EXCLUSIVE: Winnileaks emails shows Julie Meyer taking assets out of Ariadne after administration

By Tom Winnifrith | Wednesday 27 June 2018

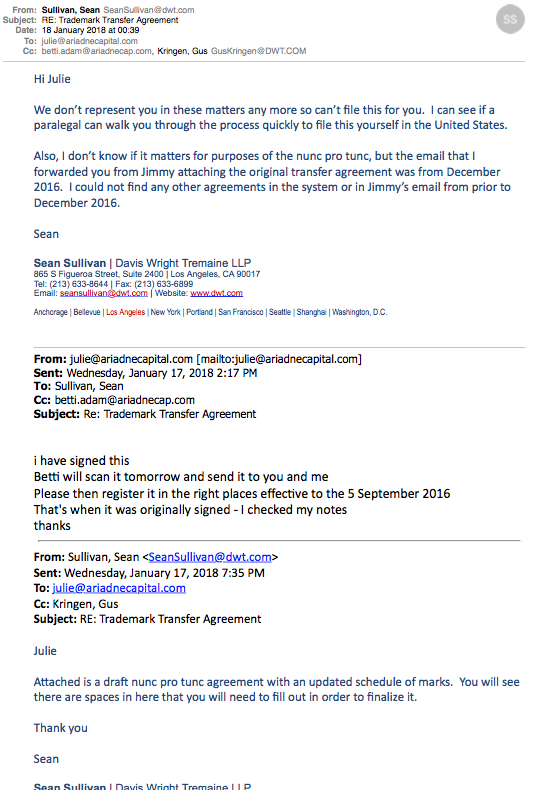

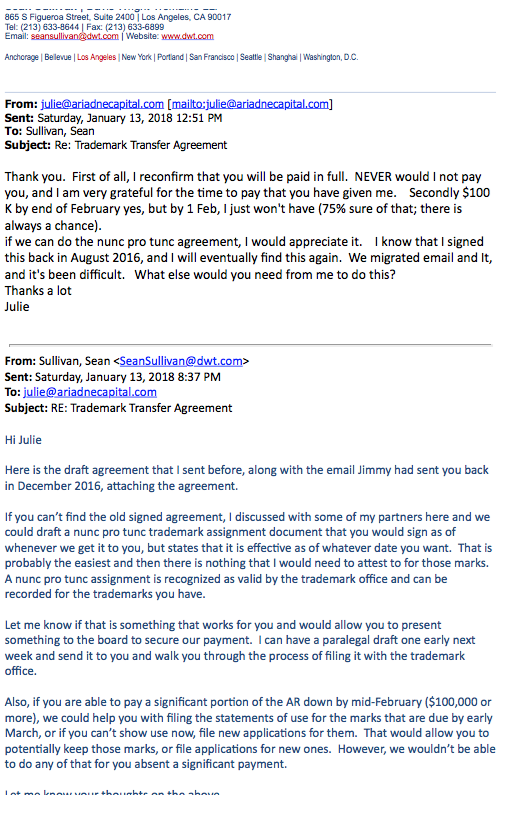

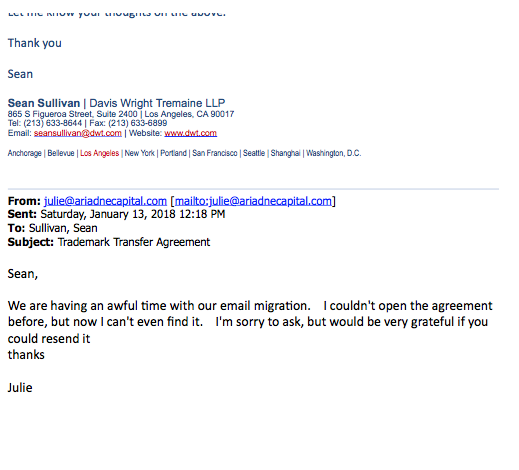

Oh dear, poor Andrew Duncan at Administrator Leonard Curtis will not like this latest set of emails to drop into the hands of Winnileaks. Not one bit. Duncan was appointed on 18 December at which point Julie "Lingerie on expenses" Meyer MBE ceased to be a director and lost any say in the running of Ariadne Capital Limited (ACL). This devastating email thread is from January 2018.

It is between Meyer and a patent attorney in the US owed money by ACL. Natch Meyer promises that the cheque is in the post. I kind of suspect that Sean Sullivan at Davis Wright Tremaine LLP is still waiting.

In this thread Julie purports to act for Ariadne and claims that an agreement to transfer all the trademarks owned by ACL to Ariadne Capital Group Limited (ACGL) in Malta was made in 2016 but that she can't find the paperwork. None the less it is agreed on a course of action to transfer all the trademarks now but to backdate it to 2016 when the supposed agreement was made.

If the agreement did in fact exist, did Julie mention that ACL owned none of its trademarks to those folks she was trying to persuade to invest in ACL as late as October 2017? If not does not that seem a tad fraudulent? And what was the consideration for this trade? That matters because in 2016 Meyer was the sole shareholder in ACGL while ACL had a raft of external investors. Surely Meyer was not just giving away assets to her own company?

And what does Mr Duncan think of Julie purporting to act for Ariadne to ensure assets are removed from ACL when he as administrator is trying to realise value for creditors by selling all assets. Has Julie hoodwinked him by taking out any other assets? I cannot imagine that he would be exactly chuffed. Can you?

This story is available to all readers

ShareProphets is reader-supported journalism

Become a member starting at £6.99 per month for all articles, the Bearcast, and our seven year archive.

Filed under:

- Julie Meyer

- Lingerie on Expenses

- Ariadne Capital Limited

- Andrew Duncan

- administrator

- Leonard Curtis

- ACL

- ACGL

- Malta

- Ariadne Capital Group Limited

- Sean Sullivan

- Davis Wright Tremaine LLP

Market News

Breedon (#BREE) – four months to 31st October LFL revenue -1%, FY expectations unchanged

21 November 2024, 07:33Complete Coverage

Recent Comments

That Was the Week that Was

Thursday »

Speedy Hire – interims, “the board anticipates the group meeting its full year expectations”. Really?…

- By Steven Moore

- 21 November 2024, 11:29

Celadon Pharmaceuticals: FFS just come clean, when’s the massively discounted placing?

- By Tom Winnifrith

- 21 November 2024, 11:14

BREAKING: Supply@Me Capital – Alessandro Zamboni in default on yet another 7 figure financing commitment

- By Tom Winnifrith

- 21 November 2024, 09:39

FCA consultation on extending time firms have to respond to non-discretionary commission motor finance complaints

- By Steven Moore

- 21 November 2024, 07:59

Frasers (#FRAS) – open letter including noting its further requisition to seek to remove Executive Chairman Mahmud Kamani as director of boohoo (#BOO)

- By Steven Moore

- 21 November 2024, 07:58

Resolute Mining (#RSG) – CEO Terence Holohan and the two other employees released in Mali and have departed the country

- By Steven Moore

- 21 November 2024, 07:57

Cohort (#CHRT) – agreement to acquire naval satellite communications business EM Solutions for c.£75m enterprise value, £40m placing and up to £1m “retail offer”

- By Steven Moore

- 21 November 2024, 07:56

Liontrust (#LIO) – H1 adj. EPS down to 30.3p, DPS maintained at 22p, notes market challenges but argues moving into a more positive environment

- By Steven Moore

- 21 November 2024, 07:45

CMC Markets (#CMCX) – H1 EPS swing to 12.8p, DPS up to 3.1p, “confident in delivering on guidance”

- By Steven Moore

- 21 November 2024, 07:38

Speedy Hire (#SDY) – H1 swing to loss, argues “consistent with prior years… expects a strong second half weighting”

- By Steven Moore

- 21 November 2024, 07:36

Breedon (#BREE) – four months to 31st October LFL revenue -1%, FY expectations unchanged

- By Steven Moore

- 21 November 2024, 07:33

PZ Cussons (#PZC) – trading “in line with expectations”, progressing with sale of St. Tropez brand and discussions on African business

- By Steven Moore

- 21 November 2024, 07:29

JD Sports Fashion (#JD.) – Q3 update, “now anticipate full year profit to be at the lower end of our guidance range”

- By Steven Moore

- 21 November 2024, 07:23

Wednesday »

Volex – interims, confidence in meeting outlook targets and a possible offer for TT Electronics?

- By Steven Moore

- 20 November 2024, 16:43

James Cropper – I having previously questioned it “repositioned for growth”, a half-year results profit (lack of) warning…

- By Steven Moore

- 20 November 2024, 16:17

A failed fund manager writes about lies (is that his specialist subject?)

- By ShareProphets

- 20 November 2024, 14:59

Tom Winnifrith Bearcast: Under what circumstances do I give up on Optibiotix and switch into Skins?

- By Tom Winnifrith

- 20 November 2024, 14:55

Churchill China – as I warned the half-year results suggested, a profit warning (and it’s ‘material’)

- By Steven Moore

- 20 November 2024, 13:37

EXPOSE: Technology Minerals: Breaking listing rules yet again, something it is not saying!!

