz plc – after poor performance and tight cash position results, what now from a “Trading and Cash Position Update”?…

- By Steven Moore

- 6 December 2024, 14:25

BREAKING: Jonathan “son of Spotty “ Rowland and Peterhouse when were you going to tell us about the strike off action?

- By Tom Winnifrith

- 6 December 2024, 13:39

Brand Architekts – recommended offer means c45% (and possibly much more) gains, bank the profits?

- By Tom Winnifrith

- 6 December 2024, 13:02

SkinBioTherapeutics – why it should revise its segmental analysis

- By Tom Winnifrith

- 6 December 2024, 11:54

EXPOSE of Eight Capital – repayment of 1AF2 Limited debt, kicking the can down the road amid smoke and mirrors and lying by Supply's Alessandro Zamboni

- By Tom Winnifrith

- 6 December 2024, 10:53

SkinBioTherapeutics – full-year results, products potential despite the detraction of its CEO means still a Buy

- By Tom Winnifrith

- 6 December 2024, 09:30

It’s the fees that count for law firms, morality takes the back seat

- By Tom Winnifrith

- 6 December 2024, 09:14

Direct Line Insurance (#DLG) – “preliminary agreement” of 275p per share cash and shares offer from Aviva (#AV.)

- By Steven Moore

- 6 December 2024, 07:59

National World (#NWOR) – “would be minded to recommend” a 23p per share possible offer proposal

- By Steven Moore

- 6 December 2024, 07:58

Frasers (#FRAS) – “intends to launch a voluntary offer for all of the shares in XXL”

- By Steven Moore

- 6 December 2024, 07:55

Celadon Pharmaceuticals (#CEL) – “received the balance of £150,000” due from a subscription, that won’t keep the lights on for long though!

- By Steven Moore

- 6 December 2024, 07:53

#QUIZ – sales fall and trading is “behind management expectations”, “existing bank facilities could be fully utilised in the first quarter of 2025”

- By Steven Moore

- 6 December 2024, 07:53

MS International (#MSI) – H1 EPS +11% to 39.8p, DPS up to 5p, emphasises “encouraged” with progress

- By Steven Moore

- 6 December 2024, 07:41

Likewise (#LIKE) – “increasing sales revenue and gross margin… on track to achieve current market expectations”

- By Steven Moore

- 6 December 2024, 07:37

James Halstead (#JHD) – trading “on track to meet our expectations of continued progress”, “remain positive about the market”

- By Steven Moore

- 6 December 2024, 07:34

Berkeley Group (#BKG) – H1 EPS -6% to 186.8p, DPS 33p, “on track to deliver profit guidance”

- By Steven Moore

- 6 December 2024, 07:30

Thursday »

Greatland Gold – a transformational acquisition Buy

- By Steven Moore

- 5 December 2024, 16:59

Aptamer – “Technical Update” following soon after AGM update, attempted ramptastic?

- By Steven Moore

- 5 December 2024, 16:28

Tom Winnifrith Bearcast: You have to be sensitive when talking of the recently departed but here goes anyway

- By Tom Winnifrith

- 5 December 2024, 14:44

Headlam – argues ‘transformation plan’ “significant early progress”, BUT…

- By Steven Moore

- 5 December 2024, 14:42

Video: The Vengeful Return of the Pendulum – Geopolitical Shifts, buy gold be very careful elsewhere

- By Tom Winnifrith

- 5 December 2024, 13:26

Tom Winnifrith Bonus Bearcast: Mr Market the manic depressive, Kefi and TrakM8, the latter is a zero, it is surely insolvent

- By Tom Winnifrith

- 5 December 2024, 12:28

Ebiquity – “a stronger H2 than H1… is proving to be the case”, BUT…

- By Steven Moore

- 5 December 2024, 12:15

Cavendish on Skinbiotherapeutics: God save us from Ashman as his M&A hunger is not sated

- By Tom Winnifrith

- 5 December 2024, 11:36

Amaroq – now that is what I call a placing: Buy at up to 90p and the shares to double from there

- By Steven Moore

- 5 December 2024, 10:42

Argo Blockchain End Game: the bond markets tell you that the shares are worth 0p, big moves in the past few days

- By ShareProphets

- 5 December 2024, 08:00

The Daily Mail laps up Ukrainian lies yet again: the North Korean girl fighters, Tom Winnifrith

- By Tom Winnifrith

- 5 December 2024, 08:00

Brand Architekts (#BAR) – recommended offer of 48p per share with shares alternative from Warpaint London (#W7L)

- By Steven Moore

- 5 December 2024, 07:57

#CARD Factory – acquisition of Garven for $25m to enter the US, trading “in line with our expectations”

- By Steven Moore

- 5 December 2024, 07:55

Frasers (#FRAS) – H1 adj. EPS -5% to 51p, warns as “both ahead of and after the recent Budget, consumer confidence has weakened”

- By Steven Moore

- 5 December 2024, 07:52

Watches of Switzerland (#WOSG) – H1 adj. EPS -16% to 18.1p, argues guidance unchanged including “underpinned by sequential trading improvement”

