By Tom Winnifrith | Wednesday 3 February 2021

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from ShareProphets). I have no business relationship with any company whose stock is mentioned in this article.

This uber-ramped but almost insolvent company will not like what follows. Since it is 100% fact based and verified there is little it can do, but if it wishes to threaten me with legal action the response will be “see you in Court Bitchez!”. I shall be ensuring that my numerous concerns are brought to the attention of my good friends at the FCA later today.

I have been assisted in publishing this by collaborators on two continents and they may have short or long positions in the stock. I suspect it will be the former. I have no position and will gain no financial benefit from any movement in the share price up or down. Now read on and enjoy!

BACKGROUND TO RED FLAG ANALYSIS

Name |

Zoetic International PLC (ZOE) |

Shares in issue currently |

195,570,034 |

Share price |

75p |

Market cap |

£147 million |

Low of March 2020 |

3.05p |

Shares in issue March 2020 |

172,920,034 |

Market cap low of March 2020 |

£5.27m |

Share price appreciation since March 2020 |

2359% |

Zoetic International PLC (ZOE) was formerly known as Highlands Natural Resources, a resources company which listed on the Main Market of the London Stock Exchange in March 2015. In March of 2019 Zoetic started the transition away from a collection of small uneconomical US based resource assets, and into a business claiming to be a vertically integrated CBD brand business, with operations in the US and UK.

A new management team led by Mr Trevor Taylor and Mr Antonio Russo, as joint CEOs, are now leading the development of a three-pronged CBD strategy:

Since March 2020, the shares have risen from a low of 3.05p to the current price of 75p, a rise of 2359%, giving it a market capitalisation of £147 million which is, as I shall show, utterly insane. The majority of that rise has come since August 2020 when the shares were still just 8p, seemingly driven by the announcement of store distribution deals in the US and Europe.

With a new pivot strategy underway, yet no company forecast guidance, no broker research published, no known institutions with a reportable position on the cap table, and having inherited a Main List quote, meaning no NOMAD to oversee news release compliance, there is limited information to easily assess the operations and prospects of Zoetic. As such I decided to conduct a red flag analysis of the company to highlight the issues surrounding the company that investors may or may not be aware of.

My extensive analysis and research on Zoetic and the markets in which it operates has been based around:

The equity story being promoted by management and certain large investors is based around the following aspects:

However my analysis of Zoetic’s fundamentals unveils a very different story with a significant number of areas of concern across multiple levels. In my, as always humble, opinion these are as follows.

Zoetic is an early-stage company with revenues of just £81,000 in the 12 months to September 2020 and only £450,000 cash to try to create a global consumer branded business predominantly around CBD infused chews and smokable cigarettes. However, there is currently substantial regulatory scrutiny at both the federal and state level around the impact of both CBD and smokable products on consumers’ health. The combination of its inhalable smoking products and multitude of health claims being made across its social media and website leaves it vulnerable to investigation. Its products are in a high-risk category and as a result of the health claims being made, appear to be in violation of FDA and FTC regulations. Its products are likely to be deemed to be new drugs requiring authorisation first before being offered for sale to consumers in the USA.

With a valuation of £147 million, trading on a historic sales multiple of 1811x, the market is pricing in huge future revenues and profits growth. However, I have very real concerns over its financial performance potential given that its products in the USA appear to violate multiple federal agency regulations. With the potential that interstate revenues from these products could effectively be ceased with a 15-day warning letter by the FDA, revenues from the Chill products in the USA could potentially be limited. The knock-on effects of being censured by the FDA, FTC or at the state level could also be highly damaging. This could include extreme difficulties in raising much needed growth capital, listing scrutiny by the London Stock Exchange (suspension or delisting issues), negative reactions from distributors and store owners, and possible investor class action lawsuits over misleading statements. Given the multitude of red flags across the business I have identified, and the risks to future revenue performance, I would take extreme caution after the recent 2359% rise. That is putting it mildly

In my view, in a negative scenario, the equity value of Zoetic could well be zero. However, even in the most optimistic forward revenue scenario this year, based on comparable valuation multiples of other CBD companies in North America, Zoetic would struggle to justify a fair value more than £10 million, equivalent to 5p per share.

RED FLAG ANALYSIS

In my Red Flag Analysis, I identify 11 macro areas of concern and a total of over 60 Red Flag risks across these areas:

All information in this document has been sourced via publicly available sources online or through physical research such as instore visits by my collaborators.

Zoetic’s Chill brand products (www.thechillway.com/shop) in the USA consist of tobacco, nicotine and THC free CBD infused chews and cigarettes being:

In researching the Chill brand and the markets it operates in, I identify key concerns at the federal, state and company levels which will have a strong bearing of Zoetic’s ability to successfully launch the brand and ultimately generate the significant revenues and profits that are appear to be already built into the current £147 million valuation.

Of all the dozens of red flags I have identified with Zoetic, by far the most serious are that:

Each could have a material negative impact on Zoetic’s ability to create a brand and generate meaningful revenues, but combined together, the risks are that its Chill products are potentially in violation of FDA regulation and hence sales could be halted or severely restricted by federal regulators with just 15 days notice.

Red flag – FDA views CBD as a new drug requiring authorisation before sale

A) Federal regulatory background

In the USA the Food and Drug Administration (FDA) has broad oversight of protecting consumer health. With respect to CBD the FDA states:

“On the federal level, the Agriculture Improvement Act of 2018 (Farm Bill) removed cannabis and cannabis derivatives that are very low in THC from the definition of marijuana in the Controlled Substances Act (CSA). At the same time, that legislation specifically preserved the FDA’s responsibility over such products” 3 (Link)

Given the lack of scientific research and evidence around the impact of CBD on human health, the FDA currently considers CBD as a potentially harmful product with numerous possible side effects that it believes needs more investigation before it can widely be sold to consumers for ingestion – i.e. taking CBD molecules into the human body via cigarettes. 4 (Link)

It goes on to say:

“In particular, the agency recently updated the public on concerns about potential harm from CBD products, including potential liver injury, interactions with other drugs and male reproductive toxicity, as well as side effects such as drowsiness. In addition, there is still much I do not know about other potential risks. For example, other than the approved prescription drug, I know little about the potential effects of sustained and/or cumulative use of CBD, co-administration with other medicines, or the risks to vulnerable populations like children, pregnant and lactating women, the elderly, unborn children and certain animal populations.” 5 (Link)

The FDA make it clear that there is going to be stricter regulation around the sale of CBD products to consumers, especially where medical claims around the positive impact of CBD are being made. Indeed any health claims made by CBD based products also falls under the Food, Drug and Cosmetic Act (FD&C Act) which regulates products “intended to have a therapeutic or medical use, and any product (other than a food) that is intended to affect the structure or function of the body of humans or animals. ” 6 (Link). Generally intended use is determined by the claims made in advertising and promotion of the product. So far the only CBD based product the FDA has evaluated and approved for health benefits is GW Pharma’s Epidiolex in 2018.

The FDA states:

“Under the statutory authorities that the FDA has the responsibility to administer, the relevant legal requirements vary depending on which type of product we’re talking about. For example, if a product is being marketed as a drug — meaning, for example, that it’s intended to have a therapeutic effect such as treating a disease — then it’s regulated as a drug, and it generally cannot be sold without FDA approval”. 7 (Link)

“In particular, we continue to be concerned at the number of drug claims being made about products not approved by the FDA that claim to contain CBD or other cannabis-derived compounds. Among other things, the FDA requires a cannabis product (hemp-derived or otherwise) that is marketed with a claim of therapeutic benefit, or with any other disease claim, to be approved by the FDA for its intended use before it may be introduced into interstate commerce. This is the same standard to which we hold any product marketed as a drug for human or animal use. Cannabis and cannabis-derived products claiming in their marketing and promotional materials that they’re intended for use in the diagnosis, cure, mitigation, treatment, or prevention of diseases (such as cancer, Alzheimer’s disease, psychiatric disorders and diabetes) are considered new drugs or new animal drugs and must go through the FDA drug approval process for human or animal use before they are marketed in the U.S. Selling unapproved products with unsubstantiated therapeutic claims is not only a violation of the law, but also can put patients at risk, as these products have not been proven to be safe or effective. This deceptive marketing of unproven treatments raises significant public health concerns, as it may keep some patients from accessing appropriate, recognized therapies to treat serious and even fatal diseases” 8 (Link)

This is extremely relevant to Zoetic’s Chill products as the hemp and CBD specialist international law firm Harris Bricken concludes:

“Therefore any health claim made about CBD infused products, including CBD Smokables, will be treated by the FDA as a drug…and thus would require the distributor [I.e. Zoetic] to submit their product to the agency for pre market approval before they can begin selling it in interstate commerce”. 9 (Link)