- By Tom Winnifrith

- 20 November 2024, 13:32

Predator Oil & Gas, the apparently missing NED and the jumping rats

- By Tom Winnifrith

- 20 November 2024, 12:57

Tom Winnifrith Bonus Bearcast: Today's note from Cavendish on Skinbiotherapeutics is utterly pointless, here's my stab at forecasts

- By Tom Winnifrith

- 20 November 2024, 11:24

Proton Motor Power Systems – states to “orderly wind down” the business, but how “orderly”?…

- By Steven Moore

- 20 November 2024, 10:59

BREAKING: Bushveld Minerals, sack the board GM called, too little too late

- By Tom Winnifrith

- 20 November 2024, 09:50

Proton Motor Power Systems (#PPS) – to wind down the business and proposed AIM cancellation

- By Steven Moore

- 20 November 2024, 07:59

Hummingbird Resources (#HUM) – states “continues to engage constructively with the Coris Parties and their advisers to finalise the subscription agreement”

- By Steven Moore

- 20 November 2024, 07:57

Equals (#EQLS) – Takeover Panel extension to 11th December for consortium to conclude negotiations of arrangements between its members

- By Steven Moore

- 20 November 2024, 07:56

Argo Blockchain (#ARB) – Q3 net loss $6.3m, still vast debt against gross cash of $2.5m

- By Steven Moore

- 20 November 2024, 07:56

Churchill China (#CHH) – “not seen the normal seasonal uplift”, expects FY profit “materially below market expectations”

- By Steven Moore

- 20 November 2024, 07:49

#FRP Advisory – notes H1 “continued growth in revenues and profits”, “confident of achieving full year expectations”

- By Steven Moore

- 20 November 2024, 07:46

Renold (#RNO) – H1 adj. EPS up to 4.2p, “confident of delivering underlying full year results in line with market expectations”

- By Steven Moore

- 20 November 2024, 07:44

Coats (#COA) – four months “sales growth improved to 11%”, expects FY “in line with market expectations”

- By Steven Moore

- 20 November 2024, 07:41

Hill & Smith (#HILS) – four months adj. organic revenue +2%, states “in line with current analyst consensus”

- By Steven Moore

- 20 November 2024, 07:39

Rotork (#ROR) – four months organic constant currency order intake +8% YoY, “in line with management expectations”

- By Steven Moore

- 20 November 2024, 07:36

Tuesday »

Tom Winnifrith Bearcast: Jeremy Clarkson bloody well should pay full IHT

- By Tom Winnifrith

- 19 November 2024, 17:59

Amaroq Minerals – Q3 results and key agreements for upcoming gold production, an upcoming catalysts Buy

- By Steven Moore

- 19 November 2024, 16:35

Calnex Solutions – interims, how confident to be of “expects to close the year in line with current market expectations”?…

- By Steven Moore

- 19 November 2024, 16:25

CML Microsystems – interims, is it really ‘progress showcasing the resilience and adaptability of the business model’?

- By Steven Moore

- 19 November 2024, 14:20

Tom Winnifrith bonus bearcast: ye or me or that idiot Magna Carta of little faith, Eco Buildings and Skinbiotherapeutics

- By Tom Winnifrith

- 19 November 2024, 11:59

Fusion Antibodies – interims argue “now well positioned”, but is it really?…

- By Steven Moore

- 19 November 2024, 11:40

Is China fraud specialist Paul Shackleton doing a bit of a Rachel from Customer services on LinkedIn?

- By ShareProphets

- 19 November 2024, 10:14

November 18 2024 and it is already Dr David Viner day! The global warming is falling fast! Tom Winnifrith

- By Tom Winnifrith

- 19 November 2024, 08:00

Photo Article: the global warming at the Welsh Hovel, Tom Winnifrith

- By Tom Winnifrith

- 19 November 2024, 08:00

SkinBioTherapeutics (#SBTX) – Croda commercial terms finalisation “based on the final testing of the SkinBiotix technology”

- By Steven Moore

- 19 November 2024, 07:59

UK Oil & Gas (#UKOG) – placing and “retail offer” at just 0.025p per share “to fund new H2 storage site”. Hmmm!

- By Steven Moore

- 19 November 2024, 07:57

Victoria (#VCP) – sells ceramic tile manufacturer in Turkey Graniser for €36.8m Enterprise Value

- By Steven Moore

- 19 November 2024, 07:56

Gear4music (#G4M) – H1 loss, argues “well-positioned and prepared for the upcoming peak seasonal trading period”

- By Steven Moore

- 19 November 2024, 07:51

Revolution Beauty (#REVB) – H1 small adj. profit but overall loss, reckons will return to growth in Q4

- By Steven Moore

- 19 November 2024, 07:49

Fonix (#FNX) – “positive” trading “in line with expectations”, “progressing well” with Portugal expansion plans

- By Steven Moore

- 19 November 2024, 07:44

GB Group (#GBG) – H1 adj. EPS up to 7.3p, “underpins” outlook confidence

- By Steven Moore

- 19 November 2024, 07:41

Genuit (#GEN) – expects FY adj. Op profit “broadly in-line with the lower end of analyst expectations”

- By Steven Moore

- 19 November 2024, 07:37

#AVON Technologies – FY adj. EPS up to $0.699, DPS down to $0.233, now sees potential to reach targets a year early

- By Steven Moore

- 19 November 2024, 07:34

Imperial Brands (#IMB) – FY adj. EPS up to 297p, DPS to 153.42p, “remain confident”

- By Steven Moore

- 19 November 2024, 07:28

Monday »

Tom Winnifrith Bearcast: Barclays wastes 15 minutes of my life

- By Tom Winnifrith

- 18 November 2024, 17:34

StreaksAI – interims argue AI technology developments “nearing completion” and “adequate working capital”, BUT…

- By Steven Moore

- 18 November 2024, 16:05

Microlise – “Update on Cyber Security Incident”, how ‘materially’ will trading forecasts and financial position meet expectations?

- By Steven Moore

- 18 November 2024, 14:05

Judges Scientific – expects certain orders now “will not all occur in time to deliver against the expectations”. Uh oh!…

- By Steven Moore

- 18 November 2024, 10:59

Bushveld Minerals: ouzo on cornflakes for the Sheriff of AIM as shares suspended pending clarification

- By Tom Winnifrith

- 18 November 2024, 10:26

The chart that proves oil stocks trump green shite, or does it?

- By ShareProphets

- 18 November 2024, 10:06

Georgina Energy:– today’s cashless warrant exercise is a massive vote of no confidence

- By Tom Winnifrith

- 18 November 2024, 09:52

Christopher Booker, this photo is just so perfect for today's dark times, Tom Winnifrith

- By Tom Winnifrith

- 18 November 2024, 08:00

Bushveld Minerals (#BMN) – with “financial uncertainty”, a turnaround specialist appointed and shares suspended

- By Steven Moore

- 18 November 2024, 07:59

Resolute Mining (#RSG) – signs a protocol for Mali business discussions, working on remaining procedural steps for release of three detained employees

- By Steven Moore

- 18 November 2024, 07:58

Microlise (#SAAS) – “vast majority of customer systems are back online, with some remaining customers conducting their own security verifications before enabling users”

- By Steven Moore

- 18 November 2024, 07:54

Celadon Pharmaceuticals (#CEL) – notes financing delays and sufficient working capital only “through to January”

- By Steven Moore

- 18 November 2024, 07:52

Petrofac (#PFC) – senior secured notes interest forbearance extended to 13th December, argues progressing a ‘financial restructure’ “at pace”

- By Steven Moore

- 18 November 2024, 07:51

Georgina Energy (#GEX) – “Operational Update” is actually an exercise of warrants for nil consideration

- By Steven Moore

- 18 November 2024, 07:50

#IQE – warns “slower than anticipated recovery”, “strategic review” and negotiating “short-term financing”

- By Steven Moore

- 18 November 2024, 07:42

Judges Scientific (#JDG) – profit warning as certain orders now likely to “not all occur in time to deliver against the expectations”

- By Steven Moore

- 18 November 2024, 07:40

#FDM Group – notes lower number of consultants assigned to clients, albeit “in line with its expectations”

- By Steven Moore

- 18 November 2024, 07:37

Begbies Traynor (#BEG) – H1 “positive momentum”, notes higher employment costs and interest rates likely to extend elevated insolvency levels

- By Steven Moore

- 18 November 2024, 07:33

Sunday »

Tern – Yet More Disaster At Wyld….Has It Sold Out Yet?

- By Nigel Somerville

- 17 November 2024, 16:29

Tom Winnifrith Bearcast: Will Southport see Keir Starmer also forced to resign, the gagging is not working! And is today's Georgina expose enough for Jerry Keen to quit?

- By Tom Winnifrith

- 17 November 2024, 16:06

Visual Aid: Top Personal Income Tax Rates in Europe in 2024

- By ShareProphets

- 17 November 2024, 15:54

BREAKING EXPOSE: Georgina Energy, the bogus research report by a firm that does not exist and the criminal charges

- By Tom Winnifrith

- 17 November 2024, 15:39

Sunday Long Reads: No Contact Children, Greek Espionage, Prediction Markets, Academic Raving, Microchip Mobilisation

- By ShareProphets

- 17 November 2024, 10:43

The View From The Montana Log-Cabin As Gold Suffers Continued Trump Dump

- By Nigel Somerville

- 17 November 2024, 10:42

Notes from Underground – Most read articles for the week ending Nov 16

- By ShareProphets

- 17 November 2024, 10:39

Saturday »

#Gowokegobroke: Boots wins the Christmas advert clanger

- By Tom Winnifrith

- 16 November 2024, 20:19

Tom Winnifrith Bearcast: why Rachel Reeves needs to resign NOW

- By Tom Winnifrith

- 16 November 2024, 20:05

EXPOSE: Georgina Energy, the 2020 slide deck and the mystery of the dog that barked

- By ShareProphets

- 16 November 2024, 19:26

Craven House Capital – a technically insolvent company without a material uncertainty warning thanks to Zak Mir's pal

- By Tom Winnifrith

- 16 November 2024, 19:04

AIM Market Statistics for October 2024 - another month of decline on the casino, a 23 year low hit

- By Tom Winnifrith

- 16 November 2024, 18:08

Friday »

Kefi – Saudi Arabia interests dilution, though remaining interest set for “a significant premium” realisation to that

- By Steven Moore

- 15 November 2024, 17:59

Creightons – half year profitability in excess of the prior full-year from this winning share tip

- By Steven Moore

- 15 November 2024, 16:37

TT Electronics – possible offer proposals, but rejected and currently “no ongoing discussions”

- By Steven Moore

- 15 November 2024, 16:29

Solid State – after just last week ‘expects particularly defence sector orders to meet market expectations’, now a prominent defence order programme “paused”!

