By Tom Winnifrith | Sunday 23 October 2022

Time and time again I warned on this website that Appbox Media and OneTrueView were boiler room scams. In all £65 million was stolen from investors who have lost everything. I did contact the FCA about this matter and in May this year, Mark Steward Executive Director, Enforcement and Market Oversight finally replied. He washed his hands of the matter which is good news for the chaps involved as they are at it again! Maybe they can take the total stealings to £100 million while the FCA sleeps.

Steward argues that this was none of his business:

“In respect of the alleged boiler room scam, according to our records, neither One True View nor AppBox Media are, nor ever have been, authorised by the FCA to carry on any regulated activities.

For the FCA to be able to take action in relation to a firm or individual not authorised by us, we need to have sufficient evidence to indicate that that firm or individual may be carrying on a regulated activity without our authorisation. Based on the information available to us, we have not seen any evidence that AppBox Media or One True View was carrying on regulated activities to be able to take further action.”

So the Steward/FCA view is that OTV/Appbox really were tech companies. But witness after witness has given evidence on these pages as to how they were approached directly by those working for the companies to invest cash. I have offered to put such witnesses in touch with Steward but he has not responded. The reality is that while there was the odd developer in the City of London offices of these companies developing the odd app which was utterly non-commercial. But the vast bulk of those working for these companies were salesmen, on high commissions, selling shares to mug punters. As such both companies were conducting regulated activities (selling shares) and that is exactly what the FCA should be investigating.

But it is not so the gang moves on to the next heist which is Eden Pharma, a bezzle I most recently covered HERE.

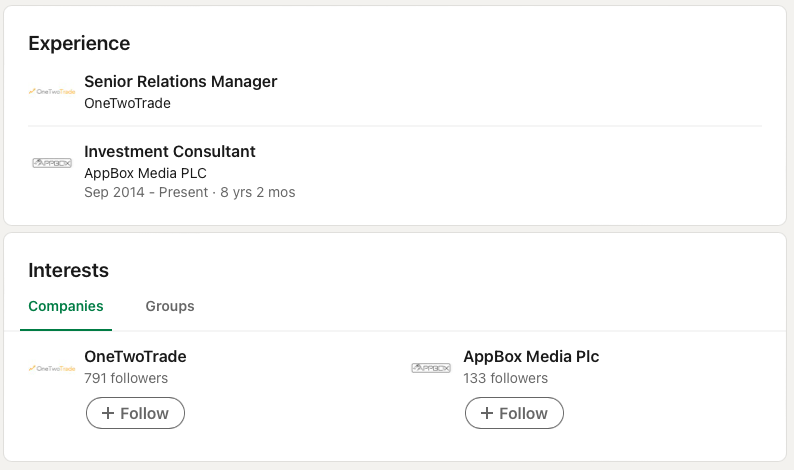

Meet Samuel Amadi whose Linkedin Profile is below. You will see that he says that from 2014 to the present day he worked as an “investment consultant” at Appbox Media. As Appbox’s last accounts were filed for the year to July 2018 and it looks to be in insolvency I suspect Sam needs to update his page but you can see it here before he does.

I have chatted to a number of folks who explains what an “investment consultant” did at Appbox. The job entailed cold calling folks and getting them to invest money. And Samuel was persuasive for many did. Mr Amadi was and is not regulated by the FCA and nor was Appbox regulated to do this.

So what is Samuel doing now? I have in my possession a letter dated March 2020 from Samuel Amadai who at that point describes himself as “Senior Business Development, Eden Pharma”. The letter reads:

“It was a pleasure to speak to you earlier and I trust that this finds you well. I am please to confirm your subscription for 50,000 ordinary shares in Eden Pharma Ltd at £1 a share for a total sum of £50,000.”

The lucky punter duly coughed up fifty grand which he will never see again. This letter which I shall share with the FCA shows clearly that Amada was working for Eden to raise money for Eden which it was not regulated to do.

If the FCA wishes it can check this out and will establish that a number of the OTV/Appbox gang have moved onto Eden operating the same unregulated modus operandi. The FCA will also soon establish that a number of intermediaries who may or may not have been regulated who pushed folks into Appbox and One True View in return for eye watering commissions have done the same at Eden.

A responsible FCA which wanted to protect consumers would act swiftly to shut these operations down before the gang’s total winnings gets to £100 million. But maybe it is simpler to wash your hands of this and pretend it is not your problem. And folks wonder why there is a growing view that the FCA is not fit for purpose.

</

</

Become a member starting at £6.99 per month for all articles, the Bearcast, and our seven year archive.

Filed under:

Sunday »

Saturday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Sunday »

Saturday »

Friday »

Tuesday »

Monday »

Sunday »

Saturday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Sunday »

Saturday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Sunday »

Saturday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Sunday »

Saturday »

Thursday »

Wednesday »

Tuesday »

Monday »

Sunday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Time left: 10:04:27