By Tom Winnifrith | Tuesday 5 June 2018

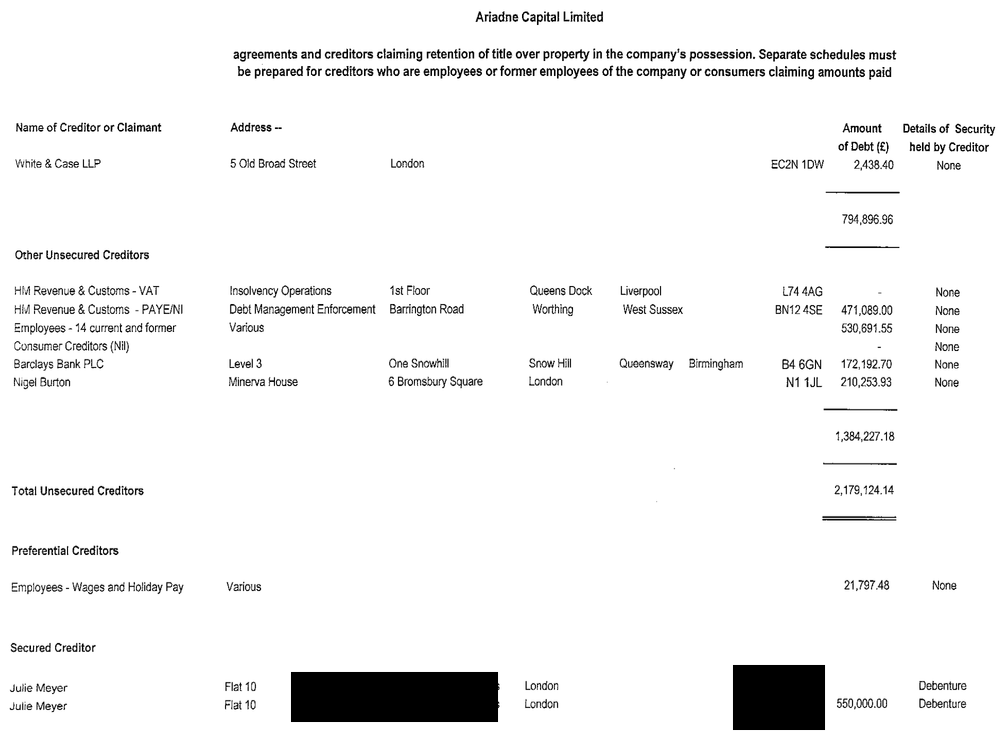

As at 31 December 2016 Ariadne Capital Limited run by Julie "lingerie on expenses" Meyer claimed to have net assets of £3.859 million in its companies house filing. Less than a year later it was bust and those assets were shown to be fantasy, imaginary - the administrator reckons that, instead, there is a creditor deficiency of £2.715 million. But a new internal document obtained by Winnileaks suggest's that number is too low, Meyer's black hole could be far larger.

