By Tom Winnifrith | Friday 4 May 2018

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from ShareProphets). I have no business relationship with any company whose stock is mentioned in this article.

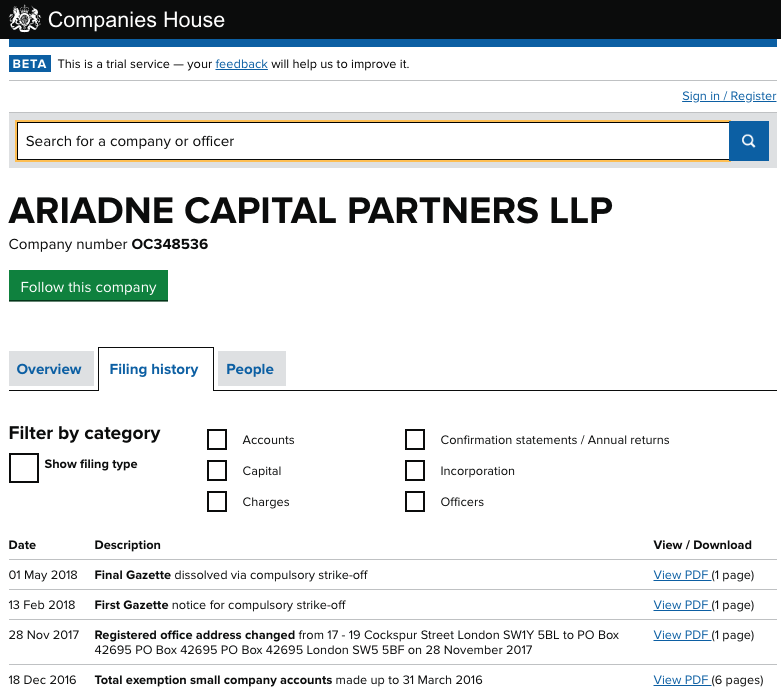

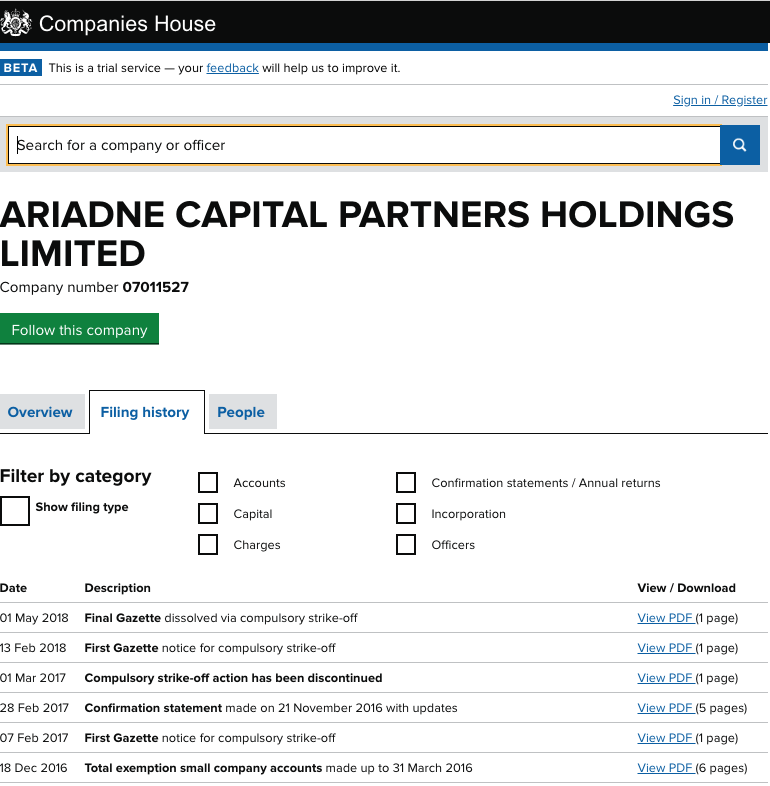

Oh dear it seems that the myriad of Ariadne companies just got that bit less complex with two more biting the dust for failure to submit accounts for the year to March 31 2017. So what were they hiding as they have now been formally struck off as you can see below...

To be fair Ariadne Capital Partners LLP was a non event more or less dormant entity so that is no great loss to the world but the other business that was struck off was a little bit more interesting: I refer to Ariadne Capital Partners Holdings Ltd

Going back over the balance sheets for the year ended 31 March 2016, 2015 and 2014 one can see a number of common features. Cash is consistently nil. That is par for the course for anything linked to ther devout Christian Meyer. But debtors - the amount owed is working backwards £79,341, £80,477 ( or £81,084 depending on which year's unaudited work of fiction is correct) £100,936 while creditors are £101,000, £101,730 and £120,930.

Now apart from the fact that different year's accounts give a different number for the 2015 debtor level ( i.e. how much money ACP is owed) with no explanation at all one should note another two matters. Firstly net assets and net current assets are in all years negative at c£20,000. I wonder if having been struck off for failing to file accounts there will be any creditors (those owed money) prepared to kick up a fuss?

Secondly all these debtors and creditors are current, that is to say payable within twelve months. But the numbers never really seem to change. I wonder just how current these sums are and who the debtors and creditors are. Well I guess we will never know.

It is just another day and while Julie Meyer concentrates on important things, like instructing her lawyer to contact twitter about accounts that have tweeted hostile comment with a view to getting them removed, her empire visibly crumbles. There will be more news on that front over the coming days and weeks.

Become a member starting at £6.99 per month for all articles, the Bearcast, and our seven year archive.

Filed under:

Thursday »

Wednesday »

Tuesday »

Monday »

Sunday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Sunday »

Saturday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Saturday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Sunday »

Saturday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Sunday »

Saturday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Sunday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Saturday »

Friday »

Thursday »

Wednesday »

Tuesday »

Monday »

Sunday »

Friday »

Thursday »

Wednesday »

Time left: 22:53:07