- By Steven Moore

- 5 December 2024, 07:50

Ebiquity (#EBQ) – expects 2024 revenue “low single-digit decline”, “below previous expectations”

- By Steven Moore

- 5 December 2024, 07:46

AJ Bell (#AJB) – FY EPS +23% to 20.34p, DPS +16% to 12.5p, “confident in the outlook”

- By Steven Moore

- 5 December 2024, 07:43

Future (#FUTR) – FY adj. EPS -12% to 123.9p, DPS maintained at 3.4p, notes “return to revenue growth in H2”

- By Steven Moore

- 5 December 2024, 07:41

Headlam (#HEAD) – argues transformation plan “significant early progress”, but five months to end-November revenue -7.3%

- By Steven Moore

- 5 December 2024, 07:34

Balfour Beatty (#BBY) – “2024 revenue expected to be c.2% ahead of prior year”, “on track to deliver earnings growth”

- By Steven Moore

- 5 December 2024, 07:30

Wednesday »

Fusion Antibodies – “Approval of Grant Funding Application”, shares soar but how justifiably so?…

- By Steven Moore

- 4 December 2024, 16:35

Tom Winnifrith Bearcast: Am I a really mean, grumpy, old bastard totally out of touch with 2024? You and my siblings can judge

- By Tom Winnifrith

- 4 December 2024, 14:58

OptiBiotix Health – poorly-produced “Launch of Dr Morepen” announcement but the potential compelling, Strong Buy

- By Steven Moore

- 4 December 2024, 14:37

IXICO – full-year results, how much is recent fundraising to ‘accelerate technology platform growth and global commercial reach’?

- By Steven Moore

- 4 December 2024, 13:30

Letter to Liam Murray re Energypathways: a yes or no answer will suffice

- By Tom Winnifrith

- 4 December 2024, 13:16

Almost 4 years of Ben Turney at Kavango: the jury is coming in and I call him out for bullshit

- By Tom Winnifrith

- 4 December 2024, 11:49

Zephyr Energy: more bad news Reverend Weight, doing the maths

- By Tom Winnifrith

- 4 December 2024, 11:11

Biome Technologies – after a trading warning last month, now a further “Trading Update and Board Change”. Uh oh!…

- By Steven Moore

- 4 December 2024, 11:07

Tom Winnifrith Bonus Bearcast: Amaroq the AIM placing of the year, shares can still double or more from here

- By Tom Winnifrith

- 4 December 2024, 10:14

Bushveld Minerals (#BMN) – in “Business Rescue proceedings”, now Chairman Michael Kirkwood and CEO Craig Coltman “have resigned… with immediate effect”

- By Steven Moore

- 4 December 2024, 07:59

Argo Blockchain (#ARB) – “November Operational Update”, bottom-line financial information dare not speak its name (natch!)

- By Steven Moore

- 4 December 2024, 07:54

#IQE – completes sale of Pennsylvania site, to receive “$2.5m immediately and a further $3.0m before the end of the year”

- By Steven Moore

- 4 December 2024, 07:52

Ethernity Networks (#ENET) – placing raises just £130,028 at 0.133p per share

- By Steven Moore

- 4 December 2024, 07:50

Amaroq Minerals (#AMRQ) – completes placing for £27.5m at 86p per share

- By Steven Moore

- 4 December 2024, 07:48

Eco Buildings (#ECOB) – “€1m in revenues now achieved as of 2 December… ahead of schedule”

- By Steven Moore

- 4 December 2024, 07:45

Premier Miton (#PMI) – FY adj. EPS down to 6.3p, DPS maintained at 6p, notes “more difficult period for active managers”

- By Steven Moore

- 4 December 2024, 07:42

ME Group (#MEGP) – “continued growth in H2… in line with the board's expectations”

- By Steven Moore

- 4 December 2024, 07:38

Zigup (#ZIG) – H1 adj. EPS down to 28.1p, DPS +6% to 8.8p, notes “lower disposal and Claims and Services profits”

- By Steven Moore

- 4 December 2024, 07:36

Treatt (#TET) – FY adj. EPS +7% to 24.5p, DPS +5% to 8.41p, argues “poised to accelerate growth”

- By Steven Moore

- 4 December 2024, 07:32

Tuesday »

Mind Gym – interims including “the business has returned to profitability”. Er, no it hasn’t!

- By Steven Moore

- 3 December 2024, 17:35

Tom Winnifrith Bearcast: who do you want as this year's Christmas carol villain?

- By Tom Winnifrith

- 3 December 2024, 16:32

Vianet – argues interims “in line with management expectations”, but that actually meaning very demanding second half requirements!

- By Steven Moore

- 3 December 2024, 16:31

SysGroup – interims arguing “further strengthening our financial stability”. Er, what about the profit (lack of) warning then?

- By Steven Moore

- 3 December 2024, 14:10

Collapsing retail sales and collapsing business confidence: who does Rachel from Customer services blame? Maggie knew who!

- By Tom Winnifrith

- 3 December 2024, 12:24

Windar Photonics – having three weeks ago stated “a strong balance sheet”, now a discounted placing including to “strengthen the company's balance sheet”!