- By Steven Moore

- 15 November 2024, 14:47

BREAKING: Rachel Reeves MP – is it from bad to worse on her CV fabrication? Is Kev Gillett for real?

- By ShareProphets

- 15 November 2024, 14:40

Hellenic Dynamics: loan still not arrived I guess Peterhouse and Cairn think lying is all fine and dandy

- By Tom Winnifrith

- 15 November 2024, 13:06

Tekcapital: yet another placing and more mendacity for the vicar?

- By Tom Winnifrith

- 15 November 2024, 12:49

Tom Winnifrith Podcast: Radio 4's Today on Bobby Kennedy, University Funding and the slowing UK economy, it's all fake news!

- By Tom Winnifrith

- 15 November 2024, 08:00

Volex (#VLX) – notes possible cash and shares offer proposals to TT Electronics (#TTG), whose board “has declined to engage”

- By Steven Moore

- 15 November 2024, 07:59

Hellenic Dynamics (#HELD) – €1m loan announced in April still “has not been received” and “now exploring alternative financing options”!

- By Steven Moore

- 15 November 2024, 07:57

Volex (#VLX) – H1 adj. EPS up to $0.152, DPS to 1.5p, “reiterates confidence”

- By Steven Moore

- 15 November 2024, 07:56

Victoria (#VCP) – argues “positive leading indicator data” but admits “off a very low base” and assessing refinancing options

- By Steven Moore

- 15 November 2024, 07:53

Audioboom (#BOOM) – states “ahead of the recently upgraded market expectation”, but just emphasises adjusted EBITDA

- By Steven Moore

- 15 November 2024, 07:48

Amaroq Minerals (#AMRQ) – “key agreements” in advance of gold production including for processing and offtake

- By Steven Moore

- 15 November 2024, 07:46

Altitude (#ALT) – notes H1 growth, “remains in line with the board's expectations for the full financial year”

- By Steven Moore

- 15 November 2024, 07:41

Solid State (#SOLI) – ‘materially below expectations’ warning as “expenditure on a prominent defence order programme has been paused”

- By Steven Moore

- 15 November 2024, 07:39

Record (#REC) – H1 EPS up to 2.58p, DPS maintained at 2.15p, trading “in line with the board's expectations”

- By Steven Moore

- 15 November 2024, 07:36

MJ Gleeson (#GLE) – AGM Trading Update, states results “will be more weighted to the second half than usual”. Hmmm

- By Steven Moore

- 15 November 2024, 07:31

Thursday »

HeiQ – ‘preparing for a capital raise in the coming weeks open to all shareholders’. Er, I wonder why!…

- By Steven Moore

- 14 November 2024, 17:10

TT Electronics – expects full-year “at the lower end of… previously stated range”, but that’s a range already lowered less than two months ago

- By Steven Moore

- 14 November 2024, 16:19

Tom Winnifrith Bearcast: Mad Welshmen and the dogs and maybe Pierro is right

- By Tom Winnifrith

- 14 November 2024, 14:57

Zytronic – having last month emphasised “material growth opportunity” of its transformation plan, now to seek a solvent liquidation!

- By Steven Moore

- 14 November 2024, 14:39

Video: Why Uranium, Gold and Silver are the Actual Winners of the US Election

- By Tom Winnifrith

- 14 November 2024, 13:45

ActiveOps – having been an AIM Awards 2024 nominee, results disappointment (natch!)

- By Steven Moore

- 14 November 2024, 11:23

Oracle Power: shares already below placing price the sheer pointlessness of it

- By Tom Winnifrith

- 14 November 2024, 11:22

boohoo (#BOO) – raises £39.3m at 31p per share, “up to” £6m “retail offer”

- By Steven Moore

- 14 November 2024, 07:59

Zytronic (#ZYT) – following strategic review, “will now seek a sale and/or wind down of the group assets”

- By Steven Moore

- 14 November 2024, 07:59

#HEIQ – “Update on Delisting and Potential Capital Raise”, delisting scheduled for 19th November

- By Steven Moore

- 14 November 2024, 07:58

Young & Co's (#YNGA) – H1 adj. EPS up to 36.72p, DPS to 11.53p, notes “Government's budget will result in significant increased costs for our industry”

- By Steven Moore

- 14 November 2024, 07:52

WH Smith (#SMWH) – FY adj. EPS up to 89.3p, DPS to 33.6p, “new financial year has started well”

- By Steven Moore

- 14 November 2024, 07:50

Burberry (#BRBY) – H1 swing to even adj. loss, notes H2 “important festive trading period” uncertainty considering “uncertain macroeconomic environment”

- By Steven Moore

- 14 November 2024, 07:47

TT Electronics (#TTG) – “expects FY24 adjusted operating profit to be at the lower end of our previously stated range of £37m-42m”

- By Steven Moore

- 14 November 2024, 07:41

Stelrad (#SRAD) – incremental early signs of a recovery in volumes within selected European markets, FY guidance unchanged

- By Steven Moore

- 14 November 2024, 07:39

B&M (#BME) – H1 adj. EPS down to 14.7p, DPS up to 5.3p, “confident in our outlook for the second half”

- By Steven Moore

- 14 November 2024, 07:35

Premier Foods (#PFD) – H1 adj. EPS up to 5.3p, “on track to deliver on full year expectations”

- By Steven Moore

- 14 November 2024, 07:32

Wednesday »

Ariana Resources – loan to further advance Dokwe project ahead of Australia dual-listing, Buy

- By Steven Moore

- 13 November 2024, 16:22

Gelion – “Produces Solid-State Separator”, again attempted ramptastic?

- By Steven Moore

- 13 November 2024, 16:14

A reader reports Roast PR to the FCA over a new porky pie but nothing will happen

- By Tom Winnifrith

- 13 November 2024, 14:44

Tom Winnifrith Bearcast: Just Eat and Grub Hub show fund managers even bigger morons than Bulletin Board Morons as $7.3bn turned into $650m

- By Tom Winnifrith

- 13 November 2024, 14:20

Ten Lifestyle – states “pleased to announce” full-year results, but what’s ‘pleasing’ about them?

- By Steven Moore

- 13 November 2024, 14:19

Biome Technologies – after September-argued “challenges… progressing towards resolution”, already another trading warning!

- By Steven Moore

- 13 November 2024, 11:42

Tom Winnifrith Bonus Bearcast: Revenge of the knicker wetters and Kefi which can now escape a placing and here's how

- By Tom Winnifrith

- 13 November 2024, 10:42

Optibiotix: would you Adam & Eve it? How is Neil Davidson not a trougher who misleads?

- By Tom Winnifrith

- 13 November 2024, 09:29

EXPOSED: The lies and smears of Zak Mir and David Burton on behalf of Georgina Energy

- By ShareProphets

- 13 November 2024, 08:53

Has the election of President Trump killed the gold bull market? What the gurus say

- By Tom Winnifrith

- 13 November 2024, 08:50

#SRT Marine Systems – fundraising to raise up to £8.5m at 35p per share

- By Steven Moore

- 13 November 2024, 07:59

#KEFI Gold & Copper – to remove outstanding exploration liabilities in Saudi Arabia by falling to 15% of joint venture, potential sale of this residual shareholding

- By Steven Moore

- 13 November 2024, 07:58

Creightons (#CRL) – H1 “small reduction in revenue” but estimates pre-tax profit “notably higher” than corresponding prior year period

- By Steven Moore

- 13 November 2024, 07:52

Fuller, Smith & Turner (#FSTA) – H1 adj. EPS up to 21.81p, DPS to 7.41p, 32 weeks LFL sales +5.4%

- By Steven Moore

- 13 November 2024, 07:48

Craneware (#CRW) – growth “in line with current market expectations”, non-executive director changes

- By Steven Moore

- 13 November 2024, 07:45

Castings (#CGS) – H1 EPS down to 7.07p, DPS up to 4.21p, FY demand schedules continue to reflect heavy truck lower build rates

- By Steven Moore

- 13 November 2024, 07:42

Dowlais (#DWL) – ten months constant currency revenue -6.1% YoY, expects continued market volatility next year

- By Steven Moore

- 13 November 2024, 07:38

Tatton Asset Management (#TAM) – H1 adj. EPS up to 13.67p, DPS to 9.5p, “remain on track to meet the board's expectations for the full year”

- By Steven Moore

- 13 November 2024, 07:32

Experian (#EXPN) – H1 adj. EPS up to $0.76, DPS to $0.1925, expects FY margin accretion towards upper end of +30 to +50 basis points range

- By Steven Moore

- 13 November 2024, 07:29

Just Eat Takeaway.com (#JET) – agreement to sell Grubhub for $650m Enterprise Value

- By Steven Moore

- 13 November 2024, 07:23

Tuesday »

Tom Winnifrith Bearcast: Tomorrow I expose Zak Mir and David Burton with their pants down

- By Tom Winnifrith

- 12 November 2024, 17:19

Marks Electrical – after late-June “optimism for the year ahead”, already now a material profit warning!

- By Steven Moore

- 12 November 2024, 16:20

Comparing farmers today to 1980s miners is duff economics and shows the class hatred that really fuels the left

- By Tom Winnifrith

- 12 November 2024, 13:55

Zoo Digital – interims, states it believes it has sufficient working capital “for the foreseeable future” but for how long likely is that?