This is made clear in an FDA presentation where on slide 8 it states “Under the FDCA, any product, including a cannabis product (hemp or otherwise), that is marketed with a claim of therapeutic benefit…is considered to be a drug. A new drug must be approved by the FDA for its intended use before it may be introduced into interstate commerce”. 10 (Link)

Harris Bricken goes on to conclude in an article entitled ‘The future for smokable CBD products is NOT great’ that:

“given the trends over the past few years regarding enforcement and regulation of smokable CBD products, we fully expect the trend to continue in the coming years. More states will without a doubt continue to implement bans or restrictions, and its virtually guaranteed that the federal government will create more roadblocks”. 11 (Link)

The FDA intends to regulate CBD strongly. In October 2020, the FDA set out a guidance paper called ‘FDA Regulation of Cannabis and Cannabis Derived Products, Including CBD’ stating:

“…FDA is aware that some companies are marketing products containing cannabis and cannabis-derived compounds in ways that violate the Federal Food, Drug and Cosmetic Act (FD&C Act) and that may put the health and safety of consumers at risk. The agency is committed to protecting the public health while also taking steps to improve the efficiency of regulatory pathways for the lawful marketing of appropriate cannabis and cannabis-derived products”. 12 (Link)

Furthermore, even if no medical claims are being made, the FDA considers it illegal to sell ingestible CBD across state borders:

“Food, including dietary supplements, is regulated differently, but with the same overarching goal of protecting consumers. Among other things, it is currently illegal to put into interstate commerce a food to which CBD has been added, or to market CBD as, or in, a dietary supplement. Essentially, the relevant statutory provisions prohibit these uses of CBD because CBD was the subject of substantial clinical investigations into its potential medical uses before it was added to foods (including dietary supplements), and, separately, because CBD is the active ingredient in Epidiolex, an FDA-approved prescription drug product to treat rare, severe forms of epilepsy.” 13 (Link)

”We are aware that there may be some products on the market that add CBD to a food or label CBD as a dietary supplement. Under federal law, it is illegal to market CBD this way”. 14 (Link)

The FTC is also now taking a firm stance against CBD companies. As recently as December 17th 2020 the FTC issued a public release entitled “FTC Announces Crackdown on Deceptively Marketed CBD Products’ where it stated:

“The Federal Trade Commission today announced the first law enforcement crackdown on deceptive claims in the growing market for cannabidiol (CBD) products. The FTC is taking action against six sellers of CBD-containing products for allegedly making a wide range of scientifically unsupported claims about their ability to treat serious health conditions, including cancer, heart disease, hypertension, Alzheimer’s disease, and others”. 15 (Link)

Andrew Smith, Director of the FTC’s Bureau of Consumer Protection stated:

“The six settlements announced today send a clear message to the burgeoning CBD industry: Don’t make spurious health claims that are unsupported by medical science,…Otherwise, don’t be surprised if you hear from the FTC”. 16 (Link)

In short the FDA & FTC believes:

B) Unpacking Zoetic’s CBD therapeutic claims

As part of Zoetic’s pivot from a resources company to a CBD company, Zoetic announced the launch of its Chill brand on 14th June 2019, at the very early stages of the FDAs scrutiny on CBD. Zoetics core marketing proposition is that its herbal and hemp cigarettes are organic and nicotine free and are a healthier alternative to smoking tobacco leaves. Furthermore, with CBD isolate sprayed onto the herbal leaves, when smoked the molecules of CBD get into the human system which may have an impact on nicotine cravings and hence help people stop smoking. These smoking cessation claims are made across its website, RNS releases and its social media accounts.

In my view this is a major problem for Zoetic as its products are marketed as playing on the health aspects of herbs vs tobacco and of CBD and its ability to have a therapeutic effect on the brain to help people stop smoking.

Medical claims that infused CBD isolate can help reduce nicotine dependency and act as a smoking cessation aid appears to be a product being marketed by Zoetic to ‘prevent or mitigate’ smoking related diseases. Zoetic is making marketing assertations that its CBD smokes can help people fight stress, anxiety and depression. Given FDA regulatory guidance, my view is that these CBD based medical claims must therefore be first approved by the FDA which considers it as a drug. I believe that Zoetic’s products are therefore being marketed in violation of federal regulation which means that they, may not be sold until approved, and are therefore subject to FDA enforcement at any point.

While Zoetic has, in my opinion, failed to alert consumers, investors and the London Stock Exchange to this fundamental issue, other CBD companies do indeed flag this critical regulatory issue. For example CBD focused company Earth Sciences Tech notes in its 2019 SEDAR filings under the risk section:

“The formulation, manufacturing, processing, labelling, packaging, advertising and distribution of our products are subject to regulation by several federal agencies, including the Food and Drug Administration (“FDA”), the Federal Trade Commission (“FTC”), the Consumer Product Safety Commission, the U.S. Department of Agriculture (“USDA”) and the Environmental Protection Agency (“EPA”)…The FDA has not approved cannabis, marijuana, industrial hemp or CBD derived from cannabis or industrial hemp as a safe and effective drug for any indication. The FDA considers these substances illegal Schedule 1 drugs…at some indeterminate future time, the FDA may choose to change its position concerning products containing cannabis, marijuana, or CBD derived from industrial hemp, and may choose to enact regulations…In this hypothetical event, our industrial hemp-based products containing CBD may be subject to regulation. In the hypothetical event that some or all of these regulations are imposed, we do not know what the impact would be on the cannabis industry in general, and what costs, requirements and possible prohibitions may be enforced. If we are unable to comply with the conditions and possible costs of possible regulations and/or registration as may be prescribed by the FDA, we may be unable to continue to operate our business”. 24 (Link)

In Zoetic’s case, you have to go to the website disclaimer section of the Chillway shipping policy copy before there is any acknowledgement by Zoetic as to the risks to its entire Chill revenue model where it states:

“The products and claims made about specific products on or through this site have not be evaluated by the FDA (United States Food & Drug Administration) and are not approved to diagnose, treat, cure or prevent disease” 25 (Link)

It seems misleading that as a public company, Zoetic makes open positive health claims about its products on its home page website, social media and in public press releases, yet then bury the actual position of the FDA’s attitude towards its products in a disclaimer

Unfortunately for Zoetic its pivot, in June 2019 into CBD infused cigarettes, perhaps unwittingly took it directly into a market that the FDA is now extremely focused on and clamping down on.

C) Impact on Zoetic?

I believe that the implications for Zoetic are two-fold. Firstly, Zoetic appears to be violating FDA regulation by promoting its products based on unproven medical claims. Secondly, while the FDA does not yet specifically flag cigarettes as a CBD ingestion delivery mechanism, the FDA is looking to limit the interstate sales of ingestible CBD until additional safety research has been conducted. I believe that the FDA is unlikely to allow a loophole around non tobacco cigarettes to be exploited to allow humans to ingest CBD given its stated “overarching goal of protecting consumers” 26 (Link). If that is the case, then the Chill range of CBD cigarettes and chew products, compounded by the associated medical claims, will be violating the FD&C Act and Zoetic could be subject to enforcement by the US FDA and Department of Justice (DOJ). Enforcement proceedings by both bodies could include:

In particular the guidance states:

“FD&C Act regulated articles that are already in distribution may be “recalled” or removed from market if FDA identifies FD&C Act violations that present consumer safety issues”. 27 (Link)

The FDA has continued to issue warning letters (the most recent batch on December 23rd 2020) to companies that were selling products containing CBD in ways that violate the FD&C Act around public safety concerns, specifically stating:

“Unlike drugs approved by the FDA, there has been no FDA evaluation of whether these unapproved CBD products are effective for their intended use, what the proper dosage might be, how they could interact with FDA-approved drugs, or whether they have dangerous side effects or other safety concerns.” 28 (Link)

“Meanwhile, we will continue to monitor and take action, as needed, against companies that unlawfully market their products — prioritizing those that pose the greatest risk of harm to the public.” 29 (Link)

The impact on such companies receiving a warning letter is that:

“The FDA has requested responses from the companies within 15 working days stating how the companies will correct the violations. Failure to correct the violations promptly may result in legal action, including product seizure and/or injunction”. 30 (Link)

For Zoetic this could mean that within 15 days of receiving a letter from the FDA its Chill products could be pulled from the market.

Indeed warnings have been issued by the FDA to other CBD focused companies across a number of areas which appear to make the same medical claims as Zoetic does:

Across the Zoetic websites, in promoting its CBD based products, it makes similar claims to those that caused the FDA to investigate and warn other CBD product companies. In my view it is likely that, given the above regulatory guidance and warning case studies, that Zoetic’s products could come under FDA scrutiny.