- By Steven Moore

- 3 December 2024, 11:29

Tom Winnifrith Bonus Bearcast: a short email from 'arry Adams and a long chat with Steve O'Hara

- By Tom Winnifrith

- 3 December 2024, 11:04

BREAKING Supply@Me Capital: another rat jumps from the sinking ship

- By Tom Winnifrith

- 3 December 2024, 10:38

Tom Winnifrith: will you join me at what really will be the final Sharestock?

- By Tom Winnifrith

- 3 December 2024, 08:39

Excruciating embarrassment at the Service station, but I will continue to stand up for Israel, Tom Winnifrith

- By Tom Winnifrith

- 3 December 2024, 08:00

#KEFI Gold & Copper – confirms £10.6m capital raise at 0.55p per share

- By Steven Moore

- 3 December 2024, 07:59

OptiBiotix Health (#OPTI) – upcoming launch of “multiple” products under Dr Morepen's newly-developed LightLife brand in India

- By Steven Moore

- 3 December 2024, 07:57

Marston's (#MARS) – FY adj. EPS up to 5.2p, current year first 6 weeks LFL sales +3.9%

- By Steven Moore

- 3 December 2024, 07:56

On the Beach (#OTB) – FY adj. EPS up to 14.1p, DPS 3p, confident in delivering growth outlook

- By Steven Moore

- 3 December 2024, 07:52

SSP (#SSPG) – FY adj. EPS up to 10p, DPS to 3.5p, “focus now is on driving greater value from a strengthened base”

- By Steven Moore

- 3 December 2024, 07:51

#WIZZ Air – November booked passengers +1.7% YoY, load factor +3.1ppts to 91.5%

- By Steven Moore

- 3 December 2024, 07:45

Greencore (#GNC) – FY adj. EPS up to 12.7p, DPS reintroduced at 2p, “encouraged by the business's underlying momentum”

- By Steven Moore

- 3 December 2024, 07:44

#MIND Gym – H1 still even adj. loss, FY outlook “unchanged, with actions taken to eliminate further costs”

- By Steven Moore

- 3 December 2024, 07:40

Gooch & Housego (#GHH) – FY adj. EPS down to 25.5p though DPS edged up to 13.2p, argues profit growth confidence this year

- By Steven Moore

- 3 December 2024, 07:37

discoverIE (#DSCV) – H1 adj. EPS -4% to 18.4p, DPS +4% to 3.90p, currently “orders run rate ahead of sales and ahead of the second quarter”

- By Steven Moore

- 3 December 2024, 07:33

Monday »

Tom Winnifrith bonus bearcast: Kefi placing, was I lied to and should we bail or buy via Primary Bid?

- By Tom Winnifrith

- 2 December 2024, 17:36

Topps Tiles – what of its response to “disastrous acquisition”, “failure to adapt to an evolving retail landscape” and other ‘Comment’?…

- By Steven Moore

- 2 December 2024, 17:36

A failed and disgraced fund manager explains his art of stockpicking

- By ShareProphets

- 2 December 2024, 17:36

Condor Gold – one possible offeror announces it doesn’t intend to make a firm offer, but another announces proposed terms…

- By Steven Moore

- 2 December 2024, 16:29

Tom Winnifrith Bearcast: a day of total shame for the FCA and glory for Jim Mellon

- By Tom Winnifrith

- 2 December 2024, 14:56

Evil Banksta: a SECOND critical question for EnergyPathways

- By Tom Winnifrith

- 2 December 2024, 13:24

GOTCHA! RegTech Open Project to delist, next stop administration?

- By Tom Winnifrith

- 2 December 2024, 12:30

Global Petroleum: the twitter ramping of CEO Omar Ahmad, does Nomad SPARK not give a FF?

- By Tom Winnifrith

- 2 December 2024, 12:16

Gamma Communications move to Main Market, a hammer blow for the AIM sewer

- By Tom Winnifrith

- 2 December 2024, 11:07

BREAKING EXPOSE: Argo Blockchain rejects more money at higher price for stinking subscription that still leaves it insolvent

- By Tom Winnifrith

- 2 December 2024, 10:55

Andrew Monk and the myth of the impoverished bankster caption contest

- By ShareProphets

- 2 December 2024, 08:00

Gamma Communications (#GAMA) – initiated workstreams to move from AIM to Main Market

- By Steven Moore

- 2 December 2024, 07:59

Metals Exploration (#MTL) – “in advanced-stage discussions” with Condor Gold (#CNR) re. a possible offer for Condor

- By Steven Moore

- 2 December 2024, 07:59

Condor Gold (#CNR) – Calibre Mining “does not intend to make an offer for Condor”

- By Steven Moore

- 2 December 2024, 07:58

Argo Blockchain (#ARB) – £4.2m subscription at 5.5p per share

- By Steven Moore

- 2 December 2024, 07:51

boohoo (#BOO) – repayment of £50m of £97m term loan following recent placing

- By Steven Moore

- 2 December 2024, 07:50

Tavistock Investments (#TAVI) – receipt of £22m of disposal proceeds, emphasises “repositioning” asset management business