- By Steven Moore

- 12 November 2024, 13:39

BREAKING EXPOSE: Roast PR Limited, the alleged Zambian gold fraud, Colin Bird and while Roast profits readers lose out

- By Tom Winnifrith

- 12 November 2024, 12:10

BREAKING: Georgina Energy and Mark Wallace and the 2013 fraud allegations

- By Tom Winnifrith

- 12 November 2024, 11:21

Facilities by ADF – as I cautioned, profit warning. To do with UK Budget and US election uncertainty or more?…

- By Steven Moore

- 12 November 2024, 11:20

Tom Winnifrith bonus bearcast: you cannot make a silk purse from a sow's ear, the tale of UK onshore oil and Union Jack Oil

- By Tom Winnifrith

- 12 November 2024, 11:04

Metro Bank (#MTRO) – £16.7m fine for “financial crime failings”

- By Steven Moore

- 12 November 2024, 07:59

Union Jack Oil (#UJO) – “planning permission for the Wressle development… has been formally rescinded”

- By Steven Moore

- 12 November 2024, 07:57

4imprint (#FOUR) – FY PBT expectations “remain unchanged and are within the current range of analysts' forecasts at just over $150m”

- By Steven Moore

- 12 November 2024, 07:55

Facilities by #ADF – warns as a significant number of productions start dates delayed to next year and “some” will not proceed at all

- By Steven Moore

- 12 November 2024, 07:53

#ZOO Digital – H1 $2.6m loss and “visibility of Q4 orders remains limited”, even gross cash down to $4.3m

- By Steven Moore

- 12 November 2024, 07:49

Cake Box (#CBOX) – H1 EPS up to 5.18p, DPS to 3.40p, “on track” for FY “in line with market expectations”

- By Steven Moore

- 12 November 2024, 07:46

Marks Electrical (#MRK) – H1 adj. EPS down to 0.72p, DPS maintained at 0.30p, FY profit warning

- By Steven Moore

- 12 November 2024, 07:43

McBride (#MCB) – “strong” trading in line with market expectations, though cautious including of commodity markets adversely impacting input costs

- By Steven Moore

- 12 November 2024, 07:40

Franchise Brands (#FRAN) – expects FY adj. EBITDA at lower end of expectations as “anticipated recovery in project work is now not expected until next year”

- By Steven Moore

- 12 November 2024, 07:36

Oxford Instruments (#OXIG) – H1 adj. EPS down to 44.7p, DPS up to 5.1p, H2 “expect to deliver our typical stronger trading performance”

- By Steven Moore

- 12 November 2024, 07:31

Monday »

BREAKING: Georgina Energy, Antony Hamilton and the undischarged bankruptcy he neglected to mention

- By Tom Winnifrith

- 11 November 2024, 16:35

Tom Winnifrith Bearcast: the wording at Dialight terrifies me as CFO walks

- By Tom Winnifrith

- 11 November 2024, 16:34

Dialight – after a week ago “confirms” half-year results for today, it’s now CFO leaves “with immediate effect” instead!

- By Steven Moore

- 11 November 2024, 16:19

Various Eateries – argues “a strong position” with a “healthy” financial position. Really?…

- By Steven Moore

- 11 November 2024, 13:53

Roast PR: Bent journalism and a 12 stock kiss of death list

- By Tom Winnifrith

- 11 November 2024, 13:12

Westminster Group and the most dreaded words in the English Corporate language

- By Tom Winnifrith

- 11 November 2024, 12:46

Hemogenyx raises £600,000 it is still bust within weeks and this stinks

- By Tom Winnifrith

- 11 November 2024, 12:09

Tom Winnifrith bonus Bearcast: gold, country risk, not a death spiral, Resolute and Ariana

- By Tom Winnifrith

- 11 November 2024, 11:14

Forterra – trading only “broadly in line” and price increases challenges ahead?

- By Steven Moore

- 11 November 2024, 10:59

Resolute Mining (#RSG) – confirms “CEO, Terence Holohan, and two other employees, have been detained in Mali by Government Officials”

- By Steven Moore

- 11 November 2024, 07:59

Aquis Exchange (#AQX) – recommended 727p per share offer from SIX Exchange Group

- By Steven Moore

- 11 November 2024, 07:59

Dialight (#DIA) – CFO Carolyn Zhang “has stepped down… for personal reasons and will be leaving the company, with immediate effect”

- By Steven Moore

- 11 November 2024, 07:54

GreenX Metals (#GRX) – Poland lodges request to set-aside arbitration award “on the basis of jurisdictional aspects of the award and procedural unfairness”

- By Steven Moore

- 11 November 2024, 07:52

Ariana Resources (#AAU) – up to $5m loan agreement to advance Dokwe project

- By Steven Moore

- 11 November 2024, 07:50

NatWest (#NWG) – second buy back of government shares of 2024, for £1bn

- By Steven Moore

- 11 November 2024, 07:46

Cavendish Financial (#CAV) – H1 adj. EPS 0.4p, DPS 0.3p, “market conditions have yet to improve significantly post the general election”

- By Steven Moore

- 11 November 2024, 07:44

Kainos (#KNOS) – H1 adj. EPS edged up to 22.5p, DPS up to 9.3p, notes “poor macro-economic conditions and delayed UK Government decision-making”

- By Steven Moore

- 11 November 2024, 07:42

Various Eateries (#VARE) – FY “small positive adjusted EBITDA”, hit outs at Budget “further major blow to a struggling industry”

- By Steven Moore

- 11 November 2024, 07:39

Forterra (#FORT) – “year to date revenues were 5% below the 2023 comparative”, maintains FY adj. EBITDA expectation of “around £50m”

- By Steven Moore

- 11 November 2024, 07:35

Sunday »

Tom Winnifrith bearcast: Resolute bosses arrested, Georgina's bosses should be

- By Tom Winnifrith

- 10 November 2024, 19:42

Visual Aid: Top 10 Countries by Value of All Their Natural Resources

- By ShareProphets

- 10 November 2024, 11:30

The View From The Montana Log-Cabin As Gold Slips On Trump Election Result

- By Nigel Somerville

- 10 November 2024, 11:20

Sunday Long Reads: Lying Researcher, Old Film Future, Tankers vs Whales, Buttons are Back, Non-Nigel Cabin on the Mountain

- By ShareProphets

- 10 November 2024, 11:14

Notes from Underground – Most read articles for the week ending Nov 9

- By ShareProphets

- 10 November 2024, 08:50

Saturday »

Jubilee Metals – “Operational Update”, a Q1 and outlook positives BUY

- By Tom Winnifrith

- 9 November 2024, 17:15

Tom Winnifrith Bearcast: Jubilee to more than double and Neil Woodford's oil bearishness overcooked

- By Tom Winnifrith

- 9 November 2024, 12:40

A disgraced fund manager turned share blogger warns about oil, bullish on Trump, UK shares and China

- By ShareProphets

- 9 November 2024, 09:48

Tom Winnifrith podcast: Democrats should stop panicking and screaming but need to think about lessons they must learn

- By Tom Winnifrith

- 9 November 2024, 00:48

Empresaria – “sale of non-core subsidiary”, but still group financial concern?…

- By Steven Moore

- 8 November 2024, 16:15

Mkango Resources: good companies just do not behave like this

- By Tom Winnifrith

- 8 November 2024, 14:49

CyanConnode – interims, was the fundraising to enhance growth and operational capabilities or mainly to keep the lights on for a bit longer?

- By Steven Moore

- 8 November 2024, 14:32

Tom Winnifrith Bearcast; Reporting back alive, good cancer news but...

- By Tom Winnifrith

- 8 November 2024, 14:27

Argo Blockchain: No it really is a zero, a 'fess up and an AI spoof, 0p here we come

- By Tom Winnifrith

- 8 November 2024, 10:09

Mkango Resources (#MKA) – expected admission of placing shares delayed to “on or around 22 November… due to administrative delays”

- By Steven Moore

- 8 November 2024, 07:59

BSF Enterprise (#BSFA) – “Portfolio Update”, attempted ramptastic

- By Steven Moore

- 8 November 2024, 07:59

Indivior (#INDV) – states “focused on acting in the best interests of all shareholders as we continue to execute on our strategy” in response to letter from Oaktree Capital Management

- By Steven Moore

- 8 November 2024, 07:55

TI Fluid Systems (#TIFS) – Takeover Panel extension for finalisation of due diligence, financing and transaction documentation

- By Steven Moore

- 8 November 2024, 07:46

Empresaria (#EMR) – sale of its 51% interest in Fines Tokyo for a repaid JPY50 million (c.£0.253m) intercompany balance

- By Steven Moore

- 8 November 2024, 07:43

Serco (#SRP) – unsuccessful in rebidding for Australia immigration contract and also notes UK Government budget tax changes impact

- By Steven Moore

- 8 November 2024, 07:39

International Consolidated Airlines (#IAG) – notes Q3 growth and “demand remains strong across our airlines”

- By Steven Moore

- 8 November 2024, 07:34

Rightmove (#RMV) – “in line to meet market expectations”, emphasises “looking ahead with confidence”

- By Steven Moore

- 8 November 2024, 07:29

Vistry (#VTY) – £165m South Division cost issues additional profit impact and group “reduced expectations for completions in the year”

- By Steven Moore

- 8 November 2024, 07:25

Thursday »

BREAKING: Argo Blockchain ‘fess up – delayed to an attempted no one watching o’clock and even then attempted obfuscation!

- By Steven Moore

- 7 November 2024, 17:35

Kefi Gold & Copper – increased proposed bank loan facilities for Tulu Kapi, Strong Buy

- By Steven Moore

- 7 November 2024, 16:35

TPXimpact – CFO appointment, to ‘create lasting shareholder value’?