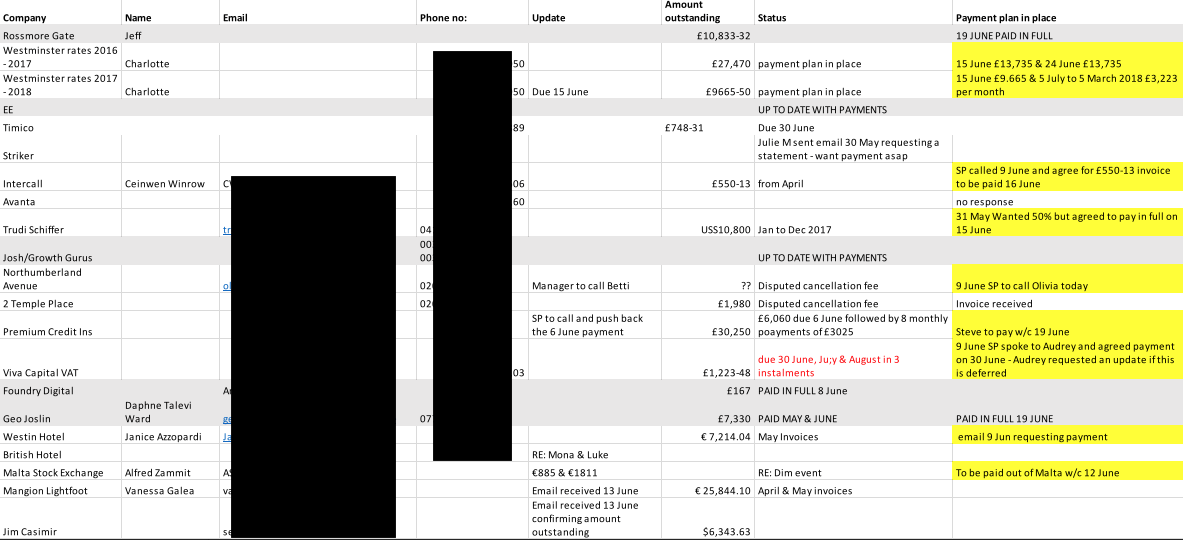

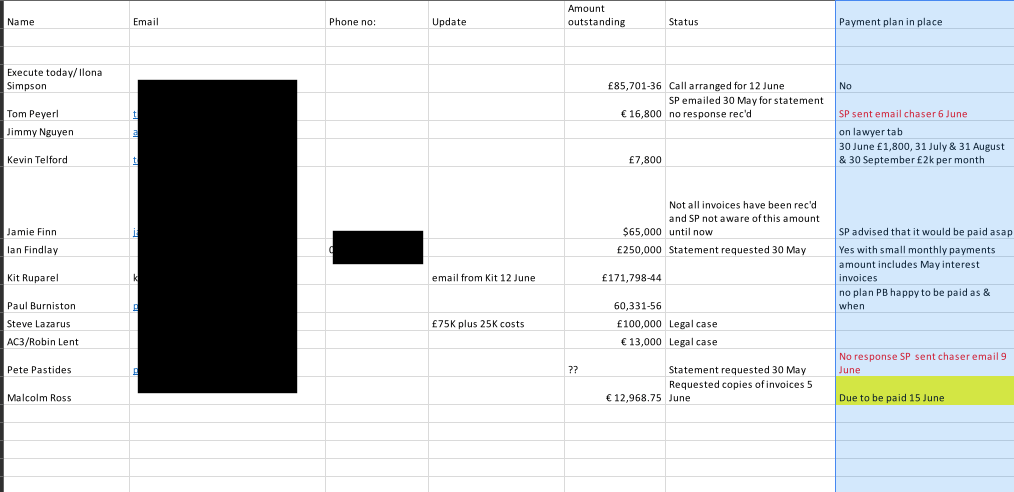

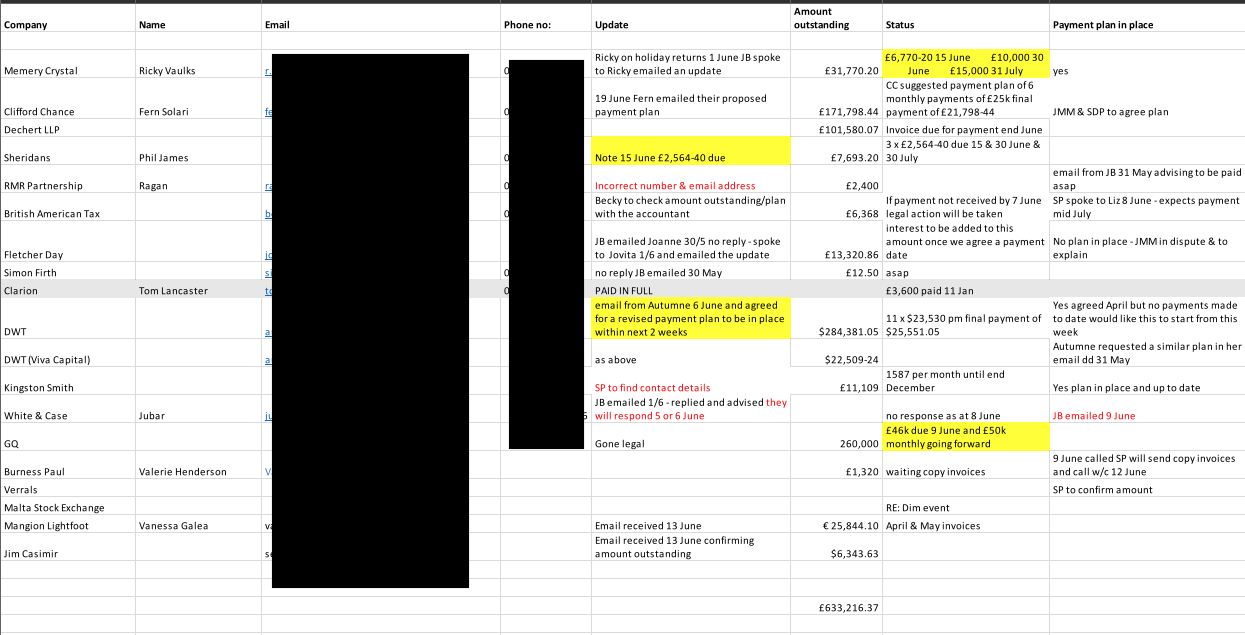

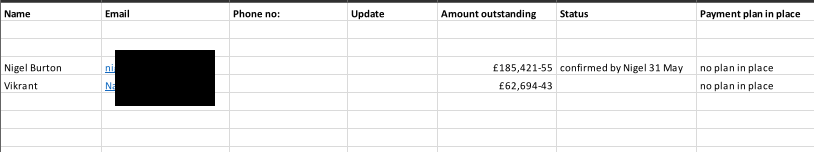

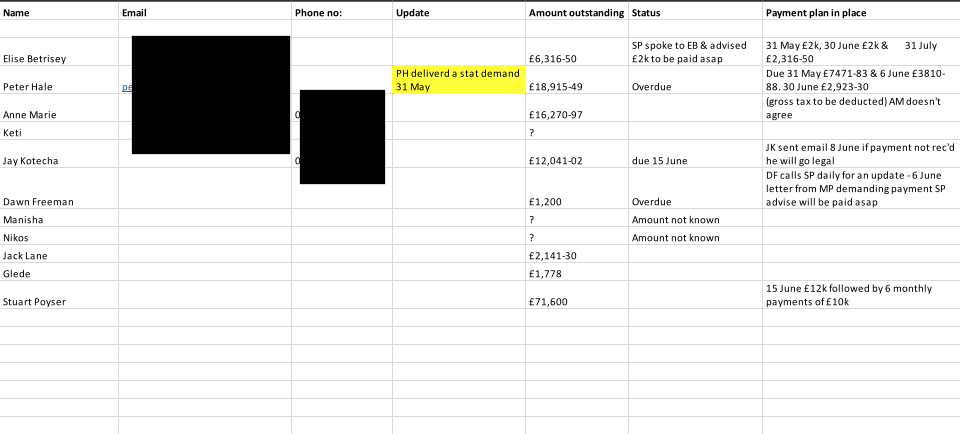

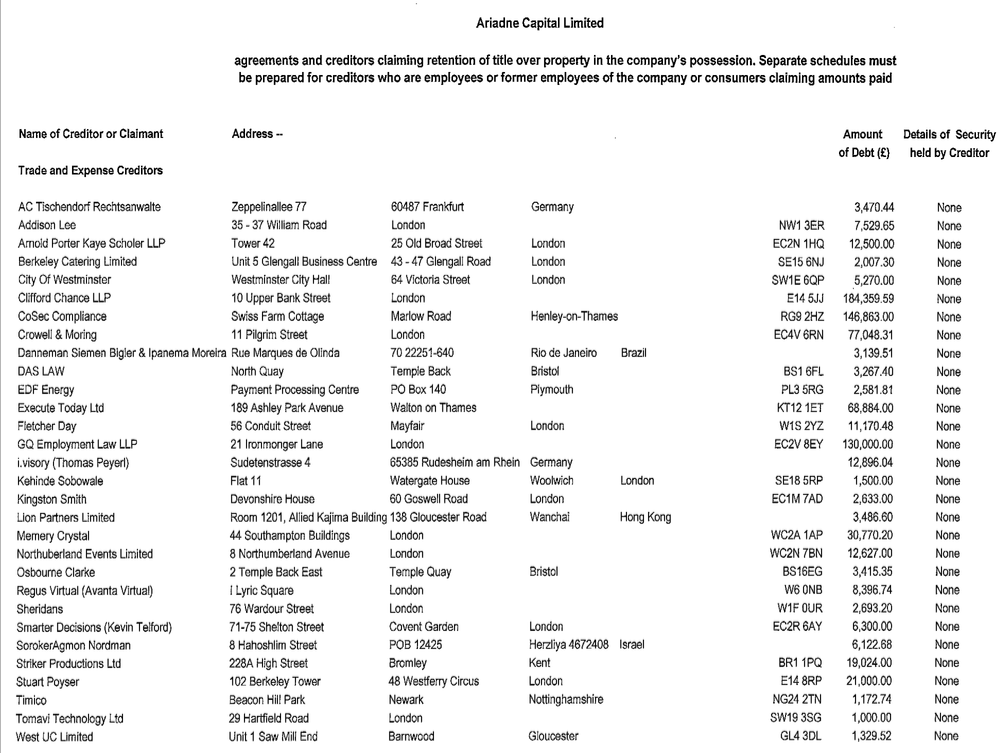

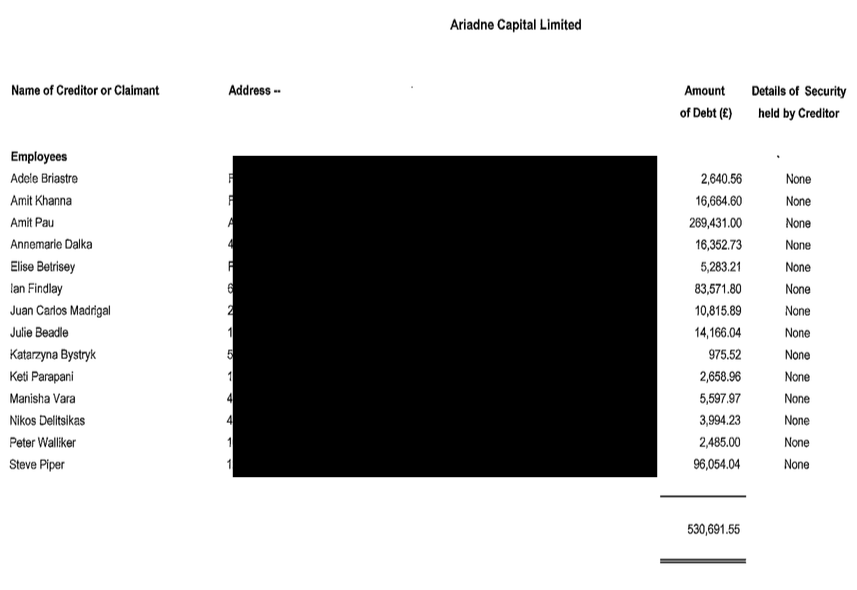

The pages below are from 30 June and show a raft of creditors. The administrator stresses that Ariadne had no cash coming in during 2017 in his report and none at the start of the year either. So you can bet the ranch that very few of them were paid after 30th June yet most of the names are missing from the administrators list of creditors published at the bottom.

We know that the administrator complained in its report that Julie Meyer was not co-operating in handing over documents and data. Now we see one reason why - the creditor deficiency could be even larger than stated making those 2016 annual report ( on the basis of which Meyer tried to raise fresh capital from investors) even more criminally misleading.