- By Steven Moore

- 2 December 2024, 07:45

Mothercare (#MTC) – H1 swing to even adj. loss, notes impacted by Middle Eastern markets

- By Steven Moore

- 2 December 2024, 07:40

K3 Business Technology (#KBT) – agreement to sell NexSys business for £36m, anticipates returning “a substantial proportion” to shareholders during H1 2025

- By Steven Moore

- 2 December 2024, 07:34

Supreme (#SUP) – acquisition from administration of trade and selected assets of Typhoo Tea for £10.2m

- By Steven Moore

- 2 December 2024, 07:29

Volution (#FAN) – completes acquisition of Fantech Group in Australasia

- By Steven Moore

- 2 December 2024, 07:24

Sunday »

Tom Winnifrith Bearcast: Now Steve O'Hara really will hate me, is his son worth £100k? And Jim Mellon gets a bid for Condor, don't get carried away

- By Tom Winnifrith

- 1 December 2024, 19:37

The View From The Montana Log-Cabin As Gold Sees Less Volatility And Trump Threatens BRICS

- By Nigel Somerville

- 1 December 2024, 16:24

Johnson Matthey shares have been very weak but it could turn things around following the restructuring of the business

- By Gary Newman

- 1 December 2024, 12:25

Sunday Long Reads: Bad Apples, Extreme Travellers, Spanish Water, Rampaging Mobs, DB Cooper

- By ShareProphets

- 1 December 2024, 11:14

Notes from Underground – Most read articles for the week ending Nov 30

- By ShareProphets

- 1 December 2024, 11:02

Photo article from the Welsh hovel: cat at work, Tom Winnifrith

- By Tom Winnifrith

- 1 December 2024, 00:00

Saturday »

Tom Winnifrith Bearcast: when did it become acceptable to tell lies?

- By Tom Winnifrith

- 30 November 2024, 19:57

Mr. Karma always gets you in the end, Giles Clarke walks the plank at Ironveld after 15 years of massive value destruction

- By Tom Winnifrith

- 30 November 2024, 18:12

Has Optibiotix sold Skinbiotherapeutics shares? Steve O’Hara declines to deny

- By Tom Winnifrith

- 30 November 2024, 15:42

EnergyPathways: when you know who you are up against you know it’s a disaster waiting to happen

- By Tom Winnifrith

- 30 November 2024, 15:05

Doing the Fandango Holdings: joke interims is the FCA totally asleep at the wheel?

- By Tom Winnifrith

- 30 November 2024, 13:26

ShareProphets readers tips for 2024 prize competition – about to enter final month update

- By Steven Moore

- 30 November 2024, 13:12

I’m in the wrong business: the price of Christmas trees is insane! Tom Winnifrith

- By Tom Winnifrith

- 30 November 2024, 00:49

Friday »

CMO Group – Friday intra-day “Q4 2024 Trading Update and Outlook” announcement. Uh oh…

- By Steven Moore

- 29 November 2024, 16:00

Tom Winnifrith Bearcast: on the nature of fraud however small

- By Tom Winnifrith

- 29 November 2024, 14:55

Evil Banksta flags up a great twitter thread on EnergyPathways: now a compelling short

- By ShareProphets

- 29 November 2024, 13:48

When is it okay to be a convicted fraudster and cover it up?

- By Tom Winnifrith

- 29 November 2024, 12:43

Tom Winnifrith bonus bearcast: what should Father Christmas bring Gary Newman and Lucian Miers this Christmas?

- By Tom Winnifrith

- 29 November 2024, 12:00

Amaroq Minerals – completes its first gold pour at Nalunaq, developing “cash flow generation” BUY with a target of up to 180p

- By Steven Moore

- 29 November 2024, 10:08

GOTCHA: Lying Charlatans at Argent Pharma flip flop on delisting, shares collapse, TW 100% vindicated yet again

- By Tom Winnifrith

- 29 November 2024, 09:40

Argent Biopharma (#RGT) – GOTCHA!, “intention to delist from the London Stock Exchange”

- By Steven Moore

- 29 November 2024, 07:57

Bushveld Minerals (#BMN) – not received amount due from Vanchem, the Business Rescue Practitioners “in discussions… including taking legal advice”

- By Steven Moore

- 29 November 2024, 07:57

Invinity Energy Systems (#IES) – appointment of Adam Howard as CFO, good luck chap!

- By Steven Moore

- 29 November 2024, 07:56

McBride (#MCB) – banking facilities refinancing noting improved terms and conditions and extended maturity

- By Steven Moore

- 29 November 2024, 07:55

Resolute Mining (#RSG) – second settlement payment under ‘Protocol’, “discussions with the Government of Mali are ongoing to clarify points of the protocol”

- By Steven Moore

- 29 November 2024, 07:43

#PEEL Hunt – H1 return to profit, though notes “sentiment in the UK has dipped following the Budget and increased concerns around global trade”

- By Steven Moore

- 29 November 2024, 07:40

Aptamer (#APTA) – “AGM Statement”, attempted ramptastic with no bottom-line or cash specifics

- By Steven Moore

- 29 November 2024, 07:36

Caffyns (#CFYN) – H1 adj. EPS up to 12.2p, DPS maintained at 5p, notes supply concerns due to Government-mandated zero-emission cars targets

