By Tom Winnifrith | Monday 18 June 2018

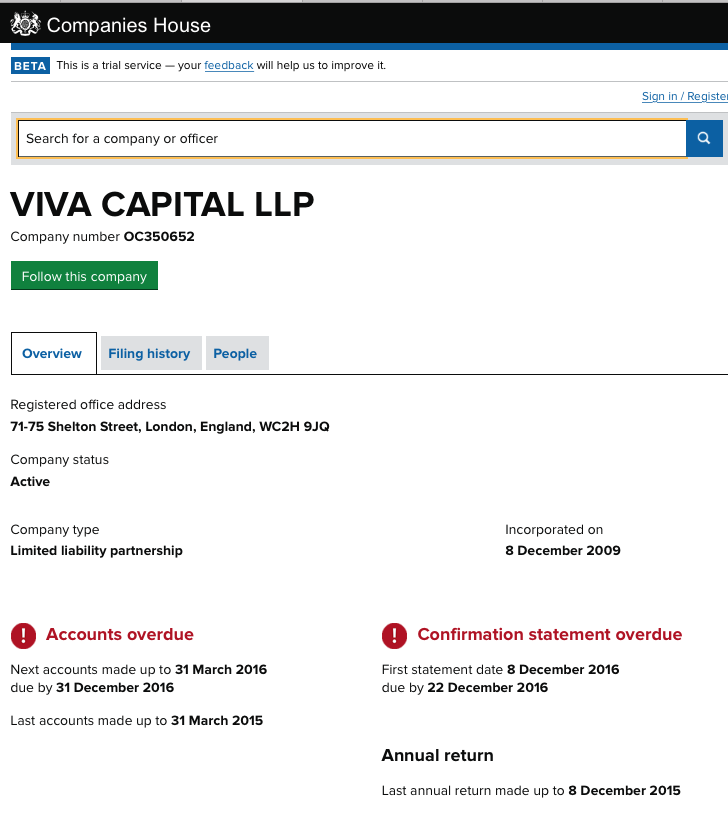

Naturally the latest accounts from Viva Capital LLP are way overdue. The report for the 12 months to 31 March 2016 was due by December 31 2016 but rules are for little people not for Julie “lingerie on expenses” Meyer. The accounts are now almost eighteen months late but historic filings show Julie up to her usual tricks.

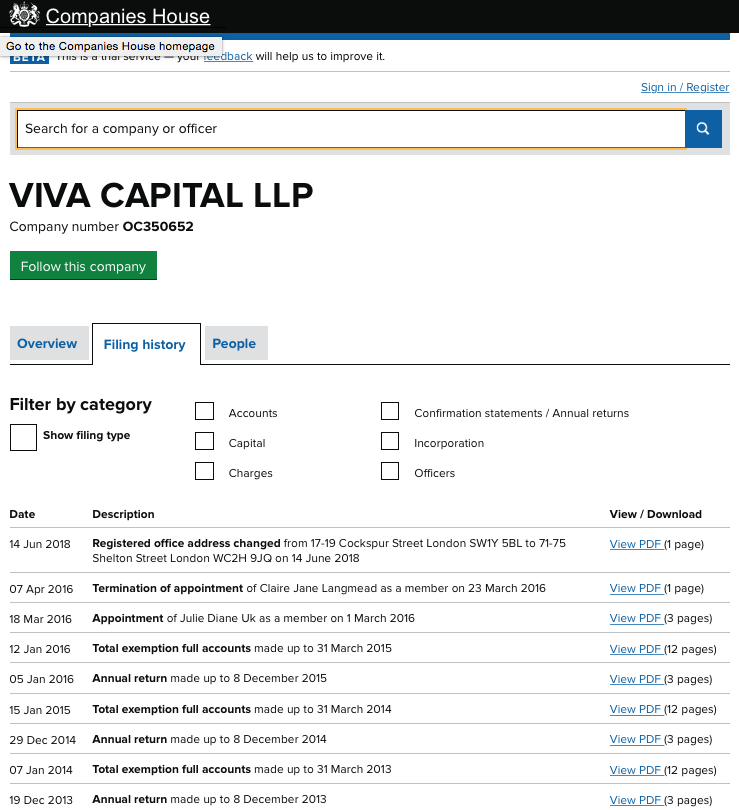

As an LLP Viva is meant to be at least two folks working in tandem. But you can see that a succession of other folks have left so that the LLP is now between Ms Lingerie on expenses and Julie Diane UK. Who? Oh that would be Julie’s long suffering PA it is just that Meyer screwed up the filing.

Viva is the firm which receives revenue for Meyer’s speaking engagements and other non Ariadne activities. One imagines that once upon a time, post First Tuesday, Julie might have made a few quid but these days with her reputation in tatters, fleeing Malta to avoid criminal charges, facing CCJs, banks chasing her for cash, Ariadne going bust, and with the IRS, HMRC, FCA, SFO and MFSA all on her case, demand for a Meyer speech may have dried up.

The last set of filed accounts are for the year to March 31 2015 and you can see this work of fiction HERE.

You sill see that sales raced ahead from £96,469 to £149,351. Well done Julie!. But hang on there seems to be a massive uplift in accruals, that is revenue booked but not yet invoiced. I am at a loss how that works when you are being paid to give a speech. Surely you just book revenue when you invoice which would be when you give your talk?

So accruals in 2015 were £59,333, up from £2,667. There was no corresponding increase in costs – in fact costs fell by c £10,000. That meant that profits surged from £38,807 to £102,635. Fabbo. Oddly, you will see that despite the business being “profitable” the cash position is nil ( down from £282) but that there is a massive surge in trade creditors due within one year from £23,875 to £64,289. Ouch. Let’s hope those accruals turn into cash although in Meyer businesses they rarely do.

If one looks at the balance sheet you will see that retained profits are up to £196,707 but oddly members ( i.e. Meyer) have had to loan Viva £180,417 to keep it going. How odd. It is almost as if amounts booked as revenue and profit just never translate into cash.

Anyhow, maybe Ms Meyer and Ms Julie Diane UK might hurry up and produce 2016 and 2017 accounts so we can check up on progress? While theyt are about it, might Julie add a note to the accounts on whether any revenue has been booked or cash received by Viva from any other Ariadne group Companies?

Become a member starting at £6.99 per month for all articles, the Bearcast, and our seven year archive.

Filed under:

Saturday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Sunday »

Saturday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Sunday »

Saturday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Sunday »

Saturday »

Thursday »

Wednesday »

Tuesday »

Monday »

Sunday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Sunday »

Saturday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Saturday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Sunday »

Time left: 15:13:32