It is worth noting the ways Meyer avoids paying bills in the notes to these accounts. Waiting until a Stat demand (the threat of a winding up order) is served to pay, agreeing payment plans or - as was the case with Steve Lazarus delaying paying by fighting spurious legal cases for as long as possible and then smearing him even after the case was lost. This document shows what a dire state Meyer's flagship was in well before it finally went tits up.

You will, however, note that though it was fighting to stay afloat there is no creditor balance for the expenses of Julie Meyer or for the landlord of the flat which Ariadne rented for her to live in. Is that not a case of treating one person as a preferential creditor? That act, as Ariadne liquidator Leonard Curtis knows, has serious ramifications including making the creditor in question personally liable for all payments received for up to two years before the administration process commenced.

Andrew Duncan of Leonard Curtis has been alerted to this spreadsheet

Former Senior Advisors

Ex Employees

Shareholders

Lawyers

Creditors

Become a member starting at £6.99 per month for all articles, the Bearcast, and our seven year archive.

Filed under:

Tuesday »

Monday »

Sunday »

Saturday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Sunday »

Saturday »

Thursday »

Wednesday »

Tuesday »

Monday »

Sunday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Sunday »

Saturday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Saturday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Sunday »

Saturday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Sunday »

Saturday »

Friday »

Thursday »

Wednesday »

Time left: 00:09:08