- By Steven Moore

- 29 November 2024, 07:33

Northern Bear (#NTBR) – H1 EPS up to 8.4p, considers “potential in the second half to trade ahead of strong prior year results and market expectations”

- By Steven Moore

- 29 November 2024, 07:28

Thursday »

Tom Winnifrith Bearcast: Bit political, bit political..I'd rather eat my own toes

- By Tom Winnifrith

- 28 November 2024, 17:29

Dr. Martens – interims emphasise “in line with expectations… delivering on our strategic objectives”, but how creditable really is that?…

- By Steven Moore

- 28 November 2024, 14:24

Hemogenyx: When folks invoke and celebrate my mother’s suicide you know they have lost the argument

- By ShareProphets

- 28 November 2024, 13:40

Tom Winnifrith Bonus Bearcast: Optibiotix, Skins, what a journalist is meant to do, transparency, Lemming and Gary Newman

- By Tom Winnifrith

- 28 November 2024, 12:47

Another AIM disaster: Electric Guitar, the Fat Lady has now started singing

- By Tom Winnifrith

- 28 November 2024, 11:17

Ariana Resources – further increased Dokwe project prospectivity, BUY

- By Steven Moore

- 28 November 2024, 10:41

Hemogenyx owning moron JohnR thinks Tom Winnifrith is a “scumbag” and "disgrace"battlng for team leukemia

- By ShareProphets

- 28 November 2024, 10:36

J Sainsbury – further share buyback tranche follows interims, BUY!

- By Steven Moore

- 28 November 2024, 09:36

Warren Buffett’s advice on how to leave an estate of staggering wealth without ruining your children

- By ShareProphets

- 28 November 2024, 09:35

Loungers (#LGRS) – recommended 310p per share offer with unlisted share alternative

- By Steven Moore

- 28 November 2024, 08:00

Scholium (#SCHO) – proposed AIM cancellation, argues its discount to NAV share price has “significantly hampered” growth ability

- By Steven Moore

- 28 November 2024, 07:56

Amaroq Minerals (#AMRQ) – its first gold pour at Nalunaq mine, currently continuing to optimise processing plant and aiming to conduct weekly gold pour

- By Steven Moore

- 28 November 2024, 07:52

Ocado (#OCDO) – from its Erith fulfilment centre Morrisons to “gradually cease deliveries”, to build volumes from both Ocado’s Dordon centre and “in-store fulfilment solution”

- By Steven Moore

- 28 November 2024, 07:45

Dr. Martens (#DOCS) – H1 swing to even adj. loss and increased net bank debt but still a dividend!, 0.85p per share

- By Steven Moore

- 28 November 2024, 07:39

EnSilica (#ENSI) – AGM update, “expects… to continue to trade in line with consensus market expectations for the financial year to 30 May”

- By Steven Moore

- 28 November 2024, 07:33

Macfarlane (#MACF) – revenue -4% YoY, “continued challenging market conditions resulting in weaker volumes and lower pricing impacting most sectors”

- By Steven Moore

- 28 November 2024, 07:30

James Latham (#LTHM) – H1 EPS down to 50.5p, DPS up to 7.95p, expected signs of market improvement so far “has not materialised”

- By Steven Moore

- 28 November 2024, 07:27

Galliford Try (#GFRD) – trading momentum “continued into the new financial year… in line with the board's expectations”

- By Steven Moore

- 28 November 2024, 07:22

Wednesday »

Aston Martin Lagonda – argues “successful” share and private debt placings mean “now well positioned for growth”. Er, a few points…

- By Steven Moore

- 27 November 2024, 16:29

Tom Winnifrith Bearcast: the three serpents in the Helium bubble garden of Jerry Keen

- By Tom Winnifrith

- 27 November 2024, 16:21

Strix – “Trading Update” = Profit Warning (natch!) and has there really been “significant progress” on the balance sheet?…

- By Steven Moore

- 27 November 2024, 15:02

Tom Winnifrith Bonus Bearcast: greatly cheered by NOT speaking to 'arry Adams or Steve O'Hara

- By Tom Winnifrith

- 27 November 2024, 12:53

Restore plc – ten months trading update, still a recovery Buy

- By Steven Moore

- 27 November 2024, 12:07

EXPOSE: BWA Group - a group that doesn’t consolidate its subsidiaries, why accounting policies can materially impact reported results

- By Tom Winnifrith

- 27 November 2024, 11:52

Focusrite – full-year results argue “growth when market conditions improve”, but when’s even that likely to be?

- By Steven Moore

- 27 November 2024, 11:27

BREAKING: Is Helix Exploration boss David Minchin a brazen liar or a reckless fool?

- By Tom Winnifrith

- 27 November 2024, 10:31

While my Electric Guitar gently weeps: suspension shocker, Fat Lady on Standby, PKF disgraced!

