By Tom Winnifrith | Thursday 31 May 2018

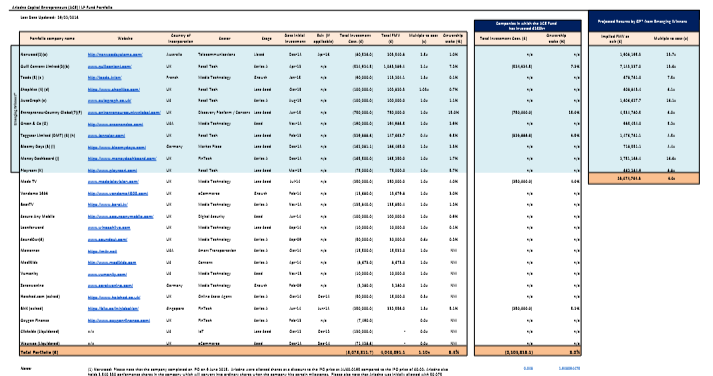

When will Julie "lingerie on expenses" Meyer start coming clean on her ridiculous ACE fund which the Useless cocksuckers at the FCA are still allowing her to raise fresh money for? We have already show the fund being used to buy worthless assets from Meyer's Ariadne Capital Limited to pay its bills HERE and demonstrated the fantasy valuations and assumptions Meyer makes HERE. Now to some more complete stinkers. Let's start with more problems with Ariadne and who owns what?

If you scroll down the spreadsheet you will come to shopitize limited, company number 07445751. The Companies House last shareholder confirmation list records Ariadne Capital Limited as the shareholder not Ariande Capital Entrepreneurs (ACE) LLP. I am sure that the administrator of Ariande Capital Limited won’t easily part with the shares. So this means a six bagger and another £600,000 of purported end stage value disappears from the ACE fund . Whether they are worth that much is another matter but surely Julie's fund would not be taking assets from Ariadne Capital or claiming them as its own.

Norwood Systems is listed on ASX. The Julie Meyer spreadsheet values its 1% stake at £1,908,195 or £190 million for a 100% stake as an exit value. Interestingly Proactive investors states the current market cap at A$11.65 million. Bloomberg states about A$12 million. This equates to around £65,000 for a 1% stake. So another £1.85 million of endgame value and a 23.7 times bagger disappears from ACE fund and Julie's fantasy projections. Since ACE invested £85,000 into Norwood it is actually sitting on a loss, even ignoring the expenses of running the fund. More lingerie for tea vicar?

And now to a screamer in the fantasy valuation department Money Dashboard (incorporated as The One Place Capital Limited)

Julie’s spreadsheet values its 1.7% stake on a fully diluted basis as having an exit valuation of £2,751,168.40. This implies a valuation for the whole business of over £160 million and would be a 16.5x bagger for the ACE Fund as it only invested £165,000. Freaking cleverer than God or what? .

The business which trades as The One Place Capital Limited reported losses of £402,097 on revenues £633,219 for the year ended 30 April 2017. It had net assets of £356,446 at that date. Even by Fintech valuation standards a multiple of over 300 times revenue for a tiny company is frankly ludicrous.

However, it gets worse. Since Ariadne Capital Entrepreneurs purchased its 3 million ordinary shares, The One Place Capital Limited has issued tens of million more shares to Reyker Nominees and Calculus Nominees (two well-known EIS investment companies) diluting Ariadne’s stake significantly in terms of percentage ownership. Based on latest Companies House confirmation statement on 8 May 2017 there are now over 229 million shares in issue reducing Ariadne’s stake to around 1.3% excluding any subsequent share issues. This implies a valuation of over £200 million or 330 times revenue on Julie’s Meyer maths.

In reality the real value is considerably lower. In the summer of 2017, Money Dashboard successfully raised money via Crowdcube. It had a target of £1 million for 9.01% of the business implying a pre-money valuation of £12.6 million see link

On that basis and pre dilution Ariadne Capital’s stake would be worth some £165,000 or around 6% of her estimate (ignoring the subsequent dilution from injection of new money). Her estimated 16.6 times multiple reduces to a zero return on original stake cost of £165,500. After Julie's rather generous expenses that reduces to a loss.

I am sure there are more winners in the spreadsheet below. This sort of material was used to raise money from investors and the FCA did nothing. Now it has been shown the extent of what Meyer was up to, the Maltese have suspended the Ariadne license to manage money yet in London the cocksuckers at Canary Wharf do NOTHING and Meyer is allowed to continue to run her fund and seek new investors. If the FCA was a horse it would be on a one way trip to the glue factory.

Click to view larger PDF version

Become a member starting at £6.99 per month for all articles, the Bearcast, and our seven year archive.

Filed under:

Tuesday »

Monday »

Sunday »

Saturday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Sunday »

Saturday »

Thursday »

Wednesday »

Tuesday »

Monday »

Sunday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Sunday »

Saturday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Saturday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Sunday »

Saturday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Sunday »

Saturday »

Friday »

Thursday »

Wednesday »

Time left: 00:54:28