- By Steven Moore

- 7 November 2024, 16:25

DSW Capital – 'Beat the Budget' transactions boost, but what’s the outlook from here?…

- By Steven Moore

- 7 November 2024, 14:20

Tom Winnifrith Bearcast: a 1 in 15000 chance this is the last one ever

- By Tom Winnifrith

- 7 November 2024, 13:38

Hummingbird it’s almost game over, watch out Celadon there is a lesson for you

- By Tom Winnifrith

- 7 November 2024, 13:15

Fadel Partners – having been AIM Awards-shortlisted for “Best Newcomer” last year, ‘Update to Trading Expectations’ is downwards (natch!)…

- By Steven Moore

- 7 November 2024, 11:44

CAB Payments (#CABP) – StoneX “does not intend to make an offer”

- By Steven Moore

- 7 November 2024, 08:00

#DSW Capital – October “exceptionally strong levels of M&A activity and completions”, increases guidance

- By Steven Moore

- 7 November 2024, 07:58

Trainline (#TRN) – H1 adj. EPS up to 9.9p, notes improved guidance

- By Steven Moore

- 7 November 2024, 07:55

Rolls-Royce (#RR.) – “confidence in the delivery of our 2024 guidance despite a supply chain environment which remains challenging”

- By Steven Moore

- 7 November 2024, 07:53

S4 Capital (#SFOR) – Q3 LFL net revenue -12.6% YoY, “primarily reflecting lower activity in both Content and one of the larger Technology Services clients”

- By Steven Moore

- 7 November 2024, 07:51

#AUTO Trader – H1 adj. EPS up to 15.56p, DPS to 3.5p, though “now expect the stock lever to be slightly negative for the full year”

- By Steven Moore

- 7 November 2024, 07:49

#ITV – Q3 update, argues confidence will deliver increased profit this year but that with further cost savings

- By Steven Moore

- 7 November 2024, 07:46

J Sainsbury (#SBRY) – H1 adj. EPS edged up to 10.7p, DPS maintained at 3.9p, remains confident in forecasts

- By Steven Moore

- 7 November 2024, 07:44

Howden Joinery (#HWDN) – since half year LFL revenue -1.9% YoY, expects FY PBT “at the lower end” of analysts' consensus forecasts range

- By Steven Moore

- 7 November 2024, 07:39

Taylor Wimpey (#TW.) – “trading in line with expectations”, argues “well positioned for growth from 2025, assuming supportive market conditions”

- By Steven Moore

- 7 November 2024, 07:34

Wednesday »

Tom Winnifrith Bearcast No 2: this strategic review could be amazingly good news

- By Tom Winnifrith

- 6 November 2024, 18:11

Aptamer – “pleased to report that the sustained focus of our commercial team continues to bear fruit”. Er, does it?…

- By Steven Moore

- 6 November 2024, 17:35

Westminster: classic bullshit from loathsome ex Tory MP and penny share spiv Tony Baldry

- By Tom Winnifrith

- 6 November 2024, 16:44

Microlise – “confident that no customer systems data has been compromised”, but employee data?…

- By Steven Moore

- 6 November 2024, 16:35

A disgraced and failed fund manager on Trump's win and China

- By ShareProphets

- 6 November 2024, 14:40

Solid State – argues “trading in-line with market expectations for the full year”, but how much really so?…

- By Steven Moore

- 6 November 2024, 14:40

Surface Transforms – “Directorate Change”, why ANOTHER share price slump?…

- By Steven Moore

- 6 November 2024, 11:20

Tom Winnifrith Bearcast No 1: GroupThink, Donald Trump and Kefi

- By Tom Winnifrith

- 6 November 2024, 09:59

Georgina Energy (#GEX) – “Operational Update”, attempted ramptastic

- By Steven Moore

- 6 November 2024, 07:59

#KEFI Gold & Copper – “initial committee approval granted by second co-lending bank for increased amount”

- By Steven Moore

- 6 November 2024, 07:59

Microlise (#SAAS) – “Update on Cyber Security Incident”, expects services “essentially back to normal” by end of next week

- By Steven Moore

- 6 November 2024, 07:57

Empyrean Energy (#EME) – £1.12m equity raise at 0.1p per share, also an up to £0.25m “retail offer”

- By Steven Moore

- 6 November 2024, 07:56

Blencowe Resources (#BRES) – £1.5m equity raise at 4p per share with warrants

- By Steven Moore

- 6 November 2024, 07:55

YouGov (#YOU) – FY adj. EPS down to 29.4p, DPS +3% to 9p, current year trading “broadly in line with the prior year”

- By Steven Moore

- 6 November 2024, 07:49

J D Wetherspoon (#JDW) – 14 weeks LFL sales +5.9% YoY, “cost inflation… has now jumped substantially again following the budget”

- By Steven Moore

- 6 November 2024, 07:45

Domino's Pizza (#DOM) – Q3 update, “expect FY24 Underlying EBITDA to be in the range of current market expectations”

- By Steven Moore

- 6 November 2024, 07:40

Marks & Spencer (#MKS) – H1 adj. EPS up to 14.7p, DPS maintained at 1p, “confident of making further progress in the remainder of the year”

- By Steven Moore

- 6 November 2024, 07:37

Persimmon (#PSN) – Q3 “in-line with expectations”, argues “well positioned for continuing market improvement”

- By Steven Moore

- 6 November 2024, 07:33

Tuesday »

Distil – interims, was recent discounted equity raise to “provide working capital”?…

- By Steven Moore

- 5 November 2024, 17:25

Amaroq Minerals – 2024 exploration update, this winning 73p offer price tip still a Buy

- By Steven Moore

- 5 November 2024, 16:40

Itaconix – “pleased to provide” trading update, but how ‘pleasing’ is it really?…

- By Steven Moore

- 5 November 2024, 16:21

Aferian – emphasises trading improvement and “well-positioned”, but how much so really?…

- By Steven Moore

- 5 November 2024, 14:34

EnSilica – full-year results argue “from both a financial and operational perspective… remains well positioned”. Er, does it?!…

- By Steven Moore

- 5 November 2024, 11:40

Victoria now just 93p, target remains 0p: a 20 red flag check list

- By Tom Winnifrith

- 5 November 2024, 11:24

Tom Winnifrith bonus bearcast: serial deceit and lying at Predator as it places

- By Tom Winnifrith

- 5 November 2024, 09:31

Preparing for election night at the Welsh Hovel, I’ll be stewing some apples, Tom Winnifrith

- By Tom Winnifrith

- 5 November 2024, 08:00

Argo Blockchain (#ARB) – “October Operational Update”, notes “mining revenue” up to $3m but bottom-line financials dare not speak their name

- By Steven Moore

- 5 November 2024, 07:57

Sosandar (#SOS) – homeware range licensing agreement with Next (#NXT), no financials (natch!)

- By Steven Moore

- 5 November 2024, 07:52

Aferian (#AFRN) – notes H2 revenue improvement, “continue to expect a reduction to net debt by year-end”

- By Steven Moore

- 5 November 2024, 07:48

Morgan Advanced Materials (#MGAM) – warns current outlook deterioration, expanding “simplification programme” and commencing “up to £40m” share buyback

- By Steven Moore

- 5 November 2024, 07:46

#WEIR – “order pipeline converting as expected”, FY guidance reiterated

- By Steven Moore

- 5 November 2024, 07:41

TP ICAP (#TCAP) – Q3 revenue +9%, “comfortable with FY 2024 market expectations for adjusted EBIT, subject to the impact of FX movements”

- By Steven Moore

- 5 November 2024, 07:39

Hilton Food (#HFG) – notes Q3 progress, “confident in delivering our full year in line with our expectations”

- By Steven Moore

- 5 November 2024, 07:36

Associated British Foods (#ABF) – FY adj. EPS up to 196.9p, DPS to 90p including 27p special dividend

- By Steven Moore

- 5 November 2024, 07:33

Christie (#CTG) – sale of its Orridge stocktaking business for initial £4m and up to a further £1m

- By Steven Moore

- 5 November 2024, 07:30

Monday »

Empresaria – states a disposal as part of “previously announced plan”, but how useful?

- By Steven Moore

- 4 November 2024, 17:29

Feedback plc – argues “successful fundraising”. Er, what about the 55% discount?!

- By Steven Moore

- 4 November 2024, 16:25

Video with Rick Rule: The Inevitability of the Gold Price Rise

- By Tom Winnifrith

- 4 November 2024, 14:53

Predator; when is the discounted bailout placing? Target from 6.25p, 3p within months

- By Tom Winnifrith

- 4 November 2024, 14:25

EnSilica – “pleased to announce” a new debt facility now, I wonder why…

- By Steven Moore

- 4 November 2024, 13:59

ProBiotix Health – wins at requisitioned General Meeting, now time for reconciliation

- By Tom Winnifrith

- 4 November 2024, 12:34

Tom Winnifrith bearcast: a trans moral quandry for daughter 2

- By Tom Winnifrith

- 4 November 2024, 12:12

Vianet – half-year update argues “in line with management's expectations”, but suggests demanding second half requirements!