- By Tom Winnifrith

- 27 November 2024, 10:07

Just Eat Takeaway.com (#JET) – “intention to delist from London Stock Exchange”

- By Steven Moore

- 27 November 2024, 07:59

Aston Martin Lagonda (#AML) – £111m equity raise at 100p per share including via PrimaryBid and £100m additional senior secured notes issuance

- By Steven Moore

- 27 November 2024, 07:58

Mitchells & Butlers (#MAB) – FY adj. EPS up to 26.4p, “strong start to FY 2025, like-for-like sales of 4.0% in the first seven weeks”

- By Steven Moore

- 27 November 2024, 07:55

Strix (#KETL) – trading warning, “now expects to report adjusted profit before tax for FY24 in the range of £18m to £19m (on a constant currency basis)”

- By Steven Moore

- 27 November 2024, 07:52

Focusrite (#TUNE) – FY adj. EPS down to 18p, DPS maintained at 6.6p, notes continuing macro pressures

- By Steven Moore

- 27 November 2024, 07:50

#PETS At Home – H1 adj. EPS up to 8.4p, DPS to 4.7p, though FY warning as longer than anticipated subdued pet retail market growth

- By Steven Moore

- 27 November 2024, 07:47

Auction Technology (#ATG) – FY adj. EPS down to $0.386, argues current trading “positive momentum”

- By Steven Moore

- 27 November 2024, 07:42

easyJet (#EZJ) – FY adj. EPS up to 61.3p, DPS to 12.1p, argues “positive” outlook

- By Steven Moore

- 27 November 2024, 07:39

Motorpoint (#MOTR) – H1 return to profit, though revenue decrease with “more affordable vehicle mix and price deflation”

- By Steven Moore

- 27 November 2024, 07:35

JD Sports Fashion (#JD.) – completes €520m acquisition of Groupe Courir following European Commission conditional clearance and satisfaction of all other conditions

- By Steven Moore

- 27 November 2024, 07:28

Tuesday »

Tom Winnifrith bearcast: egg on boat race time but for once not mine!

- By Tom Winnifrith

- 26 November 2024, 16:32

Topps Tiles – full-year results emphasise “confidence in the medium term outlook”, so what about the current outlook?…

- By Steven Moore

- 26 November 2024, 16:25

Severfield – from “market conditions are showing signs of improvement” to a ‘market conditions’ profit warning in less than four months, and worse!…

- By Steven Moore

- 26 November 2024, 14:09

BREAKING: Peel Hunt warns of £2 billion AIM IHT own goal by Rachel from Customer Services

- By Tom Winnifrith

- 26 November 2024, 14:02

Sosandar – Half Year Results, Big Helping Of Hartley's As More Jam Tomorrow Promised

- By Nigel Somerville

- 26 November 2024, 12:56

MPs and Lords say that the FCA is “incompetent” and “defective” – Pots and Kettles

- By Tom Winnifrith

- 26 November 2024, 12:21

i-nexus Global – proposed AIM cancellation, yet another roll-call of shame on the self-described “world's most successful growth market”!

- By Steven Moore

- 26 November 2024, 11:41

Golden Tuesday Bonus Bearcast: News from Amaroq and Ariana

- By Tom Winnifrith

- 26 November 2024, 10:35

Ariana Resources (#AAU) – Dokwe project exploration work delivering several resource growth opportunities

- By Steven Moore

- 26 November 2024, 07:57

Victoria (#VCP) – H1 swing to even adj. loss, net debt £658.2m

- By Steven Moore

- 26 November 2024, 07:54

Sosandar (#SOS) – H1 another loss on lower revenue, argues recent “evidence of the performance that we anticipated as customers become accustomed to paying full price”

- By Steven Moore

- 26 November 2024, 07:52

AO World (#AO.) – H1 EPS up to 1.94p, FY adj. PBT guidance “upgraded to between £39m and £44m”

- By Steven Moore

- 26 November 2024, 07:49

IG Design (#IGR) – H1 adj. EPS down to $0.112, expects H2 profit driven by “business simplification, efficiency and cost-saving initiatives”

- By Steven Moore

- 26 November 2024, 07:46

Halfords (#HFD) – H1 adj. EPS and DPS maintained at 7.6p and 3p respectively, “H2 is also impacted by short-term costs”

- By Steven Moore

- 26 November 2024, 07:43

Vp (#VP.) – H1 adj. EPS down to 39p, DPS maintained at 11.5p, “headwinds and challenging conditions continue to impact General Construction and Housebuilding”

- By Steven Moore

- 26 November 2024, 07:40

Brickability (#BRCK) – H1 adj. EPS down to 5.03p, DPS up to 1.12p, “profitability is expected to be first half weighted due to phasing of project work in the Contracting division”

- By Steven Moore

- 26 November 2024, 07:38

Compass (#CPG) – FY adj. EPS up to $1.195, DPS to $0.598, current year expects “organic revenue growth above 7.5% and ongoing margin progression”

- By Steven Moore

- 26 November 2024, 07:34

Monday »

DSW Capital – interims, will deal volumes be “returning to normal levels” in its Q4?

- By Steven Moore

- 25 November 2024, 16:00

Doc Holliday pumping and dumping at ECR: there is a case for the defence

- By ShareProphets

- 25 November 2024, 13:55

Kingfisher – Q3 update emphasises “full year profit guidance range tightened”…but that’s not in a good way!