The FDA will be alerted to this. I am a good citizen

I believe that the harmful nature of herbal smokes on consumers, together with its unauthorised CBD health claims is likely to draw federal regulators’ attention with or without me. Being a publicly traded company in the UK and US will potentially make it even more high profile, which I believe further enhances the risk of attention as the FDA looks to make examples of companies violating the regulation on CBD and marketing unapproved new drugs under section 505(a) of the Federal Food, Drug, and Cosmetic Act (the FD&C Act), 21 U.S.C. 355(a).

Red flag – FDA approval needed for any products making health claims

Without scientific proof and a full FDA authorisation process, any ingestible products (CBD based on not) may not make medical claims. Any health claims:

The FDA states, in answering the question whether it reviews health claims:

“Yes. All health claims, whether authorized or qualified, require pre-market review by the FDA. Under federal law, the FDA approves by regulation authorized health claims for use in food labelling only if the substance/disease relationship described by the health claim meets the “significant scientific agreement” standard. For qualified health claims, the FDA issues letters of enforcement discretion when there is credible evidence to support the claim”. 41 (Link)

By way of example, the FDA sent a Warning Letter on December 2nd 2020 to Smokey Mountain Naturals stating that it takes online orders for products ‘Evening Primrose Oil’ and ‘Beta Glucan’ but that:

“the claims on your website establish that these products are drugs under section 201(g)(1)(B) of the Federal Food, Drug, and Cosmetic Act (the Act) [21 U.S.C. 321(g)(1)(B)] because they are intended for use in the cure, mitigation, treatment, or prevention of disease. As explained further below, introducing or delivering these products for introduction into interstate commerce for such uses violates the Act”.

The FDA’s evidence was that on the website they had stated “Evening Primrose Oil is effective at reducing inflammation…and has been traditionally used for Eczema, high blood pressure, Inflammation”.

As such it concludes:

“Your “Evening Primrose Oil,” and “Beta Glucan” products are not generally recognized as safe and effective for the above referenced uses and, therefore, these products are “new drugs” under section 201(p) of the FD&C Act, [21 U.S.C. § 321(p)]. New drugs may not be legally introduced or delivered for introduction into interstate commerce without prior approval from FDA, as described in sections 301(d) and 505(a) of the Act [21 U.S.C. §§ 331(d), 355(a)]”. 42 (Link)

Zoetic, rather similarly, on its Chillway website under Natural Herbs 43 (Link), makes the following cure, mitigation or treatment statements regarding the herbs used in its smokable products:

It states under the ‘Ways To Relax When Stress Hits’ webpage that:

“If you smoke, one way you can alleviate your stress is with THC Free CBD Smokes Calm. They promote relaxation and calm through the mixture of safe and natural herbs that create the unique blends they offer” 44 (Link)

It states under ‘What are the benefits of CBD Chew?’ webpage that:

“…studies on CBD are still in the early stages but…include Managing chronic and non chronic pain; reducing stress and anxiety; taking the place of nicotine…you will see for yourself how CBD can work wonders for you and your body”. 45 (Link)

It states under the ‘How to Use CBD Dip’ webpage that:

“Our CBD dip is filled with, you guessed it, CBD! So what is CBD and why is it known for providing some great health and wellness benefits to its users? Relaxation; Stress and anxiety; helps with depression; relieves chronic pain…these benefits, and many more, are just some of the many reasons why using CBD dip is better than tobacco dip”. 46 (Link)

It states under the ‘Will CBD Smokes Help me Relax’ webpage that:

“CBD smokes are an excellent alternative to smoking cigarettes, as they still give you the sensation of smoking, but rather than harmful chemicals, you are smoking natural herbs which may offer benefits… CBD has been shown to have relaxing qualities and to help fight stress and anxiety. When used regularly, it can even help with depression… Using CBD smokes can be a great way to fight anxiety, as well as take the edge off. CBD can also help with pain relief and is the perfect alternative to nicotine.” 47 (Link)

Zoetic is clearly promoting its products based on the premise that a significant number of health conditions can be cured, mitigated or treated with the CBD and herbal leaves used in its cigarettes and chew pouches. However I believe all these health claims are NOT clinically proven and Zoetic has NOT sought authorisation from the FDA to make such qualified health claims. Zoetic’s cigarette and chew products and associated claims make them a new drug products under Section 201(p) of the FD&C Act and are therefore ,in my view, in breach of FDA regulation leaving it in danger of enforcement, product removal from the market and fines. Furthermore in Zoetic’s case it also raises critical questions about the London Stock Exchange listing given revenues could be coming from products that are violating US FDA regulations.

Red flag – Increasing Federal FDA and FTC scrutiny on tobacco alternatives

The US FDA and Federal Trade Commission (FTC) have the authority to regulate the sale, manufacture and marketing of tobacco products under the 2009 Family Smoking Prevention and Tobacco Control Act. One of the many regulations imposed are both strict label health warning and the requirement that all tobacco cigarettes to be stocked behind the counter behind closed doors to prevent consumers from being enticed to purchase combustible cigarettes.

Zoetic states that its Chill smoke products are able to be stocked visibly on the counter. It also openly markets that smoking hemp and herbal cigarettes, with CBD, is both a healthier and safer option and one likely to help consumers stop smoking tobacco.

However it is widely accepted that all forms of smoking and inhalation into the lungs are simply not healthy and in particular the FTC has already cracked down on this issue with other herbal cigarette companies 48 (Link):

There is a growing consumer recognition that herbal cigarettes are just as bad for health as normal tobacco cigarettes with a number of health focused websites setting out their position, such as Everyday Health which states:

“Herbal cigarettes are sometimes touted as a safe, non-addictive alternative to tobacco smoking. After all, herbal cigarettes contain no tobacco and therefore no nicotine, the drug in cigarettes that causes people to become addicted. Many people even smoke herbal cigarettes as an aid to stop smoking regular cigarettes. In fact, herbal cigarettes are as harmful as tobacco cigarettes, because any vegetable matter that’s burned produces tar, carbon monoxide, and other toxins. When you breathe in the smoke of an herbal cigarette, you’re breathing those harmful toxins directly into your lungs. Herbal cigarettes are required by the Federal Trade Commission (FTC) to carry warning labels saying that they’re harmful to your health”. 49 (Link)

The American Cancer Society advises that:

“Even herbal cigarettes with no tobacco give off tar, particulates, and carbon monoxide and are dangerous to your health”. 50 (Link)

The same trend holds true in other countries around the world. For example Tobacco in Australia states:

“Herbal and other non-tobacco cigarettes may erroneously be considered as a safer alternative to smoking, or an aid to quitting smoking, and are actively promoted as such by some manufacturers… Cigarettes that do not contain tobacco or nicotine may still produce toxic substances including carcinogens. A 2015 study assessing the safety of mainstream smoke from herbal cigarettes, compared with a generic tobacco cigarette, concluded that some harmful components—specifically, tar, carbon monoxide, benzo(α)pyrene, and phenolic compounds including hydroquinone, resorcinol and catechol—exist in the mainstream smoke of herbal cigarettes in large amounts similar to a tobacco cigarette. Although tobacco-specific components such as nicotine and nitrosamines were not detected, the study showed smoke condensates of herbal cigarettes have mutagenic potential similar to that of tobacco cigarettes arising from combustion of the product… A 2009 study conducted in China… concluding that herbal cigarettes did not deliver less carcinogens than regular cigarettes and that the Chinese tobacco industry should avoid misleading the public by promoting herbal cigarettes as safer products.” 51 (Link)

In the EU, the Tobacco Products Directive came into force in May 2016 for all EU countries which bans promotional and misleading elements on herbal products for smoking and health warnings must cover 65% of the packaging. 52 (Link)

These governmental and regulatory positions sit at odds alongside the positive claims Zoetic makes on its website:

Furthermore, in what appears to be a blatant effort to mislead consumers over serious health issues, Zoetic then contradicts all its positive marketing messages about smoking its products by warning on their packets:

“Keep away from children. Not for sale to minors. There may be long term physical or mental health risks from use of hemp extract. Consult with physician for women who are or may become pregnant or are breastfeeding. Use of hemp extract may impair your ability to drive a car or operate machinery. Smoking causes lung cancer, heart disease, emphysema and may complicate pregnancy. Cutting smoking now reduces serious risk to your health”.

Further, the online disclaimer in the Shipping Policy states:

“Smoking Warning – SURGEON GENERAL’S WARNING: Smoking Causes lung cancer, heart disease, emphysema, and may complicate pregnancy. Smoking by pregnant women may result in foetal injury, premature birth, and low birth weight. Cigarette smoke contains carbon monoxide. Quitting smoking now greatly reduces serious risk to your health. Zoetic (Chill) does not recommend smoking to anyone.” 60 (Link)

In my view there is a clear intent to portray to consumers that their products are safer and better alternative replacement to tobacco which, per above, the FTC categorically refutes. While it actively promotes the supposedly health benefits of its herbal leaves and CBD as a cessation aid in its consumer marketing messages, it subversively then warns that smoking is bad for consumer health and that “Zoetic does not recommend smoking to anyone”. These statements are contradictory and around the serious issue of human health.