- By Steven Moore

- 4 November 2024, 11:29

Feedback (#FDBK) – proposed bailout fundraising for up to £6.3m

- By Steven Moore

- 4 November 2024, 07:59

EnSilica (#ENSI) – “new debt facility to refinance its existing external loan facilities”, “up to £9 million… to November 2029”

- By Steven Moore

- 4 November 2024, 07:53

Clean Power Hydrogen (#CPH2) – following prior licence agreement termination, GHFG legal action now also terminated

- By Steven Moore

- 4 November 2024, 07:51

Zotefoams (#ZTF) – Q3 update, expects FY “to be in line with current market expectations”

- By Steven Moore

- 4 November 2024, 07:47

Vianet (#VNET) – H1 growth “in line with management's expectations”, looking ahead with confidence

- By Steven Moore

- 4 November 2024, 07:45

#WIZZ Air – October booked passengers +4.1% YoY, load factor +0.4ppts to 92.9%

- By Steven Moore

- 4 November 2024, 07:42

DP Poland (#DPP) – Q3 update only emphasising sales growth, states “expects to be in line with market expectations for 2024”

- By Steven Moore

- 4 November 2024, 07:40

Water Intelligence (#WATR) – reacquisition of Dallas franchise for initial $5m and up to $12m with also stock options

- By Steven Moore

- 4 November 2024, 07:37

#DSW Capital – acquisition of primary care solicitors DR for £6.1m in cash and shares

- By Steven Moore

- 4 November 2024, 07:29

Sunday »

Nexus Infrastructure – diversifying acquisition and recovery potential, our share tip is ahead but still a BUY

- By Tom Winnifrith

- 3 November 2024, 19:11

The View From The Montana Log-Cabin As Gold Takes A Bump And Reeves Thieves

- By Nigel Somerville

- 3 November 2024, 13:01

Sunday Long Reads: Scamming Parents, Bauyesian Superyacht, Cyclopean Cave, Bitcoin Mining Nightmare, Meeting the Voice in your Head

- By ShareProphets

- 3 November 2024, 12:59

Notes from Underground – Most read articles for the week ending Nov 2

- By ShareProphets

- 3 November 2024, 12:57

Tom Winnifrith US Election podcast, fake news, rogue polls, a Harris surge and the Dems murder Peanut the squirrel

- By Tom Winnifrith

- 3 November 2024, 01:40

Photo Article: Bonfire Night at the Welsh Hovel, Rachel Thieves up in smoke for a party of 20, Tom Winnifrith

- By Tom Winnifrith

- 3 November 2024, 01:37

Saturday »

Tom Winnifrith Bearcast: Farewell Big Dave Lenigas

- By Tom Winnifrith

- 2 November 2024, 17:26

ShareProphets readers tips for 2024 prize competition – (just under) two months to go update

- By Steven Moore

- 2 November 2024, 08:00

Friday »

Minoan – Financing Update Offers Jam Tomorrow. Maybe It Will Be, This Time?

- By Nigel Somerville

- 1 November 2024, 14:54

Tom Winnifrith Bearcast: How clever is Doc Holiday and how mendacious is the fake news FT?

- By ShareProphets

- 1 November 2024, 14:33

Microlise – “Notice of Cyber Security Incident”, at no one watching o’clock?

- By Steven Moore

- 1 November 2024, 14:29

BREAKING: The whole Steve O Hara health story Optibiotix is still not telling you

- By Tom Winnifrith

- 1 November 2024, 13:29

Turd polisher Harry Chathli, very poor form as Technology Minerals shares suspended

- By Tom Winnifrith

- 1 November 2024, 11:08

Amaroq Minerals – 2024 exploration update, remains an upcoming production and exploration Buy

- By Steven Moore

- 1 November 2024, 10:20

Regtech Open Project – now formally suspended until it files audited accounts for period to 30 June 2024. It won’t!

- By Tom Winnifrith

- 1 November 2024, 10:19

Georgina Energy: a letter to broker Jerry Keen about his resignation

- By Tom Winnifrith

- 1 November 2024, 09:53

B.P. Marsh & Partners – interims, positive again from this hugely winning share tip

- By Steven Moore

- 1 November 2024, 09:30

Video: Amaroq Part 2, the reasons why I plan to buy more shares at 81p

- By Tom Winnifrith

- 1 November 2024, 09:15

Photo article: Oxfam, 100 million Euro of your cash for this? Dad spins in his grave again, Tom Winnifrith

- By Tom Winnifrith

- 1 November 2024, 08:00

Halloween Photo Article of angels and a wannabee Rachel Reeves pumpkin at the Welsh Hovel, Tom Winnifrith

- By Tom Winnifrith

- 1 November 2024, 08:00

boohoo (#BOO) – appoints Dan Finley, currently CEO of its Debenhams business, as group CEO

- By Steven Moore

- 1 November 2024, 07:59

Challenger Energy (#CEG) – CFO Gagan Khurana “has resigned… for personal reasons, effective immediately”

- By Steven Moore

- 1 November 2024, 07:55

Ondine Biomedical (#OBI) – proposed fundraising to raise “not less than” c.£8.5m at 8.5p per share

- By Steven Moore

- 1 November 2024, 07:53

CAP-XX (#CPX) – £2.5m placing at 0.11p per share, up to a further £0.275m “retail offer”

- By Steven Moore

- 1 November 2024, 07:51

ADM Energy (#ADME) – further results delay, states now expects to publish “in the coming weeks”

- By Steven Moore

- 1 November 2024, 07:48

Active Energy (#AEG) – further loan, directors Max Aitken and Jason Zimmerman “step down” and appointment of Zeus Capital as joint broker

- By Steven Moore

- 1 November 2024, 07:46

Emmerson (#EML) – engages litigation counsel and formally notifies Morocco government of investment dispute, “is examining various funding avenues”

- By Steven Moore

- 1 November 2024, 07:42

Hummingbird Resources (#HUM) – “advanced discussions… to partially restructure its outstanding debt and to reschedule payments due”

- By Steven Moore

- 1 November 2024, 07:39

Solid State (#SOLI) – acquisition of Q-Par Antennas USA for $1.5m and a further $0.5m earn-out

- By Steven Moore

- 1 November 2024, 07:36

Cloudcoco (#CLCO) – completes disposal of its CloudCoCo Connect business

- By Steven Moore

- 1 November 2024, 07:33

Thursday »

Tom Winnifrith Bearcast: Failing Rachel from accounts

- By Tom Winnifrith

- 31 October 2024, 16:12

Nexteq – profit warning on revenue “expected to be 10-12% below previous market expectations”. And what about those previous expectations?…

- By Steven Moore

- 31 October 2024, 13:35

BREAKING: Antony Hamilton of Georgina energy slated by High Court Judge for misleading court

- By Tom Winnifrith

- 31 October 2024, 13:05

Versarien – Dog eaters welch on £242,000 due today. Tits up in 3 months?

- By Tom Winnifrith

- 31 October 2024, 12:24

85p to 1p in 10 months, a Halloween special from Liam “the Toke” Murray

- By Tom Winnifrith

- 31 October 2024, 12:10

Kainos – less than two months after “expects to deliver adjusted PBT in line”, now “expects… below current market consensus”. Hopefully my warning was heeded…

- By Steven Moore

- 31 October 2024, 11:43

EXPOSE: Georgina Energy – materially non-compliant IFRS interims for a technically insolvent company

- By Tom Winnifrith

- 31 October 2024, 11:13

SRT Marine Systems – emphasises “landmark contract” signed, but to now deliver sustained net cash generation rather than ‘jam tomorrow’?

- By Steven Moore

- 31 October 2024, 08:03

Georgina Energy (#GEX) – H1 £3.3m loss and net debt and even net current liabilities!

- By Steven Moore

- 31 October 2024, 07:55

Georgina Energy (#GEX) – ‘seismic data reprocessing progress and resource potential review’, attempted ramptastic

- By Steven Moore

- 31 October 2024, 07:52

Argent Biopharma (#RGT) – “Quarterly Report”, ended quarter with just “A$311k of cash on hand”, since raised a further just A$0.2 million

- By Steven Moore

- 31 October 2024, 07:49

Vodafone (#VOD) – MoU for potential acquisition of parts of Telekom Romania Mobile Communications

- By Steven Moore

- 31 October 2024, 07:46

Nexteq (#NXQ) – de-stocking and customer delays warning, Financial Controller Matt Staight to take over as CFO

- By Steven Moore

- 31 October 2024, 07:37

Filtronic (#FTC) – “anticipate H1 to be stronger than H2, as the retrofit completes”, though confident of FY “in line with market expectations”

- By Steven Moore

- 31 October 2024, 07:33

Synthomer (#SYNT) – “volumes continue to improve from historically low levels, although at a slower rate than during Q1 and Q2”

- By Steven Moore

- 31 October 2024, 07:30

Haleon (#HLN) – Q3 organic revenue +6.1% YoY, “well on track to deliver our full-year 2024 guidance”

- By Steven Moore

- 31 October 2024, 07:28

Kainos (#KNOS) – now expects FY revenue “moderately below current market consensus with the majority of the reduction flowing through to adjusted PBT”

- By Steven Moore

- 31 October 2024, 07:24

Spectris (#SXS) – Q3 LFL sales -10% YoY and orders -6% as anticipated recovery “is taking longer to materialise”

- By Steven Moore

- 31 October 2024, 07:21

Wednesday »

Tom Winnifrith bearcast: feeling so ill I thought it was Thursday and Halloween until just now

- By Tom Winnifrith

- 30 October 2024, 16:45

Kooth – directors share purchases, but how much confidence do they really have in this AIM Awards 2024 “Diversity Champion”?

- By Steven Moore

- 30 October 2024, 14:37

Lift Global Ventures Plc – challenges facing Lee Lederberg in its upcoming audit

- By ShareProphets

- 30 October 2024, 12:47

Time Out Group – full-year results and a placing “to fund capital investment”. Er, what about the currently further deteriorated balance sheet?

- By Steven Moore

- 30 October 2024, 11:25

My letter Reporting myself and 4 others to the FCA asking for an investigation into market abuse

- By Tom Winnifrith

- 30 October 2024, 11:14

Thoughts on a Reversion to Mean – some things never change, Victoria and Petra are examples

- By Steven Moore

- 30 October 2024, 10:48

The Shysters at Georgina Energy to report Tom Winnifrith to the FCA for market abuse:

- By Tom Winnifrith

- 30 October 2024, 08:11

Tom Winnifrith US Election podcast: big news in North Carolina and Minnesota

- By Tom Winnifrith

- 30 October 2024, 08:00

Georgina Energy (#GEX) – states “a number of recent blog and social media posts… contain a number of false and misleading statements”. Why not say who you mean?

