By Tom Winnifrith | Sunday 27 May 2018

Once again, this weekend, there is no hand waving video from the flat Julie Meyer shares with her sex toys claimed on expenses and books about following Tony Blair and Jesus. Why not I wonder? Instead she has spammed her 100% non GDPR compliant list ( I got two) with the following which strikes me as A grade MBA gibberish. It is all about creating value, something hundreds of unpaid staff, suppliers and tax men know Julie is so good at. Can any reader explain to a simpleton like me what the following is all about?

Professor Carlotta Perez went to Silicon Valley in the early 1970’s to study oil as you do if you are an economist from Venezuela. She was confronted with the disruptive force of the microprocessor which exploded onto the scene at the same time, and quickly changed her subject matter focus. She became intrigued with disruptive technologies and how the technological discontinuities were transcended, and very helpfully looked at 300 years of history for us all.

Professor Carlotta Perez went to Silicon Valley in the early 1970’s to study oil as you do if you are an economist from Venezuela. She was confronted with the disruptive force of the microprocessor which exploded onto the scene at the same time, and quickly changed her subject matter focus. She became intrigued with disruptive technologies and how the technological discontinuities were transcended, and very helpfully looked at 300 years of history for us all.

She found that the same thing happened again and again. That is that there is a disruptive technology which was either the combustion engine, or the steam engine, or the microprocessor – a sort of BIG BANG explosion that changes the shape of the next 60 to 80 years.

Following this Big Bang, there are a series of derivative technologies where the money that backs them becomes so enthralled with making money (remember 1999?) that it starts to make money out of money instead of making money out of the actual technologies and the businesses leveraging them.

This leads to a financial crisis, and then the Empire Strikes Back. We are in the Second Half of Carlotta’s 60 to 80 year cycle today where the large established conventional businesses are embedding the derivative technologies into themselves in order to transform themselves. This iterative process leads to a new common sense emerging in society and the economy where an entirely new operating model exists. People fundamentally live and work differently than they did at the beginning of the 60 to 80 year cycle.

Importantly, some people and companies clock what that new operating model is early on in the cycle. They build very successful businesses because they know what the playbook is. Today we call it the Digital Playbook. Building Ecosystem Economics® is what the Digital Playbook enables one to do, and all of the GAFA companies are Ecosystem Economics firms.

What is an Ecosystem Economics firm?

It’s pretty easy actually to see success when it happens. Google, Facebook, Apple, Amazon, AirBNB, Uber etc are growing so quickly due to a variety of factors that they share; they all implicitly understand the Digital Playbook, and they are winning because they are Natives of this 60 to 80 year cycle.

The native digital winners understand:

1) There is a network orientation to everything today, and their businesses fundamentally have networks at their core. Transactions are not linear either, but network-based. They have atleast three participants in the Unit Economics of the core transaction of their business model; the individual’s data is one of the participants in the business model, and optimizing the value of his/her data is absolutely what they do. They call it ‘relevance’ and ‘targetted advertising’, but make no mistake that Facebook and Google are optimizing for the upside of their knowledge of you. They just don’t share the value of that with you the individual that they have harvested that data from.

2) Because of the above, they are fundamentally not product-driven companies, though many of them claim to be, but ARPU-driven companies. That is, they are built around models – financial and technological models of Revenue Per User and Profit Per User. The financial architecture of these firms as a result is never about absolute revenues or profits but as they relate to users. This has significant impact on how you take new products to market, and how you establish product / market fit. The same drug could be toxic to you and save my life. So there is no classic drug which works for everyone. There is a fit between a drug and a patient. What this also means is that if you want to drive the profitability of a business unit and a product, you have to understand the profitability at the Unit Economics level for a certain type of user profile, and then target correctly. Unit Economics drives everything. To drive the Macro Economic impact of your firm in your industry, focus on the Micro Economics of your business model

3) That the winners are driving the economics of their Ecosystems not just their firms.They ask: How should this industry work? How can I drive the profits of my ecosystem not just my firm? This is critical as they optimize for the system-level win. In doing so, they put themselves at the centre of massive growth on all fronts and reap the rewards.

4) Clear Economics - If you get into an Uber car, you understand what cut of the transaction you have to pay. The driver understands his cut, and Uber takes the rest. Whereever you want people to move, if the economics are clear, they will. If they aren’t, they won’t. The itunes business model that Apple pioneered has become the business model which most effectively reflects the operating model of the age. It is the core of the Digital Playbook.