However, critically, in making such ‘Modified Risk’ claims, it is likely to be in breach of FDA regulations. The point in case was an FDA warning letter sent to www.buy-sigarettes stating that the Center for Tobacco Products of the US FDA had reviewed its products and identified Modified Risk Tobacco Violations highlighting:

“A tobacco product is also considered a “modified risk tobacco product” under section 911(b)(2)(A)(i) of the FD&C Act (21 U.S.C. § 387k(b)(2)(A)(i)) if its label, labelling, or advertising explicitly or implicitly represents that (1) the product presents a lower risk of tobacco-related disease or is less harmful than one or more other commercially marketed tobacco products; (2) the product or its smoke contains a reduced level of a substance or presents a reduced exposure to a substance; or (3) the product or its smoke does not contain or is free of a substance. Under section 911(a) of the FD&C Act (21 U.S.C. § 387k(a)), no person may introduce or deliver for introduction into interstate commerce any modified risk tobacco product without an FDA order in effect under section 911(g) of the FD&C Act (21 U.S.C. § 387k(g)).“ 61 (Link)

The FDA has also taken to sending Warning Letters to 55 retailers for selling newly regulated tobacco products to minors. Convenience stores distributing Chill products therefore could come under the spotlight. 62 (Link)

The one thing that seems increasingly likely is more stringent regulation around Zoetic’s smokable products. For an indication as to where this can go, the very first information on Altria’s home page is a clear box stating “A Federal Court has ordered Altria to make these statements 1. Health effects of smoking 2. Addictiveness of smoking and nicotine…” 63 (Link). In time I believe Zoetic may need to list all the health problems associated with its products on its home page and much more visibly on actual products vs hiding them in the disclaimer page. Zoetic will increasingly have to comply and the critical issue for Zoetic, as a start up with a new unknown brand, limited capital and greater regulatory scrutiny, is how does it promote itself to consumers to create revenues against the ever stricter regulation around smoking.

In conclusion I believe:

Zoetic is making health and prevention of tobacco smoking disease claims about its CBD based products. For example it states on the ‘How to Quit Tobacco for Good’ webpage that:

“CBD may be just what you need. The Chill Way offers a variety of products that can easily take the place of tobacco and give you the satisfaction of smoking or chewing without the harmful chemicals…if you are ready to turn your life around, then check out Chill CBD products and stop using tobacco today. You will get the same sensation of smoking and chewing, but will be filling your body with natural, organic herbs rather than harmful, toxic chemicals”. 64 (Link)

It goes on to state under Smoking Cessation:

“Because herbal smokes are much better than tobacco, they can be used to quit tobacco. In many cases, the herbal smoke can eliminate the urge to smoke tobacco completely. Unfortunately, you will still experience nicotine withdrawal, but herbal smokes can help curb the cravings more quickly.” 65 (Link)

On the ‘Best way to smoke CBD’ webpage it states:

“Smoking CBD is a great alternative to cigarettes because CBD has shown to have some important health benefits, whereas cigarettes are full of carcinogens and harmful chemicals… These pre rolls are excellent if you prefer the feeling of smoking a cigarette, but don’t want the nicotine and harmful chemicals. Chill CBD Smokes are one of the best options for smoking CBD as they are already rolled and packaged, don’t contain any harmful chemicals, and contain all organic, natural substances.” 66 (Link)

As discussed already, the FDA and FTC disagree that herbal cigarettes don’t contain any harmful chemicals and at the same time also regulate CBD and medical claims as new drug products. Health claims around a drug requires the FDA to investigate and ultimately approve it as a drug before it can be marketed or sold as such. The FDA lists several smoking cessation products which have all been through approval, none of which are smoking based. The FDA is taking this very seriously and has issued numerous Warning Letters to companies with unapproved new drugs. I believe Zoetic should not be making any reference to its products as being a smoking cessation aid nor healthy and not containing harmful substances. 67 (Link)

Furthermore, Green Light Law points out:

“Section 911(a) of the Food, Drug, and Cosmetic Act (FD&C Act) prohibits the introduction into interstate commerce of any “Modified Risk Tobacco Product” (MRTP) without an FDA order in effect for that product. Section 911(b)(2)(A)(i) defines MRTP as “tobacco product if its label, labelling, or advertising explicitly or implicitly represents: (1) the product presents a lower risk of tobacco-related disease or is less harmful than one or more other commercially marketed tobacco products; (2) the product or its smoke contains a reduced level of a substance or presents a reduced exposure to a substance; or (3) the product or its smoke does not contain or is free of a substance.” The term MRTP includes Nicotine Replacement Therapy (NRT) products that are used to help existing tobacco smokers quit smoking or reduce their overall usage and there are products with and without nicotine approved by FDA. The classic example of an NRT is nicotine gum or patches.”

Green Light Law concludes:

“If you sell hemp products as a replacement for nicotine or tobacco use, you must submit a New Drug Application to CDER for approval as a smoking cessation product.” 68 (Link)

The FDA, FTC and other regulatory bodies are now taking a very different view to CBD and smoking products. The FDA goes on to state:

“As we move forward, we are currently evaluating issuance of a risk-based enforcement policy that would provide greater transparency and clarity regarding factors the agency intends to take into account in prioritizing enforcement decisions.” 69 (Link)

I believe that Zoetic’s claims are likely to see it fall under FDA and/or FTC scrutiny. The risks in my opinion are as follows:

The Federal regulatory bodies’ concerns around CBD and smoking alternative products is already starting to filter down to each of the 50 US states resulting in tighter regulation at the state level too. In particular the issues for Zoetic are:

US states are also empowered to introduce their own laws to protect their consumers and, having enacted strict tobacco regulation, they have been getting increasingly active around the alternative smoking category where Zoetics products sit. For example:

Law firm Harris Bricken produce the Hemp CBD Risk Matrix which now shows that smokable hemp is legal, technically legal, or at least not prohibited in only 27 states, while 8 states now prohibit or severely restrict smokable hemp. In the remaining 15 laws regarding smokable hemp remain unclear, complicated, or currently under legal dispute. 74 (Link)

In Canada, the Canadian Lung Association states:

“The inhalation of smoke is harmful to lung health as the combustion of materials releases toxins and carcinogens. These are released regardless of the source – whether it is burning wood, tobacco or cannabis. Knowledge about the long-term effects of cannabis smoke is still limited but early research studies have demonstrated harm that can lead to chronic bronchitis”. It goes on to recommend the Government should “Regulate the advertising, sponsorship and promotion of cannabis. Products packaging should adhere to the same regulations as tobacco products”. 75 (Link)

The risks for Zoetic are that a growing number of US states ban smokable hemp products or legislate that they can only be sold behind the counter and out of sight like tobacco. This will also have a serious knock-on impact on consumers’ attitude towards purchasing such products generally given the health implications, and the absence of nicotine which is the primary driver for consumers to purchase smokable products. Zoetic’s addressable market across the USA is likely to be shrinking not growing. While Zoetic reports nationwide distribution agreements across the USA, it fails to point out that its products will be restricted from being placed in thousands of stores in the states where hemp smokes are banned.

Red flag – US states recognising herbal smokes as a gateway to youth smoking

As non-tobacco alternatives can currently be displayed on the counter and do not have a 21-age restriction in many states, it is intuitive that cool named and flavoured smokes could prove to be a gateway product for young people to start smoking and then move up to more harmful tobacco products.

The Washington Times quotes Dr Anne O’Donnell, associate professor and chief of pulmonary critical care at Georgetown University Hospital as saying:

“Any smoking has the potential for medical problems and an addiction to the smoking itself… The physical act of smoking and starting on that path, especially as a child, would make someone more likely to pick up the habit [of smoking tobacco cigarettes”. 76 (Link)

It is likely that in addition to stringent tobacco and vape regulation around gateway access for minors, that herbal cigarettes will increasingly come into the firing line globally. Unsurprisingly US states are starting to increasingly implement legislation to prevent the sale of herbal cigarettes to both minors and under 21s. Virginia lawmakers affirmed in February 2020 that it’s illegal for people aged under 21 to smoke hemp77 (Link) and Tennessee banned the sale of smokable hemp to minors in 2019.78 (Link)

On November 13th 2019 the New York State Public Health Law introduced the Adolescent Tobacco Use Prevention Act which in Article 13 1339 stating that 80% of smokers start smoking before the age of 21 and therefore:

“Sale of tobacco products or herbal cigarettes, rolling papers or pipes to minors is prohibited. Any person operating a place of business wherein… herbal cigarettes, liquid nicotine, shisha or electronic cigarettes, are sold or offered for sale is prohibited from selling such products, herbal cigarettes, liquid nicotine, shisha, electronic cigarettes or smoking paraphernalia to individuals under twenty-one years of age”.