- By Steven Moore

- 30 October 2024, 07:59

Eckoh (#ECK) – recommended 54p per share offer from Bridgepoint

- By Steven Moore

- 30 October 2024, 07:58

OptiBiotix Health (#OPTI) – Peterhouse Capital refuses request for consent from company to be able to vote its shares at requisitioned General Meeting of ProBiotix Heath (#PBX)

- By Steven Moore

- 30 October 2024, 07:58

Equals (#EQLS) – possible 135p per share offer and 2p per share special dividend, necessary transaction documentation being ‘advanced’

- By Steven Moore

- 30 October 2024, 07:47

CAB Payments (#CABP) – trading warning, states possible offer discussions with StoneX Group Inc. are continuing

- By Steven Moore

- 30 October 2024, 07:44

Aston Martin Lagonda (#AML) – Q3 still a loss, states “on track to deliver revised FY 2024 guidance, as supply chain disruptions are proactively managed”

- By Steven Moore

- 30 October 2024, 07:41

Next (#NXT) – Q3 full price sales +7.6% YoY, upgrades FY profit guidance

- By Steven Moore

- 30 October 2024, 07:39

Nexus Infrastructure (#NEXS) – FY “in line with market expectations”, acquisition of Coleman Construction & Utilities for a net up to £4.38m

- By Steven Moore

- 30 October 2024, 07:37

Gooch & Housego (#GHH) – acquisition of “precision optics” business Phoenix Optical for £3.4m and up to a further £3.35m

- By Steven Moore

- 30 October 2024, 07:32

#SDI – acquisition of industrial measurement systems business InspecVision for a net £6.1m

- By Steven Moore

- 30 October 2024, 07:32

Tuesday »

Tom Winnifrith Bearcast: Thank heavens Olaf is unemployed

- By Tom Winnifrith

- 29 October 2024, 16:47

Brand Architekts – full-year results, balance sheet-backed recovery Buy

- By Steven Moore

- 29 October 2024, 16:47

Ultimate Products – full-year results, “in line with market expectations”. Er, not the original expectations though!

- By Steven Moore

- 29 October 2024, 16:20

Cavendish Research Note: Skinbiotherapeutics at 18p worth 56p

- By Tom Winnifrith

- 29 October 2024, 13:53

James Cropper – CEO “to retire from the company” and replacement appointment, “repositioned for growth”?

- By Steven Moore

- 29 October 2024, 13:37

RWS Holdings – “ongoing price pressure” and net debt, is that really “a position of strength”?!

- By Steven Moore

- 29 October 2024, 11:24

Letter to Lee Lederberg of Edwards Veeder: you are hereby put on notice re Zak Mir’s Lift Global

- By Tom Winnifrith

- 29 October 2024, 10:04

IQE: CEO fired, when is the lack of profits warning? Told y'all!

- By Tom Winnifrith

- 29 October 2024, 09:19

Tern – Rats, Sinking Ship: Two Thirds Of Board Walk With Immediate Effect

- By Nigel Somerville

- 29 October 2024, 08:08

#TERN – two of three board members replaced having “stepped down… to concentrate on their other business interests”, hmmm

- By Steven Moore

- 29 October 2024, 07:59

#IQE – CEO Americo Lemos “has left the company with immediate effect”. Er, why’s that then?

- By Steven Moore

- 29 October 2024, 07:58

James Cropper (#CRPR) – CEO Steve Adams has notified of intention to retire “in early 2025”, David Stirling appointed to succeed

- By Steven Moore

- 29 October 2024, 07:53

Keras Resources (#KRS) – raises just £0.3725m at 2.5p per share

- By Steven Moore

- 29 October 2024, 07:49

Touchstar (#TST) – H2 revenue “broadly similar to the first half… below expectations”, though the half “still expected to be strongly cash generative”

- By Steven Moore

- 29 October 2024, 07:46

IG Design (#IGR) – H1 revenue -11% YoY, argues to still anticipate “strong year-on-year improvement in both profit and cash flow”

- By Steven Moore

- 29 October 2024, 07:42

Ultimate Products (#ULTP) – FY adj. EPS down to 12.3p, DPS maintained at 7.38p, maintaining expectations though “UK trading remains challenging”

- By Steven Moore

- 29 October 2024, 07:37

#RWS Holdings – H2 adj. revenue return to YoY growth at +2%, expects FY adj. PBT “within the range of market expectations”

- By Steven Moore

- 29 October 2024, 07:34

Pearson (#PSON) – Q3 “underlying group sales” +5% YoY, “on track to meet full-year expectations”

- By Steven Moore

- 29 October 2024, 07:29

Foxtons (#FOXT) – acquisitions of primarily Reading-focussed Haslams for initial £7.6m and primarily Watford-focussed Imagine Property for initial £5m, further total £3.4m deferred

- By Steven Moore

- 29 October 2024, 07:25

Monday »

Tom Winnifrith Bearcast: a day I really felt good about my work whatever twitter moron Neil said

- By Tom Winnifrith

- 28 October 2024, 15:45

SRT Marine Systems – “pleased to announce” contracts finance support package, but how sustained the ‘support’?

- By Steven Moore

- 28 October 2024, 14:34

Flight risk, odd asset salesand unpaid bills, the liquidator reports back on broker Jub Capital and Adam Dziubinski

- By ShareProphets

- 28 October 2024, 13:38

BREAKING BOMBSHELL for Georgina Energy: Grant Thornton investigation into wholesale expense abuse and fund misappropriation by Hamilton and Wallace

- By Tom Winnifrith

- 28 October 2024, 12:54

AIM Market Statistics for the month of September: another disaster for the casino

- By Tom Winnifrith

- 28 October 2024, 11:09

Catenai Klarian update: it's gibberish and it's placing ahoy

- By Tom Winnifrith

- 28 October 2024, 10:54

Kromek – full-year results argue “delivered on all our KPIs”, but why also an ‘Update’ announcement that dare not speak its name as to why an “additional loan” is needed?

- By Steven Moore

- 28 October 2024, 10:39

More ballet tickets for Evil Banksta funded by Adam Reynolds: another shocking warning at Belluscura

- By Tom Winnifrith

- 28 October 2024, 08:41

EXPOSE: Lift Global Ventures – who is the man behind Trans-Africa Energy Limited

- By Tom Winnifrith

- 28 October 2024, 08:18

Dominic White – life’s no Dolce Vita for his shareholders: where are the regulators?

- By Tom Winnifrith

- 28 October 2024, 08:12

BREAKING: Georgina Energy audit committee chairman accused of fraud and enrichment in Ben's Creek's law suit

- By ShareProphets

- 28 October 2024, 08:06

Democrats playing the Hitler card on Madison Square Gardens rally - true desperation, Tom Winnifrith

- By Tom Winnifrith

- 28 October 2024, 08:00

#WISE – co-founder and CEO Kristo Käärmann £0.35m FCA penalty re. lack of personal tax situation notification

- By Steven Moore

- 28 October 2024, 07:59

#GOOD Energy – receives possible offer proposal, “is evaluating”

- By Steven Moore

- 28 October 2024, 07:54

#TLOU Energy – proposed AIM cancellation, to remain listed on ASX and Botswana Stock Exchange

- By Steven Moore

- 28 October 2024, 07:52

Nanoco (#NANO) – receives GM requisition notice to appoint Rhys Summerton and Andre Tonkin to the board, “reviewing the content and validity”

- By Steven Moore

- 28 October 2024, 07:50

Haydale Graphene Industries (#HAYD) – raises £3m including at 0.1325p per new share, up to £0.5m “retail offer”

- By Steven Moore

- 28 October 2024, 07:46

Lloyds Banking Group (#LLOY) – notes recent motor commission Court decisions, “assessing the potential impact of the decisions, as well as any broader implications, pending the outcome of the appeal applications”

- By Steven Moore

- 28 October 2024, 07:43

Computacenter (#CCC) – Q3 “broadly in line with the prior year”, now expects FY adj. PBT “modestly behind last year”

- By Steven Moore

- 28 October 2024, 07:39

Trainline (#TRN) – upgrades guidance “following a strong start to H2”, but just provides net ticket sales, revenue and adjusted EBITDA

- By Steven Moore

- 28 October 2024, 07:36

Lords Group Trading (#LORD) – acquisition of 90% of heat pumps and renewable energy products business Ultimate Renewables Supplies for initial £0.706m and up to further £0.196m

- By Steven Moore

- 28 October 2024, 07:32

Roadside Real Estate (#ROAD) – its joint venture agrees to acquire for £70m and leaseback a sites portfolio from Lidl

- By Steven Moore

- 28 October 2024, 07:27

Sunday »

Tom Winnifrith Bearcast: BIG questions for Zak's auditor and why Ariana is such an amazing risk reward play and could be 20p

- By Tom Winnifrith

- 27 October 2024, 16:50

Card Factory could perform well going into the Xmas period and offers plenty of upside as long as it hits its targets

- By Gary Newman

- 27 October 2024, 11:54

The View From The Montana Log-Cabin As Gold Heads For Another All-Time High

- By Nigel Somerville

- 27 October 2024, 11:14

Ariana – Shares Rising As ASX Listing Nears but far more to come

- By Nigel Somerville

- 27 October 2024, 09:48

Sunday Long Reads: Tartarian Empire, Aphantasia, UK’s fastest thrill-ride, Modern-Day Library of Alexandria, Rare-Book Scoundrel

- By ShareProphets

- 27 October 2024, 08:56

Tern – Wild About Wyld? Still A Bargepole Sell, Target 0p.

- By Nigel Somerville

- 27 October 2024, 07:27

Notes from Underground – Most read articles for the week ending Oct 26

- By ShareProphets

- 27 October 2024, 01:34

Tom Winnifrith podcast: the US Election, extraordinary polls, the mendacious UK media and abortion

- By Tom Winnifrith

- 27 October 2024, 00:35

Saturday »

EXPOSE Zak Mir's Lift Global Ventures – is the TAE loan in trouble because of its apparent past links to a fraudster?

- By Tom Winnifrith

- 26 October 2024, 16:31

Tom Winnifrith Bearcast: the Shipman said, Optibiotix goofs again and Au Revoir Malcolm

- By Tom Winnifrith

- 26 October 2024, 16:24

After Nearly a Quarter of a Century, this (Very) Old Hand Says Goodbye - and Thanks for Everything.