5) All business models are B2C2B today; there is no more anything B2B or B2C. What this means is that consumer behavior, that third participant in the business model is driving overall the shape of industries. Businesses must have a way to anticipate the C in order to understand the future of their business. This doesn’t mean that they are selling to consumers or individuals directly or running retail businesses, but that the consumer fundamentally is shaping the product design of their businesses which will then be sold through various channels to the end consumer. Sometimes, this is referred to as the B2B2C business model, but that doesn’t accurately reflect the dominance of the consumer in all businesses. The CEO of an $18 billion market capitalization engineering firm challenged me on this once. He said we make engines Julie; there is no C in our B2B business. I asked him whether he knew about Surfair. He didn’t. I said, ‘they target BA Gold Card holders like myself with a twin-engine, twin-jet private fly service through commercial airports. At what point do you need to understand the consumer behavior of Surfair and the fact that they are growing a new market to understand that you need to start building a different type of engine for that market if you want to lead in your industry.’

6) Platforms are making all the money. If you are an infrastructure firm today, you are making investments without the revenue roadmap and toolbooths of Platform Economics. Think of Platforms as both the launch pads, fueling stations and highways for drivers which are us and our data, and the entrepreneurs running Digital Enablers who transform our consumer behaviours into products and start-ups. Platforms are shared infrastructure. However, different from Symbian or Swift which are failed infrastructure plays because they didn’t create tollbooths at the unit economics level or Clear Economics for all parties, Platforms today -both native and non-native – enable people to build their Personal Economies. I could be living in Athens or Nice or Zagreb, and decide to drive a car through Uber or rent a room through AirBNB to make money. Uber and AirBNB enable me to build my personal economy (make money, deliver my contribution) through their platforms.

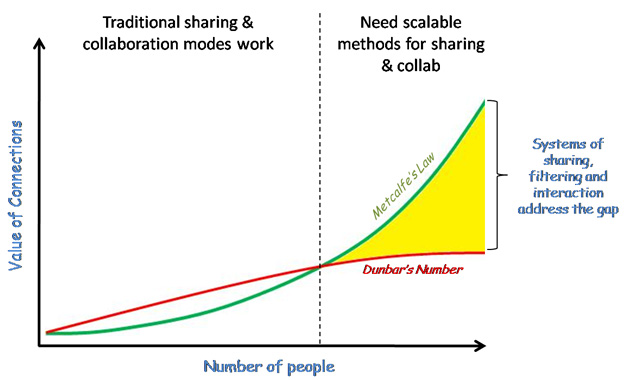

7) What used to be Enterprise Value is now Network Asset Value. Businesses grow and are valued based on the principles behind Metcalfe's law which states the effect of a telecommunications network is proportional to the square of the number of connected users of the system (n2). What Ecosystem Economics® firms understand is that Metcalfe’s law now applies to all networks not just telecoms networks.

I asked myself two questions ten years ago:

- Was it really a case of 25 companies in Palo Alto succeeding wildly, growing exponentially, and everyone else would go bust?

- If not, what would happen to everyone else? How does ‘everyone else’ succeed? How do they get to the new common sense? How do they get to the future?

The answer I’ve realized is that they study the Digital Playbook and digest it. Whereas my 15 year old goddaughter is a digital native, I am not. She knows things natively that I can only learn.

Understanding the system-level design is even MORE important for non-digital natives than digital natives, MORE important for the Empire to Strike Back than the 25 Palo-Alto based companies who are winning today.

So if you are a traditional business today which wants to get to the future, what do you do? You are a established player who is starting to understand that who you thought you were competing with is not who you are competing with, how do you adopt and integrate the Digital Playbook?

That’s what we do at EntrepreneurCountry. That’s why we push out the Digital Playbook rather than charging access to it. We believe it’s our job to share the design of the system-level win with all participants so that we can create Sustainable Economics in society.

I’d love to talk more about how you are interpreting the Digital Playbook in your firms, and working with entrepreneurs to redesign your business models. The future is one of companies empowering individuals to build their Personal Economies through engagement with Platforms. These large firms which are not native to this era have to get this future vision and consumer insight from start-ups and entrepreneurs.

If you are interested in understanding how David, Goliath and average citizens can work together in your ecosystem or your firm, do get in touch.

Very best regards

Julie Meyer

CEO, Ariadne Capital Group Ltd.

Founder, EntrepreneurCountry Global

Become a member starting at £6.99 per month for all articles, the Bearcast, and our seven year archive.

Filed under:

Saturday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Sunday »

Saturday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Sunday »

Saturday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Sunday »

Saturday »

Thursday »

Wednesday »

Tuesday »

Monday »

Sunday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Sunday »

Saturday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Saturday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Sunday »

Time left: 02:15:33