“Keep all tobacco products, herbal cigarettes…and other vaping products behind a counter in an area accessible only to employees or in a locked container”. 79 (Link)

“Do not use or accept ‘price reduction instruments (i.e. the acceptance of coupons, vouchers, rebates) and other means of charging less than a products listed price”.

Self-service displays are prohibited, and a 2002 New York State law made it illegal for common carriers such as FedEx®, UPS and DHL to ship cigarettes to New York addresses, except to an address licensed to sell cigarettes. The 2010 National Prevent All Cigarette Trafficking (PACT) Act prohibits delivery of cigarettes and smokeless tobacco through the U.S. Postal Service. These laws work to curtail the sale of cigarettes and other tobacco products over the internet, and require internet sellers to affix tax stamps and pay all federal, state, local or Tribal tobacco taxes. 80 (Link)

Similar laws are starting to be enacted around the world such as Australia which states that the display of herbal cigarettes in retail outlets is banned. They must not be visible and “not on a counter where consumers are served and in a way that smoking products cannot be accessed by consumers”. 81 (Link)

In my view this demonstrates an increasingly global regulatory view that:

I believe there are immediate issues for Zoetic:

As regulators and states wake up to the fact that that herbal and hemp-based smokes are as potentially harmful as tobacco cigarettes, as well as a possible gateway for minors to tobacco smoking, new laws are being brought in the tax these products punitively to deter purchases both at the Federal and state level.

In Europe, smokable hemp is already banned outright in the UK and France, and tougher stances are being enacted elsewhere. For example, the Government of Belgium’s Federal Public Service Finance signed a decree in April 2019 stating “the products destined to be smoked and in which the THC content is inferior to 0.2% are considered as tobacco products and will therefore be taxed as such”. This imposes a retail tax change of 25% and also requires then to comply with tobacco retailing laws such as being hidden behind the counter. 87 (Link)

It seems apparent that around Europe the product will either remain prohibited or punitively taxed. I believe Zoetic’s margins and product sales will be significantly impacted as taxes rise, as was the case with all the tobacco companies.

Red flag – Some US states imposing stricter content and labelling laws on inhalable products

Driven by the 2019 e-cigarette vape crisis in the US that caused dozens of deaths and thousands of people to be hospitalised from lung illness, states are starting to take a far stricter stance on any products that are inhaled to the lungs. Recent actions include:

The article also notes that the “mandate will likely create a wave of new product liability lawsuits targeting marijuana and hemp companies” which could have an even larger impact on Zoetic.

On the basis that the FDA and FTC have already cited that herbal cigarettes are” dangerous to your health…they contain tar and carbon monoxide”, I believe that it is likely that herbal cigarettes will be caught up in all these new state regulatory moves to protect the health of consumers. This could be particularly damaging for the Chill cigarette revenue potential and will add significant costs associated with compliance and monitoring going forward.

A point in case was the FTC’s Decision and Order Letter to a herbal cigarette company called Alternative Cigarettes Inc requiring it within 45 days “after the date of service of this order, an exact copy of the notice attached hereto as Attachment A to each retailer, distributor, or other purchaser for resale to whom respondents have supplied Pure or Glory tobacco cigarettes, or Herbal Gold or Magic herbal cigarettes, since January 1, 1998” requiring such retailers, distributors or purchasers for resale to cease using or disseminating misleading advertising related to the health benefits of the alternative cigarettes. 90 (Link)

The Order went on to mandate that:

“IT IS FURTHER ORDERED that respondent Alternative Cigarettes, Inc., and its successors and assigns, and respondent Joseph Pandolfino shall deliver a copy of this order to all current and future principals, officers, directors, and managers, and to all current and future employees, agents, and representatives having responsibilities with respect to the subject matter of this order, and shall secure from each such person a signed and dated statement acknowledging receipt of the order”.

Were this to be the case for Zoetic, this in turn would potentially become an issue for the UK and USA exchanges on which it is listed. It goes on to say:

“IT IS FURTHER ORDERED that respondent Joseph Pandolfino, for a period of ten (10) years after the date of issuance of this order, shall notify the Commission of the discontinuance of his current business or employment, or of his affiliation with any new business or employment”.

Once a company or person falls foul of the FTC laws, they remain on their radar for 10 years.

Aside from the looming Federal and state level regulatory scrutiny which will make trying to build a new brand from scratch much more complex, expensive and risky, the Zoetic Chill brand also has numerous company specific issues.

Red flag – A limited number of products and innovation

Going to the website reveals just three products of a chew pouch (3 flavour SKUs of mint, peach and vanilla), one packet of hemp smokes and two herbal based smokes (one normal called Calm one mint flavoured).

Other listed CBD brand businesses, with significantly more revenues yet much lowlier valued, often have hundreds of SKUs and ongoing brand innovation, R&D and formulation programmes. Without that, it’s difficult to generate meaningful revenues, pivot to new products in demand in the rapidly changing consumer landscape and to compete against other very similar products.

Red flag – Product mislabelling in Colorado

The 2018 Colorado House Bill established that hemp products must comply with Colorado’s Food and Drug Act which imposes certain labelling requirements around hemp products. The product label must clearly identify hemp as an ingredient and if there is CBD, the amount of CBD and whether it is an isolate.

The Chill cigarette packets are already in breach of Colorado state regulation as they do not state that the ingredient is CBD isolate.

Furthermore, each state will have their own requirements across a whole host of differing local laws and labelling to remain compliant, which will present Zoetic with significant logistical and packaging issues to be considered and it is already in breach in its home state of Colorado.

Red flag – No evidence for use as a smoking cessation aid yet evidence of harm exists

The Chill brand is being built around the message that CBD smokes and chew pouches are safer and a way to help people stop smoking. Zoetic says that it believes that “CBD may play a rapidly increasing role in smoking cessation aids, and that its Chill branded tobacco-free, THC-free and nicotine-free products are well-placed to take an increasing share of this market… It is the Board’s intention to focus the Company on non-nicotine smoking cessation products as part of its portfolio of CBD products”. 92 (Link)

However, the primary reason people smoke tobacco-based cigarettes is owing to nicotine addiction. The American Cancer society state “Nicotine is the known addictive substance in tobacco. Regular use of tobacco products leads to addiction in many users. Nicotine is a drug that occurs naturally in tobacco and it’s thought to be as addictive as heroin or cocaine”. 93 (Link)

I do not believe Zoetic has conducted any clinical research to prove these claims and therefore no such claims can be made in the marketing message. Clinical research to prove those claims would be expensive and take years to undertake. As such, the Chill claims are simply hearsay and the FDA is on a clear path to prevent such products and marketing messages. Nevertheless, on the Chill website home page (www.thechillway.com) states “A chill way to quit tobacco…”.

The British government website published a document discussing herbal cigarettes as a way to stop smoking stating:

“Although herbal cigarettes are sometimes perceived as safer because they do not contain tobacco or nicotine, they produce the same toxins as a traditional cigarette; for example carbon monoxide and tar. Smoking herbal cigarettes is also unlikely to be an effective way to stop smoking as they do not help deal with nicotine withdrawal. A further concern is that children are attracted to herbal cigarettes because, as they do not contain tobacco, by law they are not required to carry health warnings. What is more there is no age restriction…meaning they can be purchased by anyone under the age of 18…. there is no such thing as a safe cigarette.” 94 (Link)

On the US FDA website it has a page called Want to Quit Smoking – FDA Approved Products Can Help. There is no mention at all of CBD infused herbal or hemp cigarettes. 95 (Link)

In Europe, researchers from the University of Vienna found that nontobacco cigarettes produced a level of carbon monoxide similar to that of tobacco cigarettes and concluded that they a “potential health hazard” prompting BBC News to state:

“Herbal cigarettes designed as an aid to quit smoking are a potential health hazard themselves researchers have warned”. The Chairman of the British Lung Foundation summed up “If you are burning herbal cigarettes, all you are doing is substituting the burning leaves of one sort of a plant for another. A lot of people try herbal cigarettes because they think that as they don’t contain nicotine they are safer. In fact they are giving up the one bit of tobacco that doesn’t do you much harm. Nicotine is addictive but it’s the other stuff that gives you lung cancer and emphysema”. Action of Smoking and Health state that using herbal cigarettes in unlikely to be an effective way to give up smoking “Herbal cigarettes contain all the nasty chemicals in cigarettes, but they do not provide any help in dealing with nicotine addiction”. 96 (Link)

As a final point, if indeed in time CBD is proven to help people to quit nicotine dependence, then I believe there will be a significant number of safer and FDA regulated ways for people to intake CBD as opposed to smoking it in another inhalable cigarette product which is as dangerous as the tobacco product that people are trying to get away from for health reasons.