- By Malcolm Stacey

- 26 October 2024, 08:00

Friday »

Chapel Down – intra-day “Update on Strategic Review, Harvest & Trading” enough to turn its investors to drink!

- By Steven Moore

- 25 October 2024, 17:25

Tom Winnifrith Bearcast: I am very relaxed about it but I cannot do a Kefi article every day!

- By Tom Winnifrith

- 25 October 2024, 16:27

Coral Products – CEO to leave, and further financial desperation?

- By Steven Moore

- 25 October 2024, 16:15

BREAKING: Bear raider Tim Kempster calls out Predator Oil & Gas for lying about its cash needs

- By Tom Winnifrith

- 25 October 2024, 14:43

Kooth – more contract controversy, though natch with it having the ominous combination of being an AIM Awards 2024 “winner” and that being “Diversity Champion”!

- By Steven Moore

- 25 October 2024, 13:52

UK Oil & Gas on Channel 4 News last night: did not sound good

- By Tom Winnifrith

- 25 October 2024, 13:09

Zak Mir: Charting did not warn me that lending most of my balance sheet to an insolvent company was a bad idea

- By Tom Winnifrith

- 25 October 2024, 12:02

Ariana Resources – review identifies significant further Dokwe project upside potential, Buy

- By Steven Moore

- 25 October 2024, 09:37

boohoo (#BOO) – “clarification on certain matters raised by Frasers” (#FRAS), “continues the process of reviewing the requisitions”

- By Steven Moore

- 25 October 2024, 07:59

Lift Global Ventures (#LFT) – investee Trans-Africa Energy has not received funding due, loans notes redemption with Lift further extended to 31st December!

- By Steven Moore

- 25 October 2024, 07:57

Learning Technologies (#LTG) – possible offer discussions “have made material progress and remain ongoing”, deadline extension

- By Steven Moore

- 25 October 2024, 07:57

Adams (#ADA) – “proposed realisation of investments and return of capital to shareholders”

- By Steven Moore

- 25 October 2024, 07:55

Kooth (#KOO) – newsletter article “contained outdated information that underestimated the uptake and impact of Soluna in California”

- By Steven Moore

- 25 October 2024, 07:53

Celebrus Technologies (#CLBS) – H1 growth “in line with management expectations”, “confidence of another year of progress”

- By Steven Moore

- 25 October 2024, 07:50

Mincon (#MCON) – “remain confident of earnings and revenue growth in H2 2024 compared to H1”

- By Steven Moore

- 25 October 2024, 07:48

Record (#REC) – Q2 AUM up to $106bn despite net flows -$1.7bn, “in line with expectations”

- By Steven Moore

- 25 October 2024, 07:46

NatWest (#NWG) – Q3 EPS slightly up to 14.1p, argues “well placed”

- By Steven Moore

- 25 October 2024, 07:43

Wilmington (#WIL) – acquisition of health, safety and environmental training business Phoenix Health & Safety for initial £30.25m

- By Steven Moore

- 25 October 2024, 07:34

Thursday »

Tom Winnifrith Bearcast: libelling me, 'arry Adams and Stuart Ashman

- By Tom Winnifrith

- 24 October 2024, 16:57

A disgraced fund manager bullish on global equities but warns on the tech high flyers

- By ShareProphets

- 24 October 2024, 16:31

Silver Bullet Data Services – “Trading Update and Working Capital Facility”, how ‘positive’?

- By Steven Moore

- 24 October 2024, 16:30

Boohoo: damning letter from Mike Ashley as he requisitions GM to become CEO

- By Tom Winnifrith

- 24 October 2024, 14:35

Thruvision – “disappointing” interims, “to operate within the level of current funding resources” for how long?…

- By Steven Moore

- 24 October 2024, 14:00

Global Petroleum and the bankruptcy of executive officer Cecilia Yu.

- By Tom Winnifrith

- 24 October 2024, 13:55

Tom Winnifrith Bonus bearcast: GOTCHA Optibiotix but its still lying, Skins playing it well

- By Tom Winnifrith

- 24 October 2024, 11:03

PensionBee – argues placing “successfully raised £20 million”, how successfully?…

- By Steven Moore

- 24 October 2024, 10:35

BREAKING: Supply@ME Capital, a second auditor resignation letter on the way

- By Tom Winnifrith

- 24 October 2024, 10:02

boohoo (#BOO) – receives EGM requisition seeking board changes including removal of John Lyttle and appointment of Mike Ashley as CEO, is “reviewing”

- By Steven Moore

- 24 October 2024, 07:58

abrdn (#ABDN) – Q3 Assets Under Management and Administration up to £506.7bn, though net flows -£3.1bn

- By Steven Moore

- 24 October 2024, 07:49

London Stock Exchange (#LSEG) – Q3 adj. organic income +8.7% YoY, “confident of continued growth”

- By Steven Moore

- 24 October 2024, 07:45

Bloomsbury Publishing (#BMY) – H1 adj. EPS up to 24.68p, DPS to 3.89p, now expects FY “ahead of the current consensus expectation”

- By Steven Moore

- 24 October 2024, 07:42

Foxtons (#FOXT) – Q3 revenue +8% YoY, “trading in line with management's expectations”

- By Steven Moore

- 24 October 2024, 07:39

Alumasc (#ALU) – trading momentum means “confident of delivering another year of growth, in line with its expectations” despite sector demand headwinds

- By Steven Moore

- 24 October 2024, 07:37

Travis Perkins (#TPK) – “shortfall in the Merchanting segment”, “now expects FY24 adjusted operating profit to be around £135m”

- By Steven Moore

- 24 October 2024, 07:34

Unilever (#ULVR) – Q3 “underlying sales growth” 4.5%, “on track to deliver our 2024 outlook”

- By Steven Moore

- 24 October 2024, 07:30

Ashtead Technology (#AT.) – agreement to acquire “subsea electronics and ROV tooling rental and services” businesses Seatronics and J2 Subsea for £63m

- By Steven Moore

- 24 October 2024, 07:26

Wednesday »

BREAKING: PensionBee – placing, just “to accelerate investment in its US business”?

- By Steven Moore

- 23 October 2024, 17:55

Tom Winnifrith bearcast: before bed my plan B for Optibiotix

- By Tom Winnifrith

- 23 October 2024, 16:39

Franchise Brands – “Group CEO Appointment and Listing Consideration”, what about current trading consideration?…

- By Steven Moore

- 23 October 2024, 16:25

30 MPs and green grifter Dale Vince display off the scale economic illiteracy

- By ShareProphets

- 23 October 2024, 14:19

Cordel – “AI Technology Certified by Network Rail”, share price rise justified or is the announcement again ramptastic?

- By Steven Moore

- 23 October 2024, 13:45

There should be a law against doing an Andrew Bell, what is Fatty Cornish playing at?

- By Tom Winnifrith

- 23 October 2024, 11:24

Strip Tinning – “delighted to announce” a new Glazing sales nomination, but what about recently with “significant wins” meant to drive growth?…

- By Steven Moore

- 23 October 2024, 11:09

Optibiotix FD walks and disgraced Neil Davidson dissembles on O’Hara health

- By Tom Winnifrith

- 23 October 2024, 10:54

Tom Winnifrith Bonus Bearcast: Will you help us sack David Bramhill at Union Jack said the email

- By Tom Winnifrith

- 23 October 2024, 10:50

Querying the health benefits of Tesco tinned tomatoes, Tom Winnifrith

- By Tom Winnifrith

- 23 October 2024, 08:00

OptiBiotix Health (#OPTI) – Finance Director Graham Myers to “step down”, David Blain to join as acting FD, only provides on CEO Stephen O’Hara “recovering after a short illness and expects to be back at work shortly”

- By Steven Moore

- 23 October 2024, 07:50

World Chess (#CHSS) – “announces plans to Launch World Chess Tour”, ramptastic

- By Steven Moore

- 23 October 2024, 07:49

#HOME REIT – notes property auction sales, “sufficient proceeds to fully repay the outstanding Scottish Widows loan will be realised upon completion of the outstanding sale properties”

- By Steven Moore

- 23 October 2024, 07:49

British Land (#BLND) – COO David Walker to become CFO “after a comprehensive search and review of internal and external candidates”

- By Steven Moore

- 23 October 2024, 07:40

Franchise Brands (#FRAN) – divisional CEO Peter Molloy appointed company CEO, “beginning to consider” move from AIM to Main Market

- By Steven Moore

- 23 October 2024, 07:37

Image Scan (#IGE) – stronger H2 as anticipated, argues “confidence for future growth in FY25 and beyond”

- By Steven Moore

- 23 October 2024, 07:34

#WPP – Q3 adj. LFL revenue +0.5% YoY, notes “Q4 facing a tougher comparative than Q3 and macro uncertainty”

- By Steven Moore

- 23 October 2024, 07:32

Barratt Redrow (#BTRW) – recent weeks “solid trading”, though considers “it will take some time for customer confidence to fully recover”

- By Steven Moore

- 23 October 2024, 07:28

Lloyds Banking Group (#LLOY) – Q3 profit slightly lower YoY, though still “confidently to reaffirm our 2024 guidance”

- By Steven Moore

- 23 October 2024, 07:25

Reckitt Benckiser (#RKT) – Q3 LFL net revenue -0.5% YoY, taking current year’s to +0.4%, notes impacted by Mount Vernon tornado in July

- By Steven Moore

- 23 October 2024, 07:21

Tuesday »

Reader Poll: who should be chairman of Optibiotix?

- By Tom Winnifrith

- 22 October 2024, 16:47

The Revel Collective – full-year results from former Revolution Bars Group, is it now really “well positioned for future growth”?…

- By Steven Moore

- 22 October 2024, 16:05

Time left: 12:01:20