- By Steven Moore

- 25 November 2024, 13:54

Letter to FRC: please investigate Zak Mir, Lift Global Ventures and Lee Lederberg of Edwards Veeder

- By Tom Winnifrith

- 25 November 2024, 13:07

Tom Winnifrith bonus bearcast: just a few more thoughts on Microstrategy vs Golden Prospect Precious Metals

- By Tom Winnifrith

- 25 November 2024, 12:45

Dialight – interims argue “confident that further progress will be made in the second half”, but sufficient for the balance sheet position?…

- By Steven Moore

- 25 November 2024, 11:19

EXPOSE: Has Graham Bond of RSM been a very naughty boy with his Celadon homework?

- By Tom Winnifrith

- 25 November 2024, 10:15

#GOOD Energy – Takeover Panel extension to 23rd December “to allow further time for Esyasoft to progress its due diligence”

- By Steven Moore

- 25 November 2024, 07:55

Software Circle (#SFT) – “up to” £16.7m new loan facilities, to repay £6.7m of outstanding bonds

- By Steven Moore

- 25 November 2024, 07:50

Rentokil Initial (#RTO) – CFO Stuart Ingall-Tombs retiring, Paul Edgecliffe-Johnson to succeed

- By Steven Moore

- 25 November 2024, 07:48

#DSW Capital – Deputy CEO Shru Morris to succeed James Dow as CEO on 1st April

- By Steven Moore

- 25 November 2024, 07:45

#DSW Capital – H1 small profit, “deal volumes in November and December are likely to be subdued, as many transactions were brought forward ahead of the Budget”

- By Steven Moore

- 25 November 2024, 07:42

Dialight (#DIA) – H1 another even adj. pre-tax loss, notes macroeconomic ‘caution’

- By Steven Moore

- 25 November 2024, 07:39

Kingfisher (#KGF) – Q3 LFL sales -1.1% YoY, “expect adjusted PBT of c.£510m to £540m (previously c.£510m to £550m)”

- By Steven Moore

- 25 November 2024, 07:36

Benchmark (#BMK) – agreement to sell genetics business for £230m and up to further £30m

- By Steven Moore

- 25 November 2024, 07:32

Anglo American (#AAL) – agreement to sell steelmaking coal mines in Australia for US$2.775bn and up to total US$3.775bn

- By Steven Moore

- 25 November 2024, 07:29

Sunday »

Tom Winnifrith Bearcast: does Optibiotix need an FD and time to short bitcoin?

- By Tom Winnifrith

- 24 November 2024, 18:17

Golden Prospect – Late In Year 2024 Tipfest Update As Subscription Deadline Looms

- By Nigel Somerville

- 24 November 2024, 17:29

The View From The Montana Log-Cabin As Gold Attempts To Stage A Comeback

- By Nigel Somerville

- 24 November 2024, 14:05

Sunday Long Reads: London Fish Markets, Junk Food Fights Back, Should India Only Speak Hindi?, Don Simpson, Painting Protests

- By ShareProphets

- 24 November 2024, 13:46

Notes from Underground – Most read articles for the week ending Nov 23

- By ShareProphets

- 24 November 2024, 12:49

Tom Winnifrith podcast: British missiles hitting Russia, not in my name

- By Tom Winnifrith

- 24 November 2024, 00:00

Saturday »

National World – saga continues as possible offerer Media Concierge warns it on “false and misleading statements”!

- By Steven Moore

- 23 November 2024, 19:26

SkinBioTherapeutics – “finalisation of commercial agreement with Croda” to further spark the shares, Buy

- By Steven Moore

- 23 November 2024, 11:04

Friday »

National World – considers possible offer proposal has “potential merits”, BUT…

- By Steven Moore

- 22 November 2024, 15:25

Tom Winnifrith Bearcast: Hemogenyx you guys are taking the piss!

- By Tom Winnifrith

- 22 November 2024, 14:57

A failed fund manager offers his great thoughts on Jaguar and its relaunch

- By ShareProphets

- 22 November 2024, 13:52

Nostra Terra is a great example of why the AIM market is dying and has been for some time

- By Gary Newman

- 22 November 2024, 12:20

Video: The Darkening Skies Over Wall Street – Ominous Signals for Investors

- By Tom Winnifrith

- 22 November 2024, 12:01

Letter to the FCA demanding suspension of the trading in the shares of the technically insolvent Supply@ME Capital fraud

- By Tom Winnifrith

- 22 November 2024, 11:55

Coats Group – “continued momentum with double-digit sales growth”, but still looks to offer value

- By Steven Moore

- 22 November 2024, 11:26

Webis: Jim Mellon takes it private, in reality shareholders’ equity already worthless

- By Tom Winnifrith

- 22 November 2024, 11:25

Tom Winnifrith Bonus Bearcast: Now Lemming Junior says switch from Optibiotix to Skinbiotherapeutics

- By Tom Winnifrith

- 22 November 2024, 10:36

BREAKING: Lift Global Ventures – deep dive into 30 June 2024 numbers, its off to the FRC I go!