In short, Chill products are marketed as smoking cessation aids but the smokable products are still fundamentally unhealthy and have not been authorised as being able to be marketed as smoking cessation products.

Red flag – Flavoured smokes products designed to attract younger people

The purpose of the FDA requiring smokable products to be stored behind the counter in closed doors is to deter both adults and children alike. Children in particular are susceptible to ‘cool smoke products’ and especially if flavoured. In its September 2020 update Zoetic in fact points out the “the regulation of tobacco based menthol cigarettes which are now banned in Brazil, Canada…the European Union and the UK” 97 (Link). That is because they are inherently unhealthy, but then so is smoking herbal cigarettes. The FDA banned clove and all fruit flavoured cigarettes in 2009 to reduce teen smoking in the USA stating “These flavoured cigarettes are a gateway for many children and young adults to become regular smokers” 98 (Link). Zoetic only has three smoke SKUs with one being CBD Smokes Mint. Flavoured products in tobacco and vapes are already under regulatory scrutiny and being banned and the same will likely hold true for any smokable flavoured products, its just that flavoured herbal smokes is such a small market that it hasn’t likely yet drawn attention like tobacco. As Zoetic distributes its CBD Smoke Mint packs across the USA it could quickly draw regulatory scrutiny on their Mint flavoured smokes as a gateway for young people into smoking.

To this point I note that in July 2020, the Colorado Department of Law (Colorado is where Chill is primarily distributed currently) launched a case to sue Juul citing that:

Chill appears to be squarely in the sights of the kind of products that regulators are clamping down on and law makers are starting to sue.

Red flag – A rise in class action lawsuits against CBD companies

Law firm Goodwin Law warns that hemp derived CBD companies are increasingly facing class action litigation claims by both consumers and investors driven by product claims, regulatory uncertainly and preventable mistakes by companies themselves. It notes that the primary cause of claims are when shareholders look to recover investment losses after a company’s stock price drops following corporate disclosures. Plaintiffs asset claims are based on allegedly false and misleading statements made by the company and its officers. Dating back to the beginning of 2018, there have been 19 securities class actions filed against companies in U.S. federal courts against publicly traded companies operating in the cannabis or CBD sector. 100 (Link)

Zoetic’s stock is up 2359% since March which puts it in the firing line considering the assessment of:

Zoetic Investors purchasing Zoetic shares on the LSE and OTC exchanges over the past year during the strategy pivot could well have done so based off some of the company assertations listed above. Accordingly, I believe there is a risk that investors could feel they were misled and that could be the basis for class action lawsuits, both in the USA and the UK.

Red flag – PRODUCT liability claims and a question of insurance

In Zoetic’s Annual Report for year end to March 2020 it claims one of the risks facing the group is ‘Product Liability’ stating:

“The Group’s products will be produced for sale directly to end consumers, and therefore there is an inherent risk of exposure to product liability claims, regulatory action and litigation if the products are alleged to have caused loss or injury. Accordingly the Group maintains a product liability insurance policy”. 101 (Link)

As established above, given the FDA and FTC consider herbal cigarettes no safer than tobacco/nicotine cigarettes and have already forced Herbal Gold to state on its packets that smoking herbal cigarettes are dangerous to consumer’s health, the risks to litigious claims from selling unhealthy products to people in the US are high. As the Chill product doesn’t have a 21-age limit, Zoetic can sell what is deemed to be a dangerous product by regulatory bodies to 18 to 20 year olds. This business model carries a wide variety of risks.

The major tobacco companies have all been embroiled in health-related litigation costing them hundreds of billions of dollars. Individual litigation awards have run into $10s of millions. Recently litigation has now moved into the vape sector with Juul now facing claims mostly brought by parents of teenagers who claim lung damage and seizures.

The issue for Zoewtic may be threefold:

Litigation cases where companies are not sufficiently covered has driven many companies into bankruptcy.

Red flag – Herbs vs hemp leaf demand small in USA

Market research firm Nielsen projected the smokable hemp market will reach $70-80 million in 2020, which includes categories such as loose CBD flower, hemp-CBD pre-rolls, cigars and other inhalable products. Zoetic’s market cap is currently more than twice the size of the entire US market.

So, Chill smokable products can only compete for a share of that spend in:

If the entire addressable market share of spend on pre-rolls in convenience stores was 10% of the $70-80 million total market, then Chill’s addressable market in 2020 was just $7-8 million nationally. If it could take 10% share of all hemp cigarette brands, then its revenue potential would be $700,000 to $800,000. Chill only has one hemp smoke SKU and was effectively only sold in Colorado in 2020, therefore taking a 10% share seems extremely unrealistic. Additionally, the herbal smoke market is likely to be therefore even smaller.

There is a risk that retail investors, in driving Zoetic’s market capitalisation to £147 million, in the absence of guidance, are materially overestimating the revenue potential of a brand with 3 SKUs in a competitive and small market, even if it was to be able to successfully build the brand out nationally. The early evidence suggests this to be the case given that total 12 month sales to September 2020 were just £81,000.

Red flag – Unfounded uniqueness claims in alternative smokes

Zoetic makes claims about the uniqueness of its smoke products in a 29th May 2020 update “The Company is not aware of any other tobacco-free, THC-free, nicotine and nicotine/CBD containing products in the market”.

However, a simple Google search reveals that there are many companies offering CBD containing tobacco/nicotine free smokes with low or no THC 102 (Link).

In my view fact there is little to differentiate the Chill smokes brand or product from an extremely crowded market of alternative CBD smoke suppliers, many of whom have been around for decades and have already built brands. There is limited shelf space and inevitably competition will quickly bring down margins.

Furthermore, I believe being ‘THC free’ is not really relevant to consumers as all CBD products across the USA have to contain less than 0.3% THC as dictated by the 2018 Farm Bill Act. Zoetic seems to play up THC free as regulation in the UK means that without a Home Office licence (which Zoetic does not have) then a company operating or listed in the UK may not generate any revenues from any products that contain any THC traces, even at 0.3%. However, consumers of alternative smokes are extremely unlikely to care whether herbal or hemp leaves contain 0% or 0.3% THC so the Chill differentiation to multiple other brands in the eyes of consumers is in reality negligible.

Red flag – Consumers are moving away from smokable CBD products for health reasons

Zoetic’s strategy presents a paradox. Part of the equity story is based around the fact it operates in the fast-growing CBD space. However, the CBD growth story is based around the health aspects of CBD molecules. Thousands of wellness brands and products have emerged to tap into the health aspects of the product. However, there are multiple issues around smokable products. Zoetic’s Chill smokes strategy is based around offering people access to the health benefits of CBD (still being disputed by the FDA), yet via an unhealthy delivery method of smoking.

The recognition that smoking generally is unhealthy regardless of the type of leaf being smoked has seen a huge shift away from smoking combustible leaves to other consumption methods for their intake of CBD such as vaping, edibles, tinctures, patches etc.

The switch away from smoking as a method of cannabidiol intake is likely to be accelerated further by Covid. A July 2020 survey by TVape reported revealed that consumers “are also shifting towards vaporizer use and away from combustion…attributed the shift to concerns over their lung health”. Incredibly the survey found that the number of people who predominantly smoked fell from 16.67% to just 6.11% in 2020 amid Covid fears. 103 (Link)

Zoetic’s products are inherently in the unhealthiest segment of the delivery routes and the market will almost certainly continue to see a secular shift by consumers in a post Covid era away from smokes as a desirable way of consuming CBD, towards other products, even without the interreference of the FDA and other regulatory bodies. If just 6% of consumers choose to take CBD via smoking, and Zoetic operates in a niche segment of herbal smokes, with its product in only a fraction of possible retail outlets, the ability to generate any sort of meaningful revenues must be limited.

Red flag – Manufacturing scaling issues and FDA compliance requirements

If the promised demand for Zoetic’s products does materialise ( and I think that most unlikely), it will have to scale its outsourced manufacturing capability significantly. Scaling, particularly on a global basis, is extremely difficult and fraught with risk. Indeed, I note that in the September 2020 trading update Zoetic stated “Following significant demand for its Chill brand products, Zoetic is pleased to have restocked its range of tobacco alternative CBD smokes online. With hemp, calm and mint varieties now back in stock…”. This suggests that Zoetic is already struggling to manage its inventory supply even at the current very low levels of demand as indicated by its limited financials. 104 (Link)

The company states that it is exploring its manufacturing options but provides little details as to the companies it is working with, its ability to scale or indeed its costs. Furthermore, managing international manufacturing capabilities or trying or import CBD smoke products from the USA to European countries is likely to present significant barrier and regulatory hurdles given concerns around CBD products.