- By ShareProphets

- 22 November 2024, 08:00

National World (#NWOR) – Media Concierge urges it “to engage constructively” re. a 21p per share possible offer proposal

- By Steven Moore

- 22 November 2024, 07:59

Webis (#WEB) – proposed AIM cancellation, to “reduce costs and protect shareholder value”

- By Steven Moore

- 22 November 2024, 07:58

Learning Technologies (#LTG) – Takeover Panel extension to 6th December as discussions with General Atlantic “are advanced but remain ongoing”

- By Steven Moore

- 22 November 2024, 07:57

TI Fluid Systems (#TIFS) – Takeover Panel extension to 29th November for ABC Technologies “to finalise financing and other arrangements”

- By Steven Moore

- 22 November 2024, 07:56

Tavistock Investments (#TAVI) – subsidiary businesses disposal completion conditions satisfied and agreement to acquire asset management business Alpha Beta Partners

- By Steven Moore

- 22 November 2024, 07:47

#LPA – weaker H2 YoY due to delayed orders, FY adj. “breakeven… in line with previous guidance”

- By Steven Moore

- 22 November 2024, 07:40

#RTC Group – “continue to drive growth” and “remain confident in our ability to capture further value”

- By Steven Moore

- 22 November 2024, 07:39

Games Workshop (#GAW) – “trading since the last update on 18 September 2024 is ahead of expectations”

- By Steven Moore

- 22 November 2024, 07:33

#DFS Furniture – “order intake remaining in growth over the first 20 weeks” and continuing cost reductions, Marie Wall to join as Interim CFO

- By Steven Moore

- 22 November 2024, 07:32

Michelmersh Brick (#MBH) – trading “benefiting from the quality of the order book”, “in line with market expectations”

- By Steven Moore

- 22 November 2024, 07:27

Thursday »

Tom Winnifrith Bearcast: starting my hard conversation with Steve O' Hara

- By Tom Winnifrith

- 21 November 2024, 17:29

FW Thorpe – expects results “marginally ahead of last year”, but is such trading sufficient for the valuation?

- By Steven Moore

- 21 November 2024, 16:25

Eco Buildings Group – letter of Intent for potential significant new contract, risk/reward Strong Buy

- By Steven Moore

- 21 November 2024, 14:52

Ariana Resources – “Zenit Portfolio Operations Update”, the “portfolio” to expand?

- By Steven Moore

- 21 November 2024, 14:43

JD Sports Fashion – emphasises “well positioned for peak season”… but even with that only expects ‘lower end of guidance range’!

- By Steven Moore

- 21 November 2024, 14:25

Tom Winnifrith bonus bearcast: Which accounts from Zak Mir are a tissue of lies?

- By Tom Winnifrith

- 21 November 2024, 13:15

Speedy Hire – interims, “the board anticipates the group meeting its full year expectations”. Really?…

- By Steven Moore

- 21 November 2024, 11:29

Celadon Pharmaceuticals: FFS just come clean, when’s the massively discounted placing?

- By Tom Winnifrith

- 21 November 2024, 11:14

BREAKING: Supply@Me Capital – Alessandro Zamboni in default on yet another 7 figure financing commitment

- By Tom Winnifrith

- 21 November 2024, 09:39

FCA consultation on extending time firms have to respond to non-discretionary commission motor finance complaints

- By Steven Moore

- 21 November 2024, 07:59

Frasers (#FRAS) – open letter including noting its further requisition to seek to remove Executive Chairman Mahmud Kamani as director of boohoo (#BOO)

- By Steven Moore

- 21 November 2024, 07:58

Resolute Mining (#RSG) – CEO Terence Holohan and the two other employees released in Mali and have departed the country

- By Steven Moore

- 21 November 2024, 07:57

Cohort (#CHRT) – agreement to acquire naval satellite communications business EM Solutions for c.£75m enterprise value, £40m placing and up to £1m “retail offer”

- By Steven Moore

- 21 November 2024, 07:56

Liontrust (#LIO) – H1 adj. EPS down to 30.3p, DPS maintained at 22p, notes market challenges but argues moving into a more positive environment

- By Steven Moore

- 21 November 2024, 07:45

CMC Markets (#CMCX) – H1 EPS swing to 12.8p, DPS up to 3.1p, “confident in delivering on guidance”

- By Steven Moore

- 21 November 2024, 07:38

Speedy Hire (#SDY) – H1 swing to loss, argues “consistent with prior years… expects a strong second half weighting”

- By Steven Moore

- 21 November 2024, 07:36

Breedon (#BREE) – four months to 31st October LFL revenue -1%, FY expectations unchanged

- By Steven Moore

- 21 November 2024, 07:33

PZ Cussons (#PZC) – trading “in line with expectations”, progressing with sale of St. Tropez brand and discussions on African business

- By Steven Moore

- 21 November 2024, 07:29

JD Sports Fashion (#JD.) – Q3 update, “now anticipate full year profit to be at the lower end of our guidance range”

- By Steven Moore

- 21 November 2024, 07:23

Wednesday »

Volex – interims, confidence in meeting outlook targets and a possible offer for TT Electronics?

- By Steven Moore

- 20 November 2024, 16:43

Time left: 09:00:58