A particular problem for volume manufacturing is around labelling issues. Increasingly states around the US and each European country are bringing in their own rules around package labelling requirements and what can, can’t and must be stated on cigarette packages. This will involve significant legal advice and then printing complexity for its products being distributed to 50 states in the USA (minus the states where they are already banned) and 15+ countries around Europe. I would question whether Zoetic is resourced and funded to maintain strict compliance and the logistical headache this will present for a start-up. Again, this further highlights the issues around the smoking space that Zoetic has decided to pursue as its strategy vs other CBD companies that chose to operate in far less regulated products.

Furthermore, if the FDA considered Zoetic’s products as unapproved drugs, then it will also scrutinise the manufacturing processes and facilities to the same level that it would expect drugs to be produced to. In a recent warning letter sent to Herbal Doctor Remedies the FDA stated:

“…because your methods, facilities, or controls for manufacturing, processing, packing, or holding do not conform to CGMP, your drug products are adulterated within the meaning of section 501(a)(2)(B) of the FD&C Act, 21 U.S.C. 351(a)(2)(B)…. You have manufactured, prepared, propagated, compounded, or processed drugs that were being offered for commercial distribution in the United States while your drug manufacturing facility, Herbal Doctor Remedies at 497 Cumbre Street, Monterey Park, California, was not an FDA registered establishment”. 105 (Link)

It would appear unlikely that the current manufacturers of the Zoetic Chill range, in spraying CBD into products that are being marketed as having medical benefits, are aware that:

Guidance for contract manufacture of drugs is extremely strict and onerous. 106 (Link)

Red flag – Questions around a strategy of bespoke display cases

Zoetic believes that by showcasing its CBD smokes in display cases on the point-of-sale counter, it will increase brand awareness and opportunistic purchases. It claimed in the February 2020 trading update:

“Moving forward, the Company is introducing display cases which hold 48 of its products. These are typically placed on the sales counter and, by increasing brand awareness, management estimates that the introduction of these cases could potentially double daily sales given the prominence they give to the Chill brand and products.” 107 (Link)

I believe there are multiple issues here:

Contrary to Chill products becoming increasingly visible via display cases and on store shelves, I believe they are likely to become increasingly invisible behind the counter. That would be a major problem for a company with no existing brand or funds to advertise to create a brand. Consumers walking into a convenience store will have to know and recall the Chill brand or they simply won’t know that its stocked there to ask for it.

Red flag – Headwinds to building a consumer brand in the cigarette category

It will be extremely hard for Zoetic to create a well-known brand around Chill. Issues will include:

Currently (as of 27th January 2021) the Chill Way Twitter account has 162 followers and 487 on Instagram which makes it almost irrelevant and shows there is no ‘cult’ brand being built even at the smallest level in Colorado after a year and a half of being in the market.

With cultivation, extraction and manufacturing all outsourced now, the revenue growth potential of Zoetic is heavily dependent on retail store distribution deals that it can put in place. A number of such deals have been announced but in each case no metrics or guidance are provided.

MAJOR Red flag – Bonus payments in Schrader Oil beta stores & destocking

Zoetic’s only distribution deal of note prior to September 2020 was with Schrader Oil/Ox Distributing, billed as its beta store test. On April 1st, 2019 Zoetic signed a 2 year distribution deal for its CBD products to go into their 18 convenience stores. However, even though Schrader Oil owns 12% of Zoetic and would therefore be highly incentivised to proactively market hard to ensure strong sales, Zoetic recently announced in January 2021 that it has achieved zero in store sales in the six months to September 2020 which I struggle to tally with prior comments about the success they were having in the beta stores.

When my comrades mystery shopped several Schrader Oil stores, in talking to store employees they were informed that they get paid a bonus for pushing the Chill brand onto consumers. I am not sure whether Zoetic or Schrader is paying this staff bonus commission, but it would seem logical that any other store owners around the USA, which do not own Zoetic shares, are highly unlikely to pay staff a bonus specific to selling Chill products vs thousands of others in their stores. As such the stated beta KPIs of 2-3 packs a store a day (slide 8 of presentation in link below) are likely to be highly misleading when extrapolated to stores outside the 18 strong Schrader networks. 108 (Link)

With the Schrader Oil stake in Zoetic now worth £17.6 million, it is likely to be more valuable than its entire 18 store portfolio. My belief is that this bonus scheme could be in place so Zoetic’s management can report strong beta results of 2-3 packs a day to investors. However, given the beta KPIs in store are all that they have guided on, I believe that this special bonus scheme should have been disclosed as it is relevant to statements made such as in the March 2020 year end trading update where Zoetic states:

“The Directors of the company are pleased to report that the consumer reaction to the Company’s Chill branded products has exceeded their expectations; in stores where Chill has been on sale for several months, they have experienced consistent increased sales month on month”. 109 (Link)

Furthermore, Zoetic also states a margin of 50% on packs, but I do not know if these bonus payments have been included in calculating that margin. If Zoetic product marketing is being subsidised by payments from Schrader Oil to its employees, then that should also be disclosed as it will have an impact on the real margin as well as the pack sales numbers.

Nevertheless, despite this statement above in March year end results, in the recently reported September 2020 interim results, Zoetic states that “The Period only saw limited initial sales of our CBD products as we were seeing online only, and the physical store roll out had not yet begun”.

This guidance that sales to September 2020 were 100% online is perplexing. Prior guidance has been that the 18 stores should have been selling 3 packs a day between March and September 2020 and wholesale prices are 50% of retail of $10, i.e. $5/pack. As such, on that basis during the March to September period the Schrader beta trial should have generated 18 stores x 3 packs x 182 days x $5 wholesale= $49,000 of revenue.

The online only comment also does not tally with the March 2020 year end trading update or the February 02, 2020 trading update that stated “The Company’s realistic objective is to supply around 500 new stores per month, subject to customer demand and manufacturing constraints, and so management estimate that it is likely to take up to two years for products to be rolled out across the entire network [12,000 stores]” and, per above, that in Schrader stores sales were increasing month on month. 110 (Link)

Finally, I note that in November 2020 EG Group acquired the Schrader Oil chain of 18 stores and they are being rebranded Loaf N Jug. Under new ownership this bonus scheme to drive sales of the Chill brand is likely to be ended as EG Group does not have any incentive to try to drive sales of that brand out of the hundreds on sale without the added incentive of Zoetic equity. To test this theory, in subsequent visits to the stores in December 2020 and January 2021 I was advised by staff in several of the shops that in fact, under the new owners, the Chill brand was being de stocked and is being replaced by a new CBD brand called Solari Hemp. (Read reports Loaf n Jug has another brand going in)

Red flag – AATAC distribution deal lack of transparency or uniqueness

Much of the dramatic share price performance in H2 2020 seems to have been driven by expectation around a deal with Asian American Trade Association Council (AATAC) with the 24th November 2020 announcement stating “This transformational deal will facilitate the introduction and recommendation of the Company and its products to over 88,000 AATAC partners and will pave the way for the Company’s Chill brand to be sold from eye-catching new point of sale display stands at high footfall convenience stores, gas stations and corner stores in all US states”. 111 (Link)

However I see several critical issues behind the headline announcement:

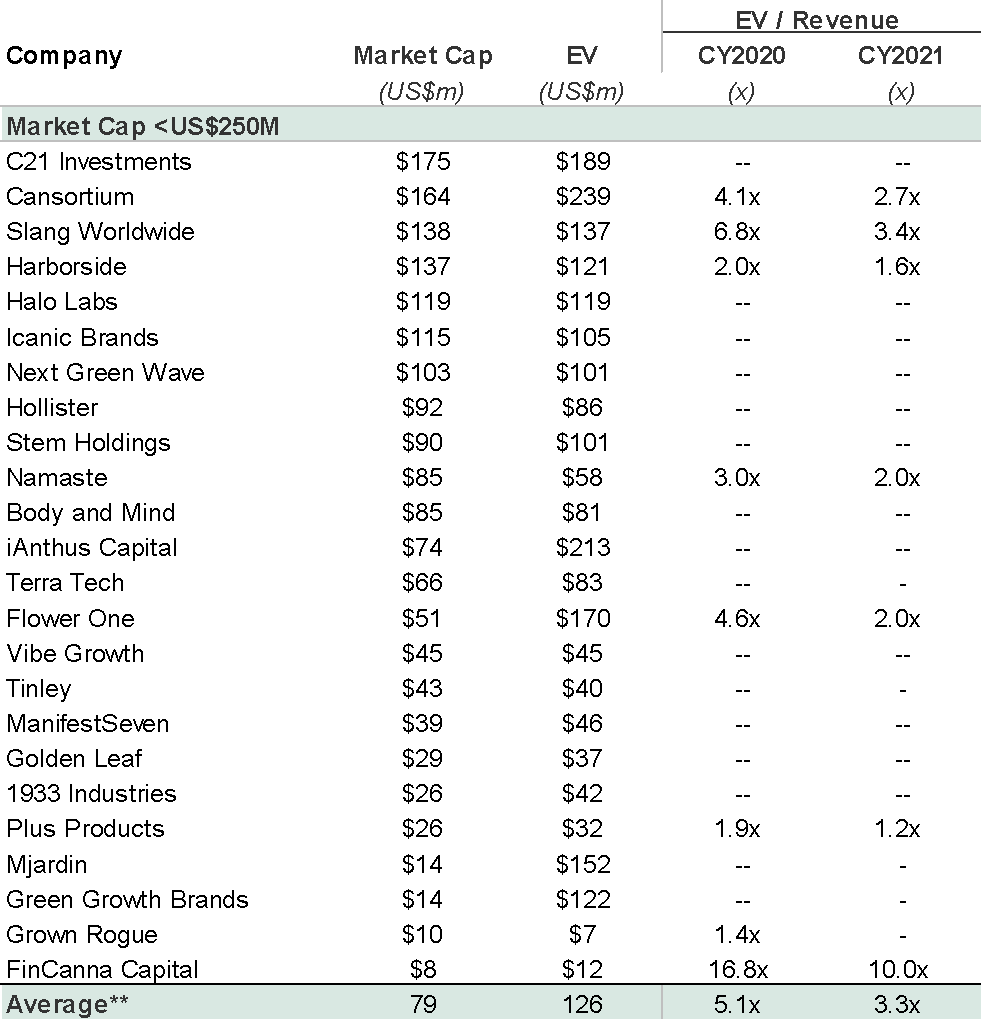

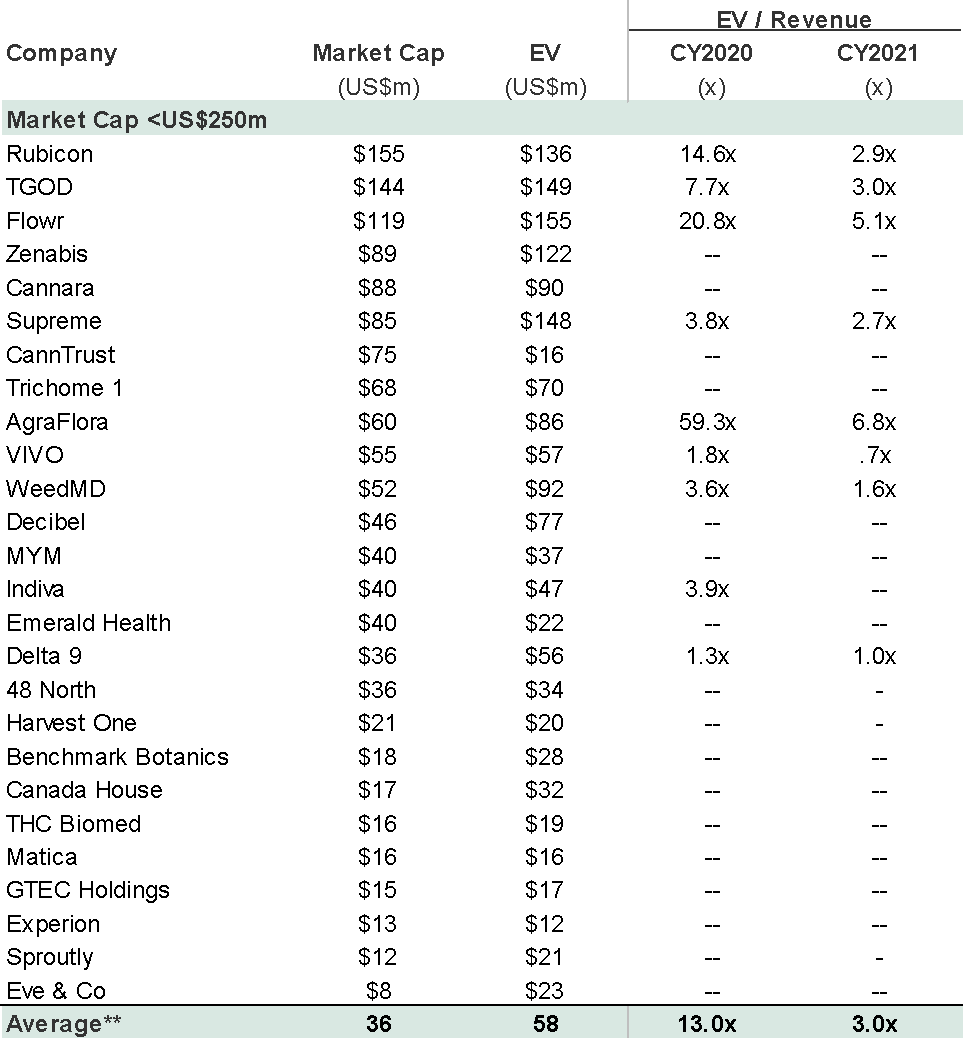

Critically, even spending significant sums training and marketing around the AATAC agreement is no guarantee of success. Indeed, my research has found that distribution deals for CBD products via the AATAC are not unique at all and in most cases seems to have little impact of the companies’ financial performance post agreement.

The conclusions that I draw from the above is that:

Zoetic announced its partnership with AATAC deal on 24th November 2020 with CEO Trevor Taylor stating “This game-changing partnership represents a real watershed moment for Zoetic. With a reach across tens of thousands of retail outlets, the Company will have unprecedented access to the market and can continue on its mission to bring the Chill brand to the local stores and pockets of every consumer”.

The evidence from numerous other companies is in fact that there may be little if any impact. Nevertheless the stock jumped 35% from 43p and ran up to 75p adding £62 million of market value to Zoetic on this one distribution deal. If I put sales on the 3x average multiple other CBD brands trade at, the market priced in £21 million of revenues from the AATAC deal. Based on the financial evidence of at least 8 other CBD companies, I believe this would be an astounding achievement. 123 (Link)

Red flag – Betterment distribution agreement

Zoetic announced an agreement on June 1st, 2020 that Betterment will market Chill products to its network of outlets. However, no metrics or terms were provided. Some eight months later January 29th update there was still no mention that any such roll out had started to its network.

Red flag – Mr Checkout agreement

Zoetic announced a partnership with Mr Checkout in October 2019 – a national group of distributors in the US for direct store distribution for 150,000 independent retail members – with a trial with 15 distributors. In February 2020 update Zoetic commented that “Progress with MrCheckout has surpassed expectations”. Since then, there has, as far as I am aware, been no further mention of the relationship and whether it has led to anything.

Red flag – New Age Beverage corporation reference

In the 5th February 2020 trading update the company stated “Zoetic has developed interest from New Age Beverages Corporation, a Nasdaq listed distributor of healthy, natural products”. Nothing has been mentioned since.124 (Link)

I am surprised at this information being disseminated and could be an example of news being put out just to keep retail investors interested. In my thtree decades of experience most other Main List companies only announce deals of this nature once signed to avoid embarrassment that a deal doesn’t materialise, as appears to be the case here.

Red flag – European distribution agreements void of any information

On 6th July 2020 Zoetic announced a distribution agreement covering Czech Republic and Slovakia for the Chill brand 125 (Link). On 10th September 2020 it announced a second agreement with an unnamed distributor to take the Chill tobacco brand into 15 markets across Europe. It claims that “The Agreement will see the Company’s premium CBD offering reach consumers in over 15 markets across the European Union, with thousands of stores making preparations to stock the Chill range” 126 (Link). However again there are no metrics or KPIs except for the guidance that thousands of stores are preparing. They key question I have is how, and on what basis, did management have that confidence to report to the Stock Exchange that thousands of stores in Europe were preparing to take its product, and why, half a year later there still isn’t any announced product in stores anywhere in Europe?

I suspect that, as with US distribution deals, there are no guarantee of minimum sales orders, numbers of outlets that will purchase or any other metric with which to judge the impact of these deals, or such crucial metrics would likely be announced by Zoetic to give confidence. It is also that in both European distribution deals the company declines to name who the partner is.

In addition, there is also no commentary around issues such as:

Red flag – Unrealistic store rollout guidance

In the February 2020 interim results the company guided that “the Company’s realistic objective is to supply around 500 new stores per month” 128 (Link). In June it said that guidance was delayed owing to Covid but that things were improving 129 (Link). There has been no further guidance on actual store numbers ordering and stocking its Chill products but the 6 month results to September revealed that sales were “online only” for the period 130 (Link).

Red flag – Inaccurate & outdated statements on online distributors websites

Zoetic has a relationship with a distribution company called Mr Checkout which makes statements on its website like:

It also have a partnership with LeafyQuick where again the distributor claims that it is “grown and hand crafted in Colorado”. Strangely it also offers CBD vape cartridges on that site, but that product does not appear on its own www.thechillway.com website or anywhere else that I can find.